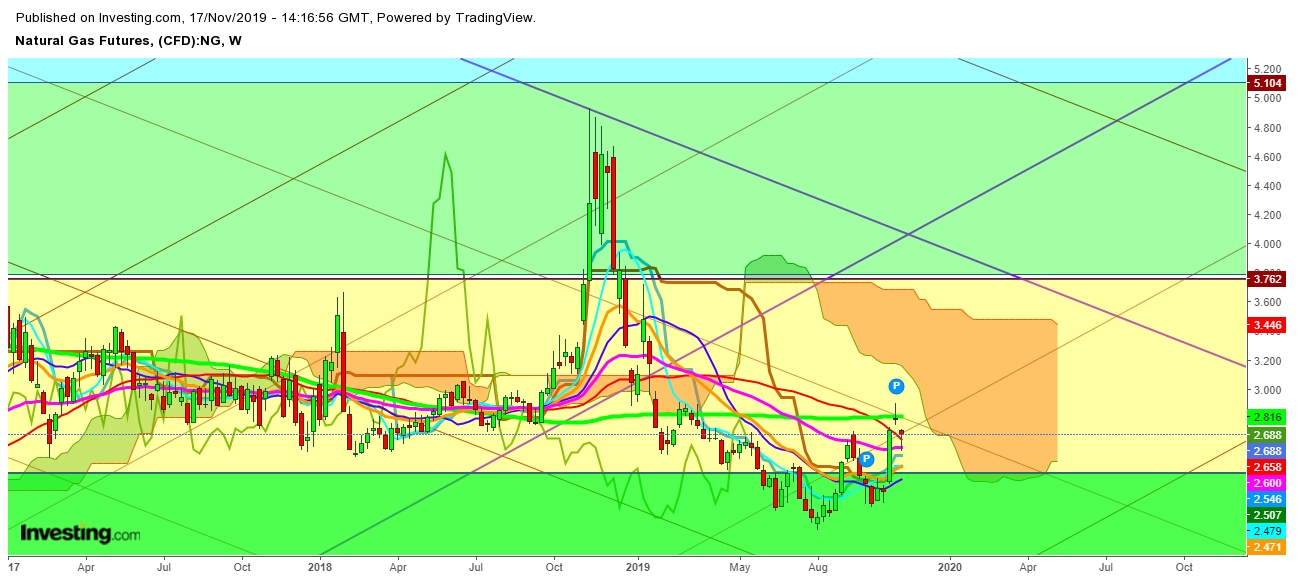

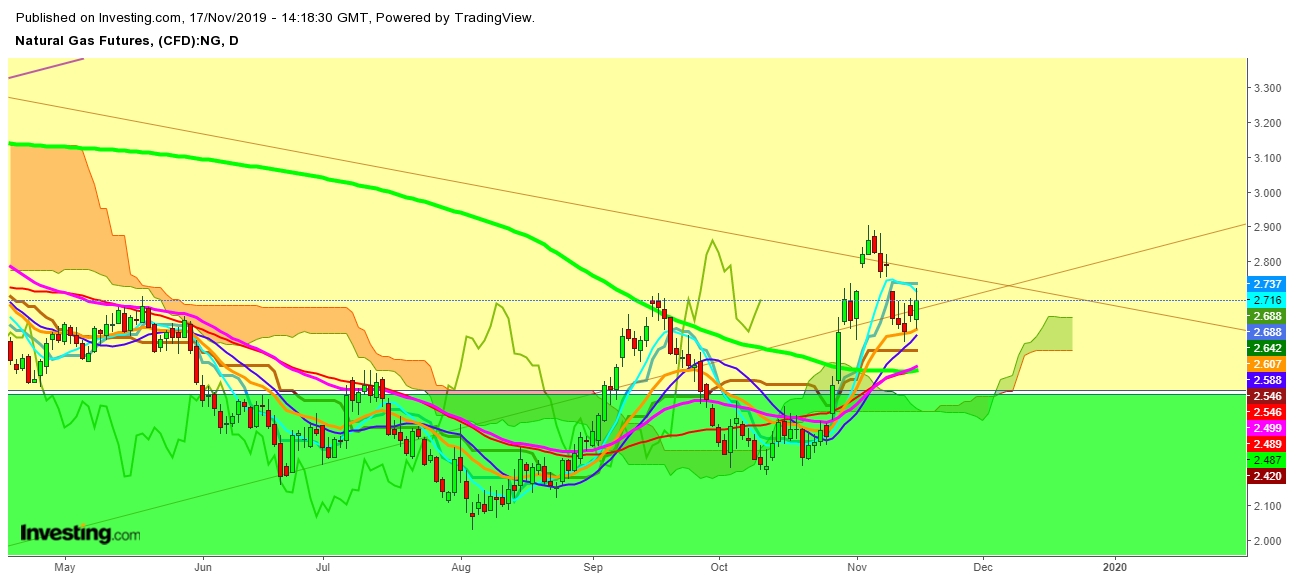

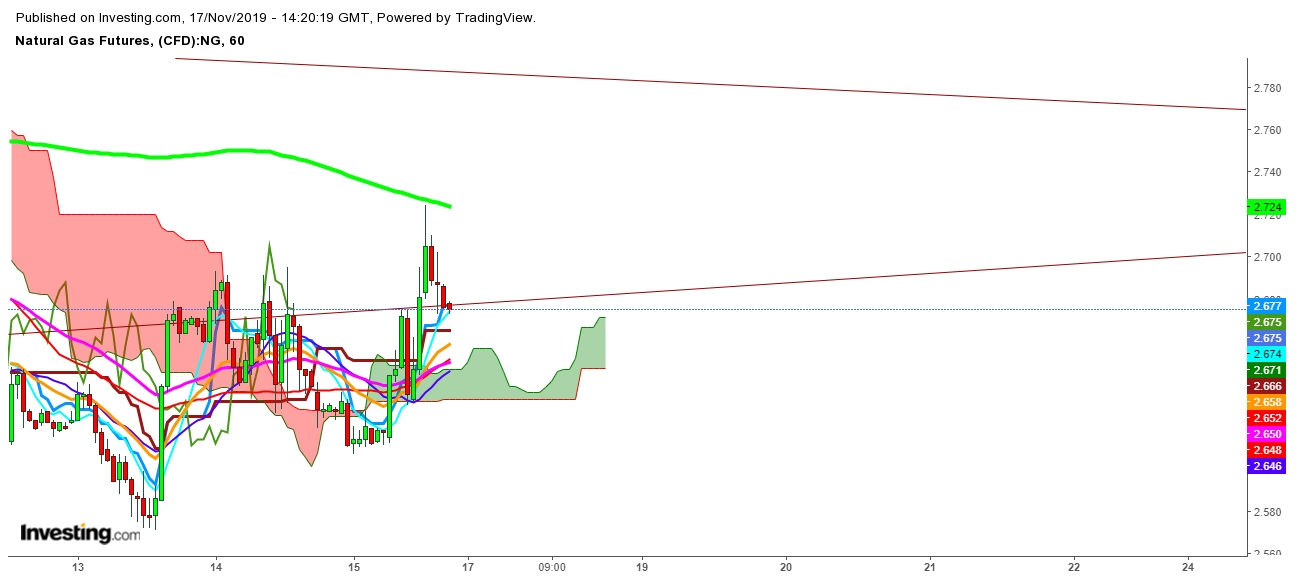

On analysis of the movements of Natural Gas, in different time frames, I find that a gap-up opening on the first trading session of the upcoming week above the level of $2.788 will confirm the continuity of an uptrend voyage; which has next stop for bulls at $3. No doubt that the Natural gas futures have attained enough strength to test the levels of $2.948 within first two trading sessions amid growing volatility, but a sustainable move above the level of $2.948 will keep the trend in favor of bulls.

Finally, I conclude that the formation of "Golden Cross" in a daily chart looks evident enough for a breakout move during the upcoming week; which may provide a sufficient base for the next peak of Natural Gas during this season.

Watch my video on Natural Gas below.

Disclaimer

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.