Despite a sudden surge in demand on Wednesday, natural gas futures remained under bearish pressure this Thursday as the announcements of weekly inventory levels were not too attractive for the bulls to defend their territory above $4.477, finally attracting big bears to come forward.

On Friday, despite the appearance of an upward move from the day’s low at $4.153, the selling spree could start once again above the immediate resistance at $4.371 due to the changing weather outlook for this weekend.

According to Natgasweather reports, a frigid arctic blast will continue to impact much of the eastern half of the US through Saturday with rain, snow, and highs of -0s to 40s, lows of -20s to 30s for robust national demand while the warmer exception will be the West and far southern and western US with highs of 50s to 70s.

Warmer temperatures will gain ground over much of the US late this weekend into early next week with highs of 40s to 70s.

I anticipate that such a weather forecast could result in wobbly moves on Friday as the currently prevailing scenario for the high demand for natural gas is likely to change this Sunday and will keep the demand on the lower side next week.

Technical Levels to Watch

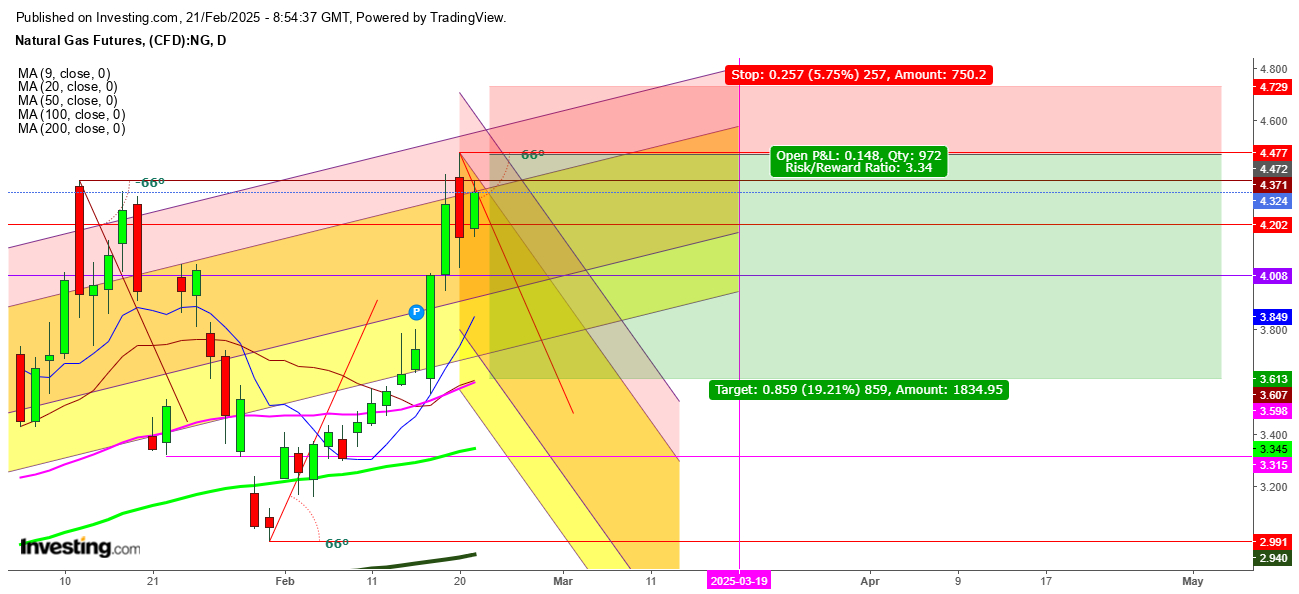

On the daily chart, natural gas futures are facing stiff resistance at the immediate resistance at $4.371 indicates if the natural gas could not sustain above this, bears will take the command to trigger a selling spree till today’s closing.

However, if the natural gas futures hit immediate support at $4 likely to result in a sharp reversal despite the thick presence of bears at this level.

If the natural gas futures find a breakdown below this significant support, the next support will be at the 9 DMA at $3.850.

Inversely, in case of a breakout by the natural gas futures above the next resistance at $4.477 will provide a good opportunity to take a short position with a stop loss at $4.729 for a target at $3.613.

Disclaimer: Readers are advised to take any position in natural gas futures at their own risk as this analysis is only based on observations.