Analyzing the movements of the Natural Gas Futures during the last week, I find that natural gas bulls were in hurry to retreat from Wednesday’s high at $8.123, after trading in a narrow range since last week’s opening at $7.737 when President Vladimir Putin threatened to cut supplies of energy products to nations that introduce price caps on Russian commodities.

Undoubtedly, Russia might want to maximize its revenue from natural gas. It would not be surprising if they turned back the flow of natural gas as the injection season in Europe is about to end.

On the other hand, the last inventory announcement on last Thursday projected a build-up in stockpiles that propelled the bearish sentiments to push the Natural Gas Futures to test the weekly lows at $6.741 before closing the week at $6.860.

Storms Coming

On Friday, Tropical Storm Hermine formed by 5 p.m. from Tropical Depression Ten, several hundred miles west of the African coast, the center’s latest advisory said. Hermine is moving north-northwest at 10 mph with maximum sustained winds of 40 mph.

Hermine could strengthen through Saturday but expected to weaken beginning Sunday and dissipate early next week, the 8 p.m. update said. I find that its current path does not show it reaching land.

In its 8 p.m. update, the National Hurricane Center said the storm expected to become Ian is moving west-northwest at 15 mph. It was 410 miles east-southeast of Kingston, Jamaica, and 720 miles east-southeast of Grand Cayman.

Forecasters are also monitoring another system in the Atlantic, a broad area of low pressure in the Atlantic which has a 30% chance of developing in the next five days, as the Tropical Depression Nine is the biggest concern.

No doubt that the Natural Gas Futures could remain volatile as the National Weather Service Miami wrote in its Friday morning briefing that “all tropical threats are in play” in South Florida, including damaging winds, storm surges, flooding, and tornadoes.

Undoubtedly, this sudden change in climate could keep demand on the low side, as the National Hurricane Center specialist Phillipe Papin said on Friday that there is still a healthy amount of uncertainty in the track forecast at the day 4-5 timeframe.

The Charts

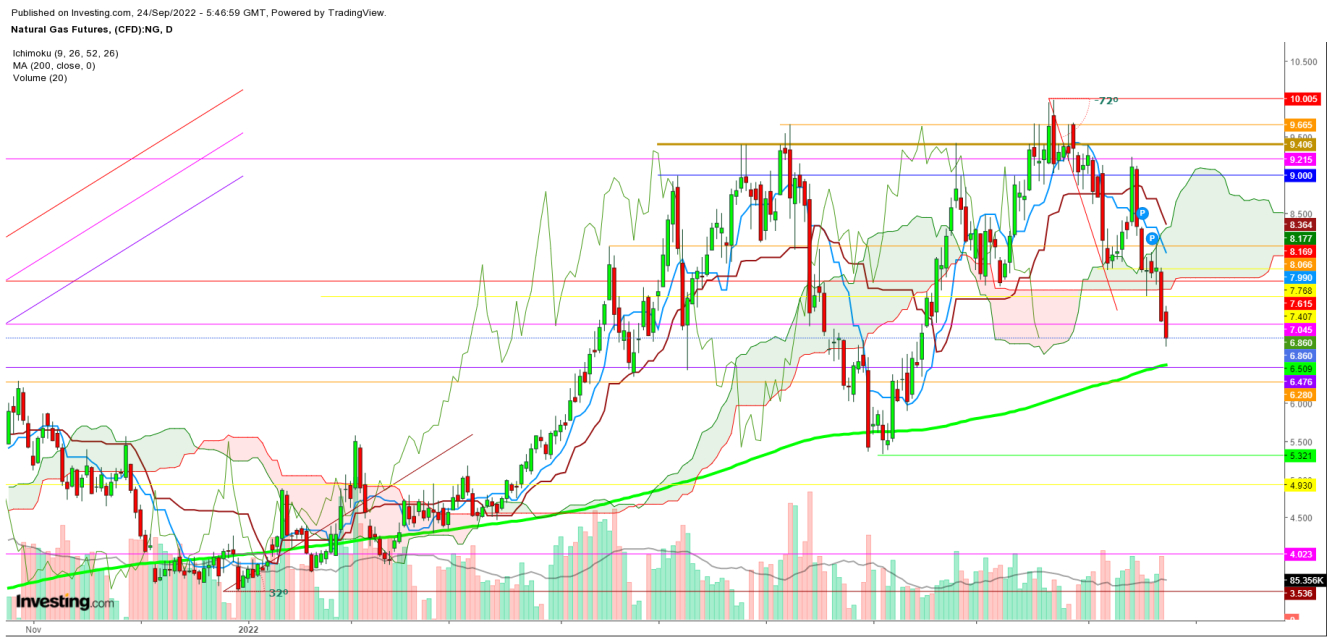

Technically speaking, in a monthly chart, the futures found strong buying support below 9 DMA, currently at $6.821, before closing the week at $6.841.

In a weekly chart, the futures have seen a steep fall during the last five weeks after testing a seasonal peak at $10.005 on August 23 and currently trading much below the 26 DMA, which is at $7.630 that ensures the current fall to continue during the upcoming week.

In a daily chart, the Futures are showing extreme weakness as trading much below the lower end of the ‘Ichimoku Clouds’ after the formation of a ‘Bearish Crossover’ on September 6, as I explained in my last analysis.

On the other hand, amid growing uncertainty over Hurricanes during this time of the year, Natural Gas Futures could start the upcoming week with a gap-up as ever since 2005, when Hurricanes Katrina and Rita destroyed multitudes of offshore production platforms, the Gulf of Mexico production sits at only about 2 billion cubic feet per day (bcf/day). Therefore, depending on the size and intensity of the storm and if it targets major coastal cities, hurricanes are now regarded as more demand reduction events.

No doubt that a weekly gap-up opening could be there as the uncertainty still looms due to the changing weather conditions in the Gulf of Mexico.

Finally, I conclude that the Natural Gas Futures could see a weekly move from $7.407 on the upper side to $5.858 on the lower side if the upcoming week starts with a gap-down opening.

Disclaimer: The author of this analysis does not have any position in Natural Gas and WTI Crude Oil futures. Readers are advised to take any position at their own risk; as Natural Gas is one of the most liquid commodities of the world. All the readers may subscribe to my YouTube channel ‘ss analysis’ to watch my upcoming video on the weekly outlook for the week of Sept. 26.