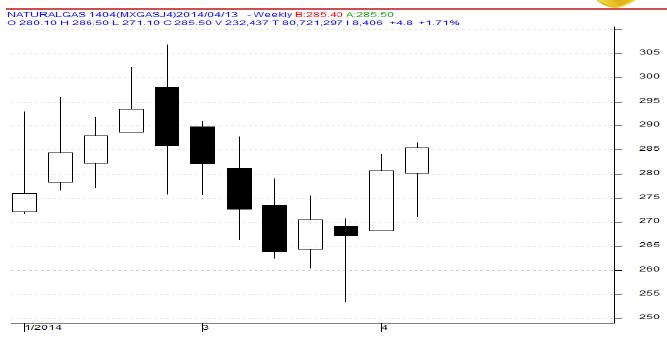

MCX Natural Gas April as seen in the weekly chart above has opened the week at 280.10 levels during this period prices has made a low of 271.10 levels. As expected in the end of the week prices bounced back from the support level towards the high of 286.50 levels. During this week prices able to close above the previous week’s closing of 280.70 levels and finally closed 1.17% higher on 285.50 levels. As per the price formation, during this week prices formed “Bullish Candlestick” pattern which indicates bullishness.

For the next week we expect Natural Gas prices to find support in the range of 275 - 273 levels. Trading consistently below 273 levels would lead towards the strong support at 268 levels.

Resistance is now observed in the range of 293 - 295 levels. Trading consistently above 295 levels would lead towards the strong resistance at 300 levels, and then finally towards the major resistance at 305 levels.

MCX / NYMEX Natural Gas Trading levels for the week

Trend: Up

S1 - 273 / $ 4.50 R1 - 295 / $ 4.90

S2 - 268 / $ 4.30 R2 - 305 / $ 5.10

Weekly Recommendation: Buy MCX Natural Gas April between 273 - 278, SL - 268, Target – 290 / 295.