On Monday, natural gas jumped as the bulls were more energetic at dawn after a gap-up weekly opening.

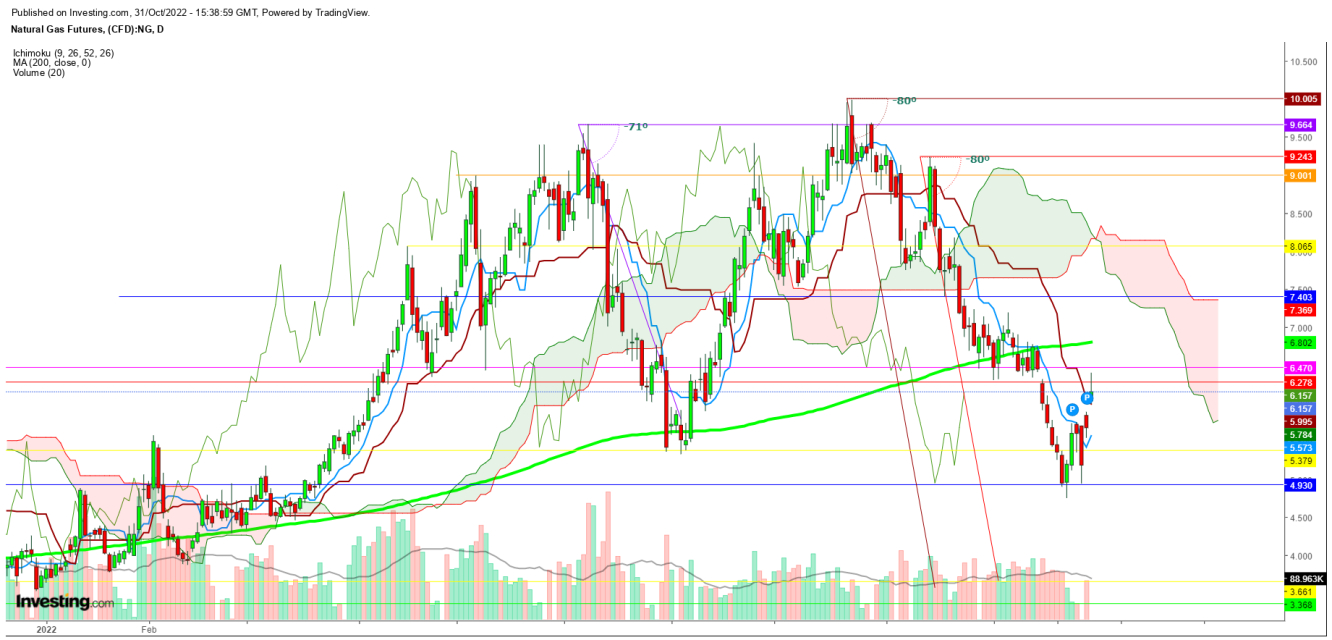

The move was a good bounce from the upper end of the ‘Ichimoku Clouds’ but failed to find a breakout above the immediate resistance at $6.4 and started to turn down.

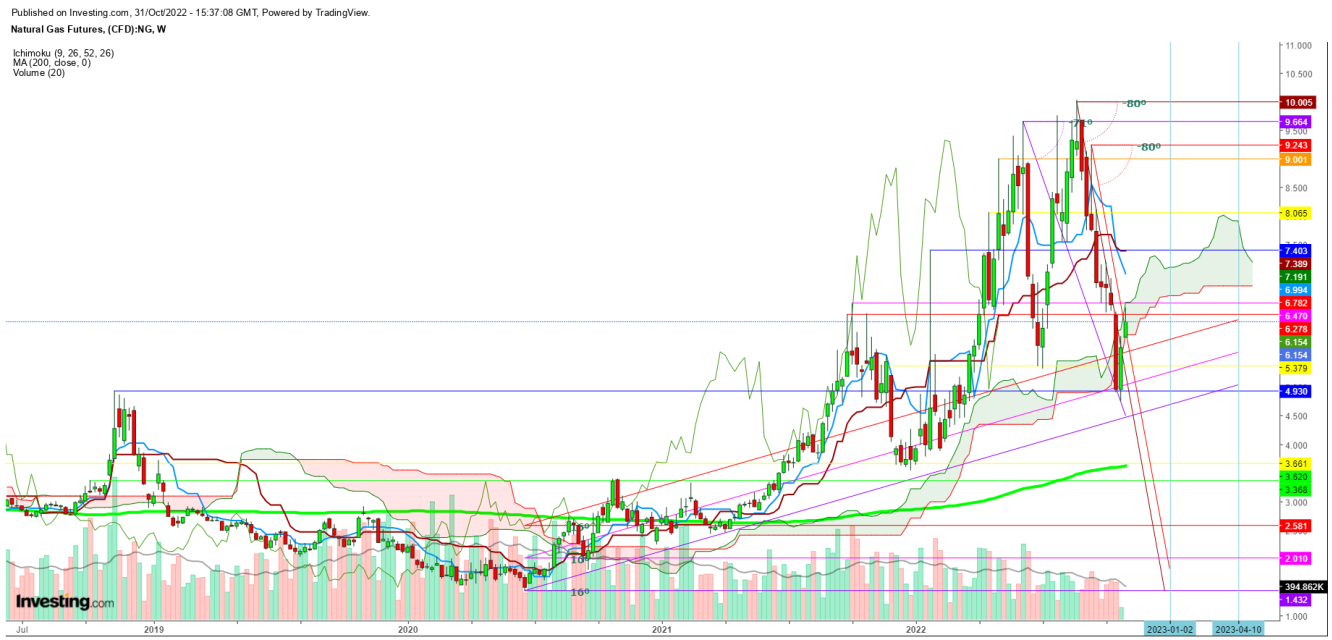

In a weekly chart, the current week’s candle still shows exhaustion as found stiff resistance at the upper end of ‘Ichimoku Clouds’ due to a ‘Bearish Crossover’ formation with 9 DMA below the 26 DMA.

In a daily chart, natural gas shows the impact of selling pressure after testing the day’s high at $6.396 as the production glut amid supply disruption seems to continue due to changing weather patterns at this time of the year.

Technically, if natural gas does not hold above the opening gap on Oct. 31, the current sell-off from the day’s peak looks steeper than ever. The exhaustion could push the natural gas prices to hit $5.561 on Nov.1.

A breakdown below $5.676 will be the bears' first confirmation of a breakthrough during this week and may push natural gas to hit $4.888 this week.

The exhaustion still looms over the natural gas prices but remains invisible as the wild price swings encourage the bulls to enter the scenario. The panic selling could follow the current move anytime as the weather looks quite supportive for the bears.

Disclaimer: The author of this analysis does not have any position in Natural Gas. Readers are advised to take any position at their own risk, as Natural Gas is one of the most liquid commodities in the world.