ETF and ETN products tend to add liquidity to the futures markets. The derivatives allow for speculation in commodities futures markets without venturing into the futures arena. They have increased the addressable market as they are available to market participants with a standard equity trading account.

The first ETF/ETN product in the commodities asset class was the (NYSE:GLD) that replicates the price action in gold. Since then, a host of other unleveraged and leveraged products burst upon the scene in many different raw material markets. The rise of the derivatives has added to the volume, and open interest as market makers, arbs, and other market participants hedge the price risk in the futures market.

Natural gas is one of the most volatile commodities that trade in the futures markets. The UGAZ and (NYSE:DGAZ) products that offered triple leverage on the up and downside in the natural gas arena traded millions of shares each day. The United States Natural Gas Fund (NYSE:UNG) (UNG) is the unleveraged natural gas product that follows the price of the energy commodity higher and lower.

UGAZ and DGAZ Were Highly Liquid Alternatives To The NYMEX Futures

UGAZ and DGAZ became standard products for market participants looking to take risks in the natural gas arena without venturing into the futures market on NYMEX. The short-term triple leveraged products traded millions of shares and added significant liquidity to the futures arena as the hedging of the risk positions found their way into the active month futures contracts.

The Velocity Shares 3X long and short ETN products were highly successful over the past years as an alternative for those with access to a standard equity account. Credit Suisse (SIX:CSGN) was the issuer of the ETN products. ETNs have an added risk of the credit of the issuer.

Delisting By Credit Suisse Of Its Velocity Shares ETNs

On June 22, Credit Suisse AG announced its intention to delist and suspend further issuances of a host of leveraged ETN products, including UGAZ and DGAZ. The financial institution did not provide specific reasons for the decision, but it was likely the result of events in the crude oil futures market on April 20. When the nearby NYMEX crude oil futures contract fell below zero, and a low of negative $40.32 per barrel, it sent a chilling signal to the derivatives markets. The potential for a similar move in natural gas or other commodities was likely behind the decision.

Natural gas has a long history of volatile price action as it has traded from a low of $1.02 to a high of $15.65 per MMBtu since 1990. The potential for a move below zero in the natural gas futures market at its delivery point at the Henry Hub in Erath, Louisiana, likely drove the decision to delist the bullish and bearish leveraged ETNs late last month.

Futures, futures options and BOIL will pick up the slack but expect a decline in some speculative activity

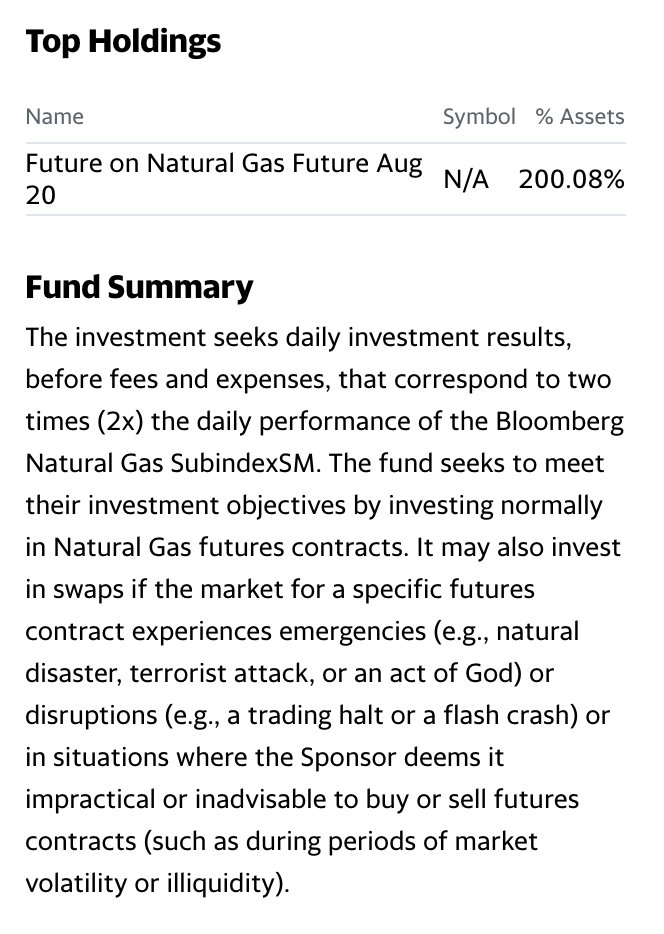

Natural gas will continue to attract speculators looking to participate in bullish and bearish price trends in the energy commodity. When it comes to leverage, the only choices are the futures arena or the ProShares Ultra Bloomberg Natural Gas product (BOIL) and its bearish counterpart (KOLD). The fund summary and top holdings of BOIL include:

Source: Yahoo Finance

(NYSE:BOIL) offers double leverage on the upside, and (NYSE:KOLD) is the inverse product. BOIL and KOLD have net assets of $50.6 and $25.19 million, respectively. BOIL trades an average of 1,022,814 shares each day, while KOLD’s average is 132,409 shares. BOIL charges a 1.31% expense ratio, and KOLD’s is 1.54%.

The BOIL and KOLD products have experienced an increase in volumes now that UGAZ and DGAZ are no longer available. However, the volume on the natural gas futures exchange is likely to suffer as the millions of shares of the triple leveraged Velocity Shares products will no longer translate into buying and selling in the futures market.