- US hurricane season is in full swing, affecting natural gas supply.

- Lower storage injections could provide bullish fuel too.

- Amid this, the commodity could target a move toward $3 resistance

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

Natural gas prices have surged in recent weeks, driven primarily by severe weather, with Hurricane Helene wreaking havoc along the U.S. East Coast.

The storm has claimed 93 lives and left over 2.4 million people without power.

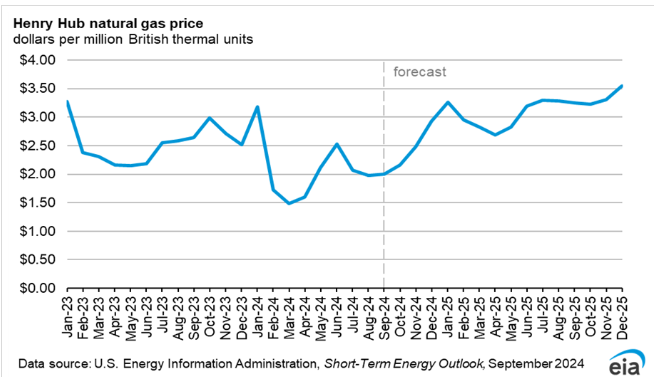

Amid this turmoil, Henry Hub natural gas prices are steadily climbing, approaching the critical $3 per MMBtu mark.

This upward momentum is further fueled by significantly lower-than-average storage additions, a factor that, according to the EIA, could push prices even higher in the coming quarters.

Hurricane Helene Disrupts Natural Gas Production

The Atlantic hurricane season always adds volatility to natural gas markets, and this year is no exception. Helene has already shut down nearly 20% of natural gas production in the Gulf of Mexico, pushing prices up by around 30% in September alone.

With production heavily disrupted, the market is bracing for further gains, especially as the storm’s impact deepens.

On top of weather disruptions, supply-and-demand dynamics are adding more pressure to the upside. Natural gas storage replenishments fell to 47 billion cubic feet for the September 16-20 period, far below the five-year average of 88 billion cubic feet.

Meanwhile, unseasonably warm temperatures and solid economic growth in the U.S. continue to sustain demand. In the short term, these combined factors create a perfect storm for prices to break through the key $3 per MMBtu level.

Medium- and Long-Term Gas Price Forecasts

The EIA expects natural gas prices to keep rising in the months ahead. Their forecast predicts an average price of $2.52 per MMBtu in Q4, climbing to $3.01 per MMBtu in Q1 2025.

The market may hit peak pricing toward the end of next year, with an average price of $3.36 per MMBtu.

The primary driver of this trend will be increased LNG exports, which continue to grow alongside relatively stable domestic supply.

Moreover, with the hurricane season in full swing, more severe storms could further disrupt production and exacerbate price increases.

Key Resistance Levels for Henry Hub Contracts

As Henry Hub prices trend upward, two critical resistance levels are in focus. The first challenge for buyers is the $3.10 per MMBtu barrier, set by the June lows.

Should prices break through this level, the next target lies at $3.40 per MMBtu, representing historical highs.

On the downside, local support levels sit at $2.65 and $2.45 per MMBtu, which could serve as bounce points if corrective pullbacks occur.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services.