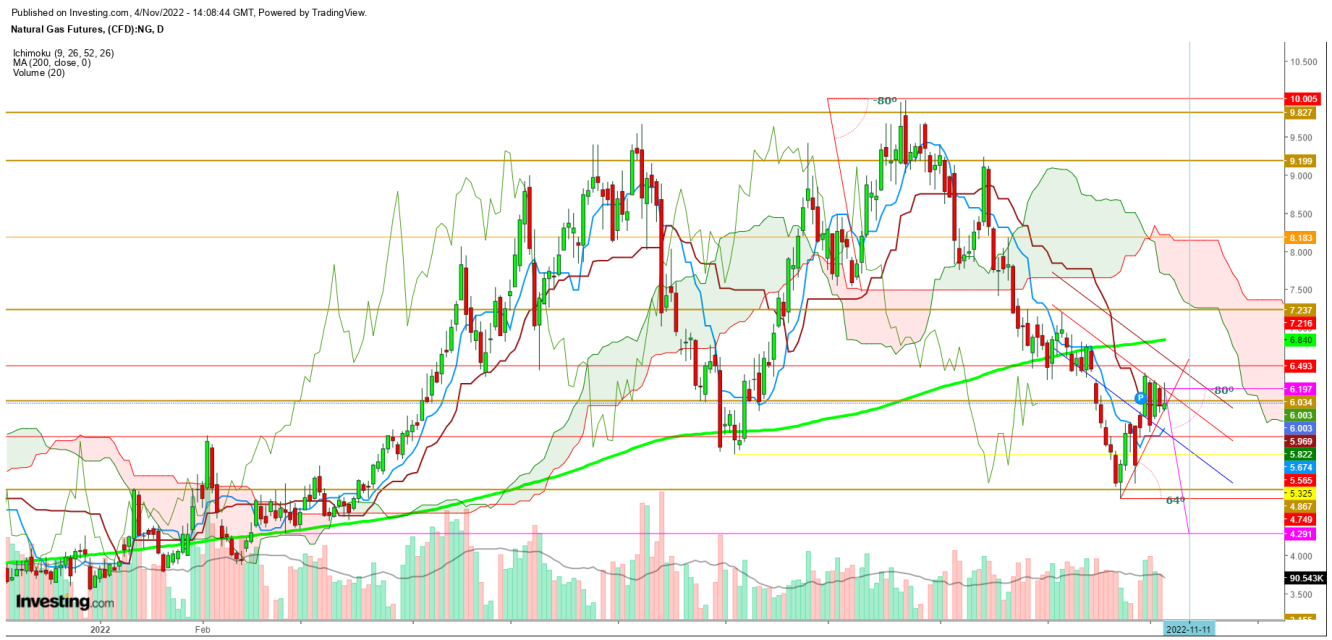

By analyzing the movements of natural gas futures since Oct. 31, we can see that the selling is visible enough on every upward move to confirm a breakdown soon as the bulls find it difficult to sustain above $6.3.

On the daily chart, the commodity sustained below a descending slope, which could result in a sudden surge in the selling spree this Friday.

The bears could trigger selling during the last hours of the week as the bulls look reluctant to hold longs during the weekends amid changing weather patterns.

The warm weather pattern will continue to rule the eastern half of the US Sun-Wed, while the West remains cool enough to keep the demand very low for the next 7-days.

Undoubtedly, bulls and bears have looked hesitant since the announcement of large build-in stockpiles last Thursday and the upcoming winter. I find a low demand during this weekend could attract bears to remain in command the following week.

Technically speaking, the formation of a bearish crossover in a daily chart has resulted in a selling spree on Friday as the formation of an exhaustive candle is about to complete.

The contract felt the advent of selling pressure from the day's high at $6.274 as the bulls keep trying to defend the immediate 26 DMA support, currently at $5.969.

A weekly closing below $9.585 will be the first confirmation of the continuity of a breakdown during the upcoming week below the 9 DMA, currently at $5.674. Only a sustainable move above $6.312 could keep the trend in favor of the bulls.

Disclaimer: The author of this analysis does not have any position in Natural Gas. Readers are advised to take any position at their own risk, as Natural Gas is one of the most liquid commodities in the world.