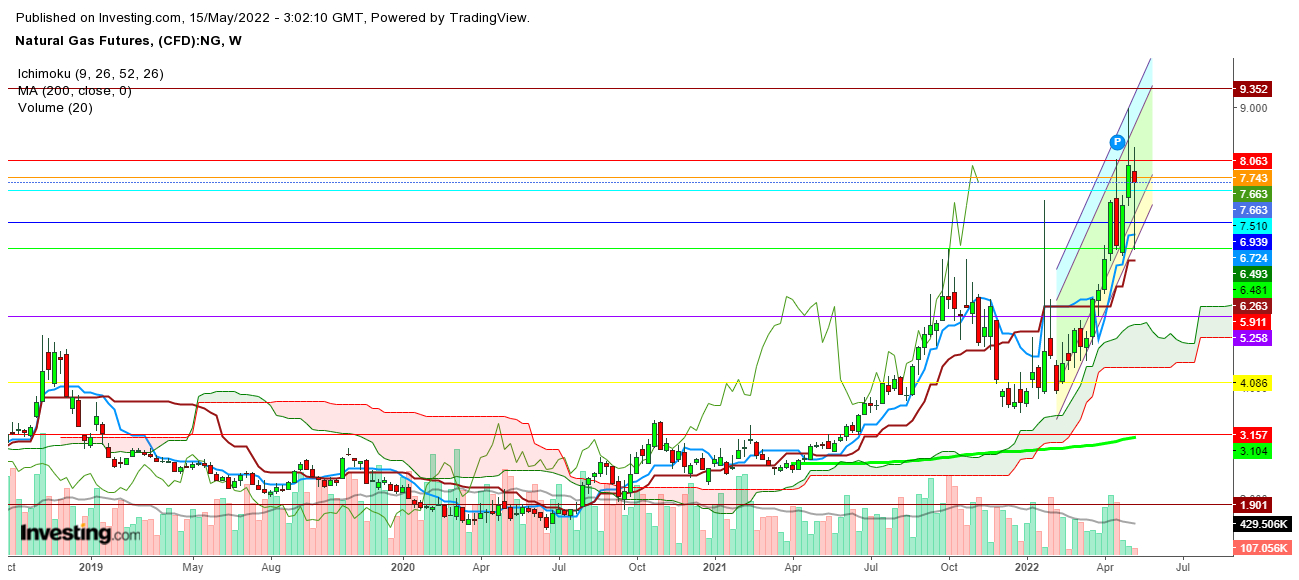

In the video below, the importance of the $7.571 level—NG's latest position is discussed—including how last week’s closing at $7.663 favored the natural gas bulls. Traders will be closely watching the opening level on the first trading session of the upcoming week.

No doubt, NG bulls were quite aggressive during the last week as they bought every sharp slide and pushed the futures from $6.450 to $8.284 before closing the week at $7.663.

Finally, the weekly closing is above long-term support at $7.571, a level that was the starting point of 2008’s peak.

Technically speaking, on the weekly chart, NG futures look quite indecisive as the selling from the week’s high still maintains $8.3 as immediate resistance. Undoubtedly, a breakout above this immediate resistance will keep the uptrend intact during the upcoming week as the rest of the formations are still bullish.

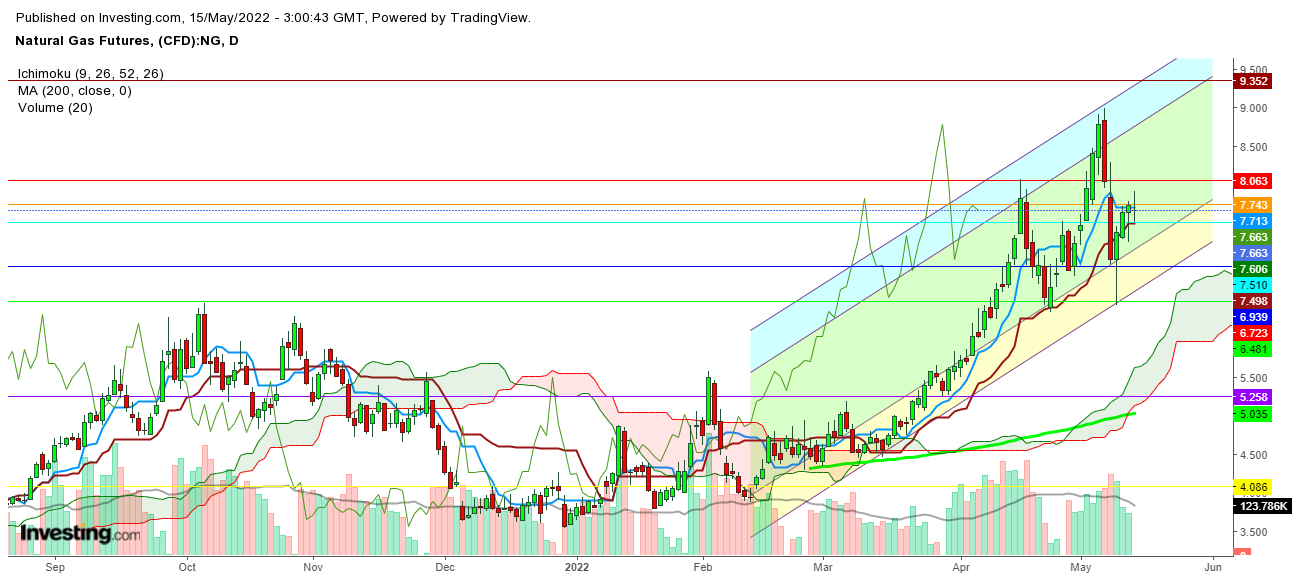

NG started an uptrend last Tuesday as the weather favoring the bullish sentiments continued till Thursday. But Friday’s move was quite indecisive as the natural gas futures found support at the 26 DMA and resistance above 9 DMA, finally closing the day below the 9 DMA. So this move looks a little suspicious when considering continuity of bullish sentiments.

No doubt, NG will still be maintained inside the mid of the uptrend channel, which confirms continuance of the current bullish momentum. That said, volatility could remain higher during the upcoming week as the summer demand could add one more leg to the bullish sentiments.

Changing global moves by different countries as they deal with the Russian energy embargo could continue to impact the NG movements this coming week, as any sudden policy change could disrupt the supply chain.

Disclaimer: The author of this analysis does not have any position in Natural Gas futures. Readers are advised to take any position at their own risk; as Natural Gas is one of the most liquid commodities of the world.