Natural gas prices hardly reacted to the news that Russia was likely to invade Ukraine. The White House told American’s in Russia to leave the country within the next 24-48 hours. The weather could remain warmer throughout most of the United States for the next 2-weeks. But, the natural gas price-action punishes the bears in the mid of February historically. This phenomenon could prevail during the next two weeks of February 2022.

Technically, the natural gas futures faced stiff resistance at $4.040 and $4.430 on every upward move, but during the last week, the price attempted to find a base at $3.876. Undoubtedly the overall trend was bearish since this week when natural gas started the session with a gap down. The price could try to fill this gap during the upcoming week to remain in an uptrend.

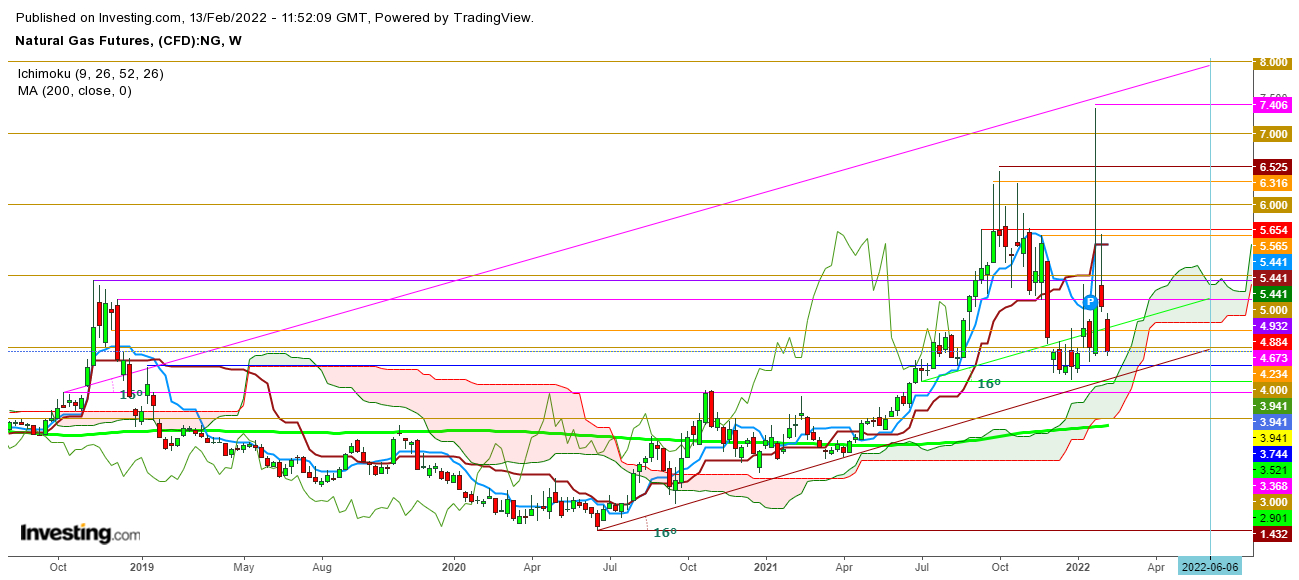

In a weekly chart, the natural gas futures witnessed a slight pullback during the last few hours, before weekly closing. Finally, the closing of Friday in green indicates the presence of value-seeking buyers below $3.888. The price action showed a substantial move during the previous week but felt stiff resistance at $5.5 and continued to slide during the last week.

Natural gas will make an upward move if Russia signals its intention to invade Ukraine during the upcoming week. Russian President Vladimir Putin did not indicate in a phone call with French President Emmanuel Macron on Saturday that he was preparing to invade Ukraine. However, uncertainty still looms.

In a daily chart, the candle formed on Friday looks evident enough for extreme volatility during the next week, and such volatility, natural gas could find a bid in a trading range of $3.726 to $5.747. Undoubtedly, this is not the time to think for a sustainable upward move, but a short-term move could hit $5.428 if the prices find a sustainable move above 200 DMA, which is currently at $4.256.

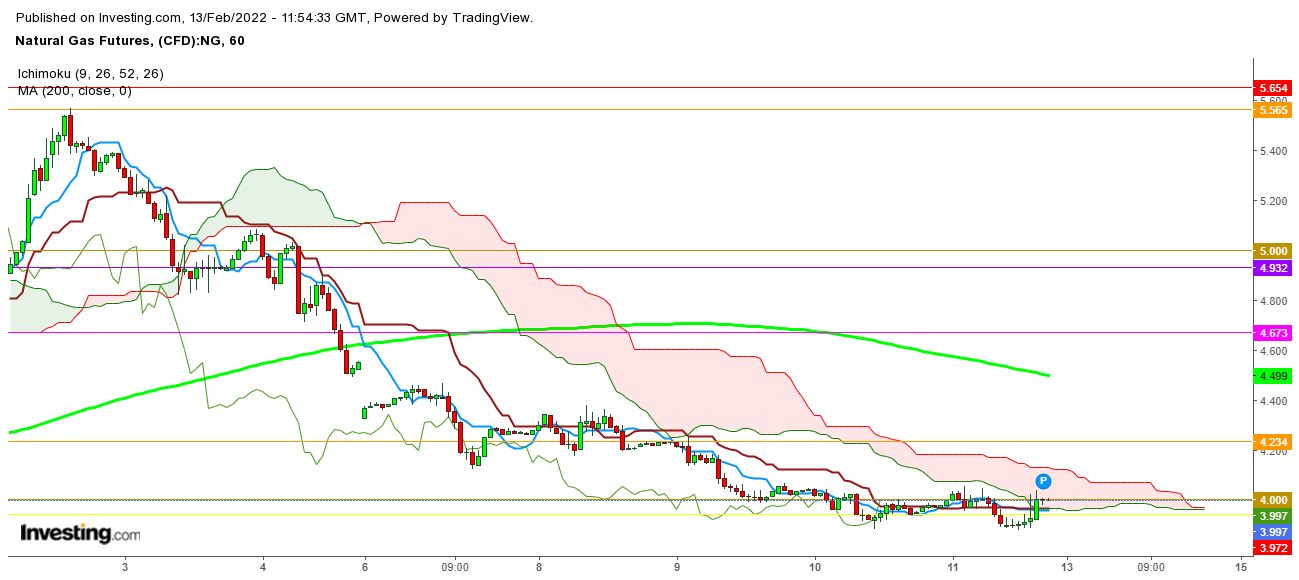

In an hourly chart, the last hour moves on Friday ensures a gap-up opening as the week shorts could find covering bets on gap-up. If natural gas finds a sustainable move above $4.123, the bulls could try to hit 200 DMA, at $4.499, during the first two trading sessions. And a sustainable move above 200 DMA could push the price to hit $4.673 before the announcement of the weekly inventory.

In a 15 Minutes chart, the prices show a strong closing. The formation of a bullish crossover by 9 DMA above 200 DMA could ensure a short-term swing in the upward direction as prices were trading in a 15 Minutes chart well above the Ichimoku Clouds.

An upward swing could be short-lived. But if natural gas finds a sustainable move above $4.424, that could generate a short-covering rally any time during the next week due to any shift in news flow on the Ukraine front.

On the lower side, if the prices start the upcoming week with a gap-down opening below $3.881 could generate selling sprees on every reversal until the prices fail to sustain above $4.932. The growing volatility could influence the price movement. The natural gas prices could repeat the price action of the second week of January 2022.

Disclaimer: The author of this analysis does not have any position in natural gas futures. Readers are advised to take any position at their own risk, as natural gas is one of the most liquid commodities in the world.