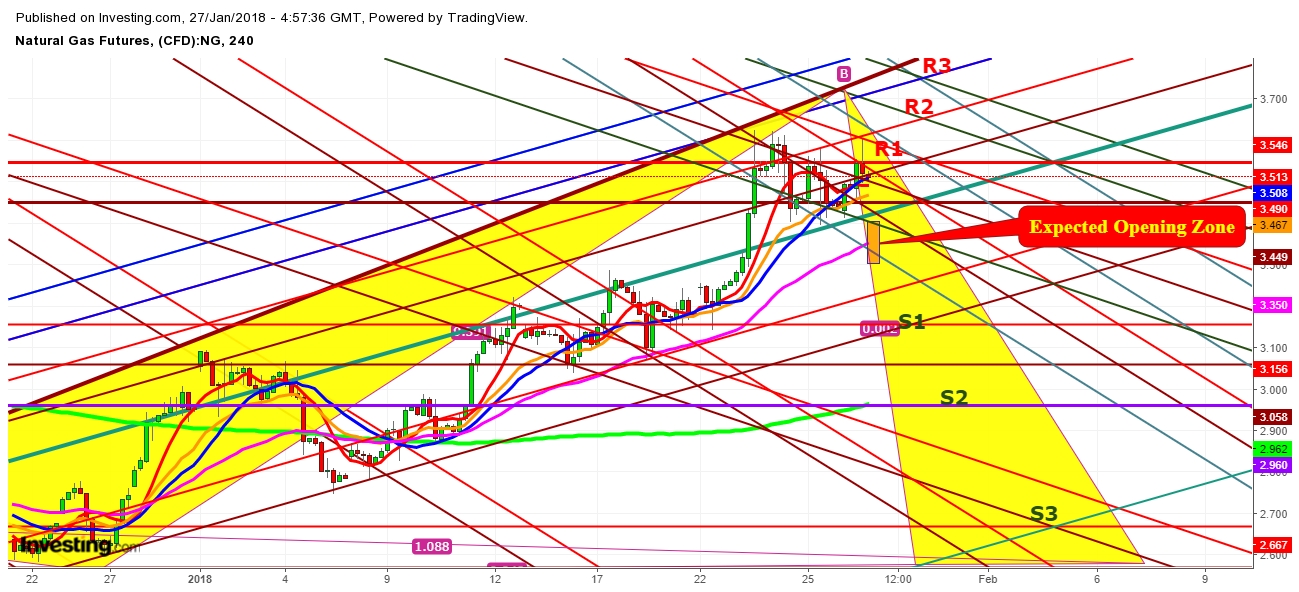

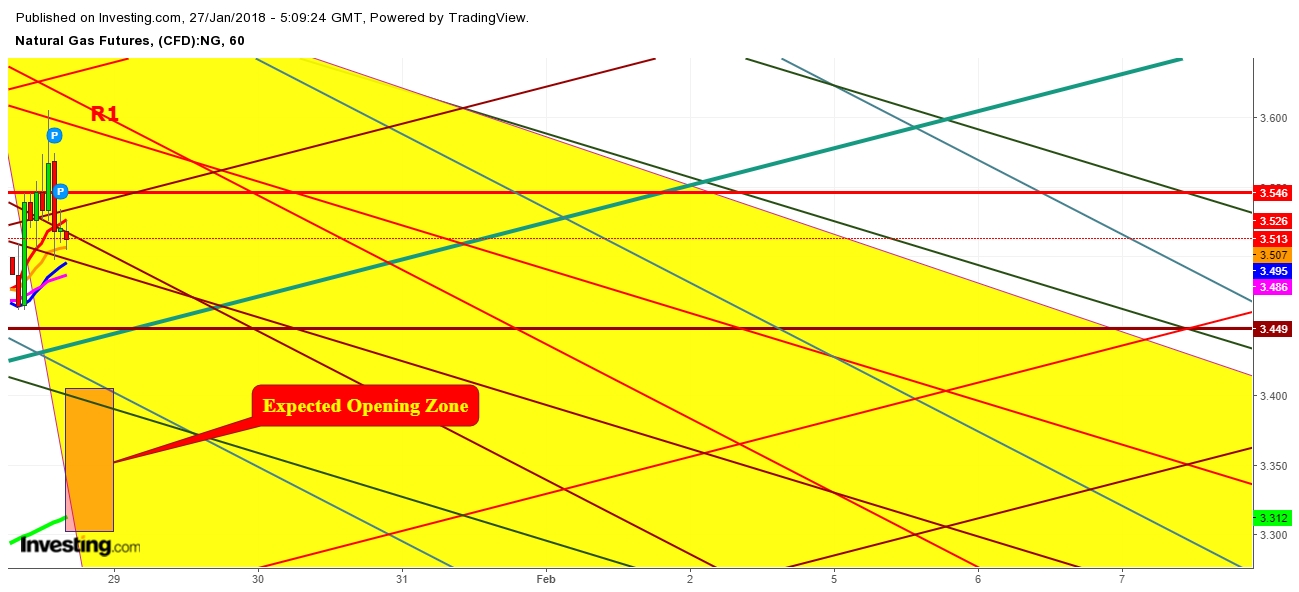

On analysis of the movement of Natural Gas futures price since my last analysis , I find the Natural Gas Futures price has been struggling still inside the exhaustive zone, which makes the situation evident enough for steep downward moves during the upcoming weeks. Secondly, the basic logic behind bullish move – expectation of more withdrawal – seems going to fade on announcement of impending inventory on February 1st, 2018 which is expected to be less then (-) 100B. Thirdly, expectations for higher number of HDDs seems going to be on the lesser side, which were expected earlier on the higher side.

Observations

Having a closer look at the technical zones on January 27th, 2018 which I noted in my last analysis on January 24th, 2018, I find the reflection of bearishness upon the movement of Natural Gas futures price is evident enough for me to conclude my thoughts.

Conclusion

I conclude an expected propositional trading zone for the Week of January 28th, 2018.

Disclosure

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.