Sometimes, minor developments are left unnoticed while a natural gas trader goes through a busy schedule in digging out immense details about the underground stock position, weather conditions, and demand-supply outlook for the current week or month. Natural gas is the most liquid commodity in this world has the potential to negate all the fundaments all of a sudden with a minute change in the current scenario.

Despite a warm-weather announcement for most parts of the United States, Natural gas futures could not close the last week well above the high of April. Natural gas remained volatile in the previous week due to expected growth in industrial and domestic demand that could remain strong during the upcoming weeks due to growing hopes of economic recovery. Undoubtedly, the commodity hedge funds have returned amid a sudden surge in demand amid increasing probabilities of establishing normalcy in the European and Asian countries after vaccination.

The current rally has thrown the global equity markets into overbought territory that makes the situation more vulnerable. On the other hand, the commodities are at their lowest level due to denting impact of Covid-19 that could attract commodity hedge funds to trade in commodities aggressively during the upcoming weeks. While money has flooded into other commodity investments, hedge funds are a more surprising choice after years of outflows and closures of several high-profile firms.

Undoubtedly, the comeback of hedge funds could create massive volatility in natural gas to make a profit from the most liquid commodity, but this could extend the directional moves in either direction all of a sudden without any correlation with fundamentals. Hedge funds focused have generated strong returns in 2021. Investors long wary of such funds are now putting money into them, betting the recovery from the pandemic will charge demand for oil, gas, and raw materials from metals to grains to sugar and coffee.

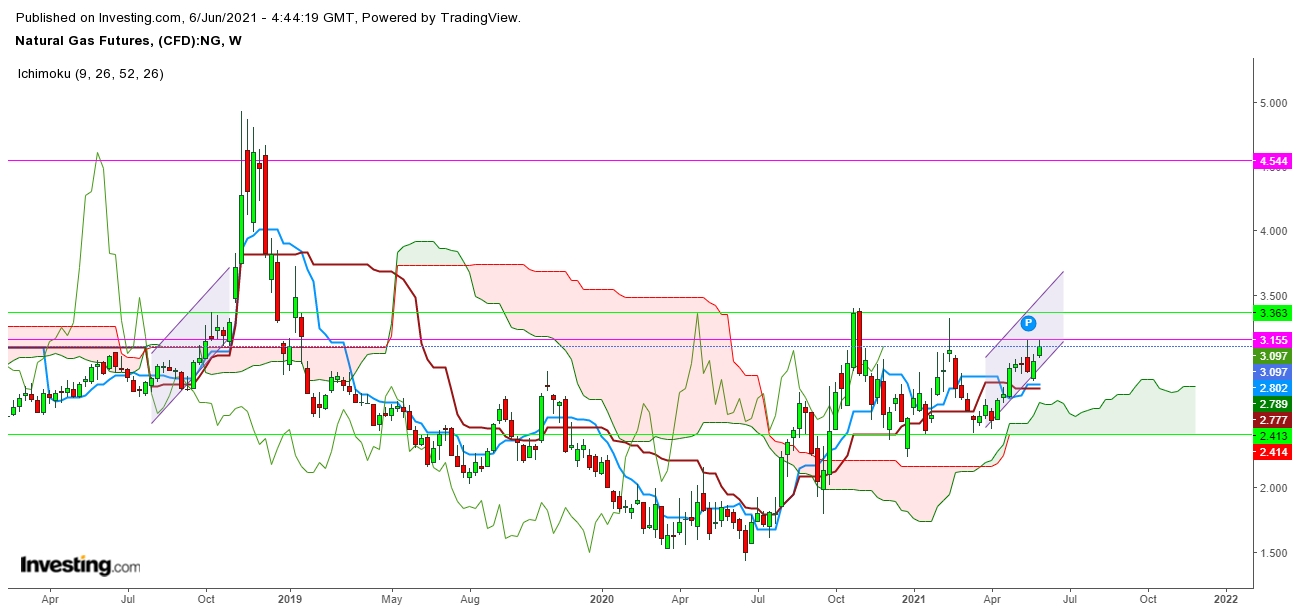

While analyzing the movements of natural gas futures in different time frames, I noticed that the current moves have similarities with the directional moves that the futures had during the year 2018 before testing a seasonal peak in November 2018. I find that the formations visible in natural gas futures during the last three months look evident enough for a blasting move during June and July in 2021. Undoubtedly, hedge funds could propel natural has futures in an upward direction. I find that if the natural gas futures start the upcoming week with a gap-up opening above the immediate resistance at $3.155 which would confirm the continuity of the current uptrend in natural gas.

Disclaimer: The author of this analysis does not have any position in Natural Gas futures. Readers are advised to take any position at their own risk; as Natural Gas is one of the most liquid commodities of the world.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Natural Gas: Cyclical Repetition Could Favor Bulls

Published 06/06/2021, 12:44 PM

Natural Gas: Cyclical Repetition Could Favor Bulls

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.