Thursday, the EIA weekly natural gas storage reported a draw of -190 Bcf, undoubtedly bearish but still more than the five-year average of -154 Bcf. But the cold winds from Canada pushed their way into the US amid peak winter.

I expect the EIA to report a massive withdrawal of around -250 Bcf in February due to a sudden surge in demand for natural gas in the next 2-days as a frosty weather system will track across the Great Lakes and East with rain, snow, and lows of -0s to 30s for massive national demand.

The western and southern US will be mild to warm with highs of the 40s to 70s. National demand will ease late this weekend into early next as warm conditions return across the southern and eastern US with highs of the 50s to 80s, although short-lived as another frigid system with rain, snow, and lows of -10s to 2s arrive upstream over the Midwest, Rockies, and Plains. But, the overall heating demand could remain high during the upcoming week.

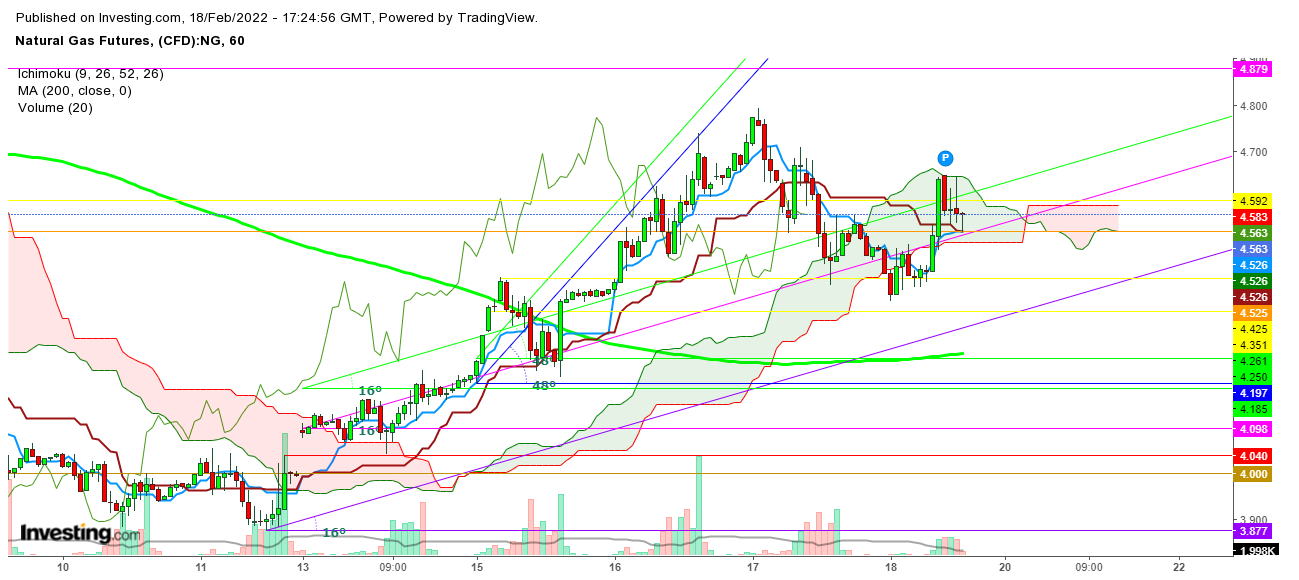

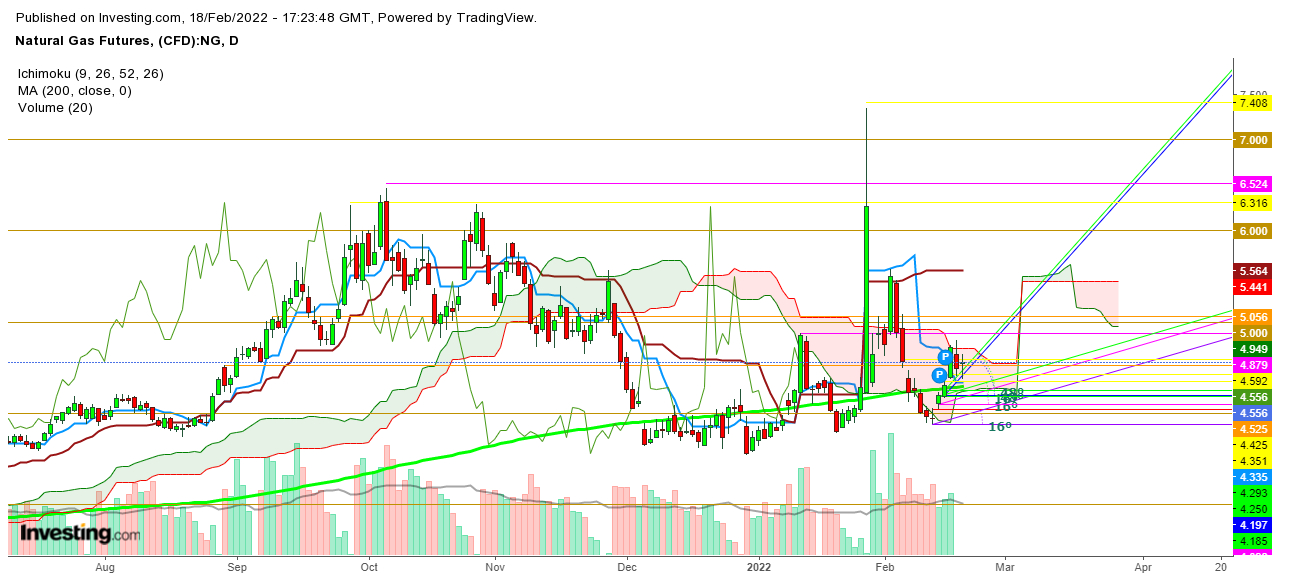

On analysis of the price action of the Natural Gas Futures during the last hours on Friday in a daily chart, I find the bears look busy in covering their shorts before the long weekend, which could result in a gap-up opening on the first trading session of the upcoming week as the geopolitical situation in Ukraine looks evident enough to take a sudden directional move that could be a game-changer for the price-action of the Natural Gas Futures during the upcoming week.

Technically speaking the Natural Gas Futures could find a decisive closing today as the next week has contract expiry on February 24 and the national holiday on February 21 on the occasion of the Presidents’ Day in the USA making the upcoming week too short to take a decisive move by the traders. Undoubtedly the overall situation could increase volatility for natural gas prices.

On the lower side, the Natural Gas Futures could find sufficient support at 200 DMA in a daily chart, and on the upper-side $5.7 could be the next immediate target for the natural gas bulls. For a more in-depth analysis of the expected outlook of the Natural Gas price action, readers may subscribe to my YouTube channel SS Analysis.

Disclaimer: The author of this analysis does not have any position in Natural Gas futures. Readers are advised to take any position at their own risk; as Natural Gas is one of the most liquid commodities of the world.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Natural Gas: Long Weekends, Cold Snaps Set To Short-Squeezing

Published 02/18/2022, 12:31 PM

Updated 07/09/2023, 06:31 AM

Natural Gas: Long Weekends, Cold Snaps Set To Short-Squeezing

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.