Despite a bump on Monday, heavy selling pushed natural gas lower at the day’s closing. The growing exhaustion could continue this week if the opening gap is filled-up on Tuesday.

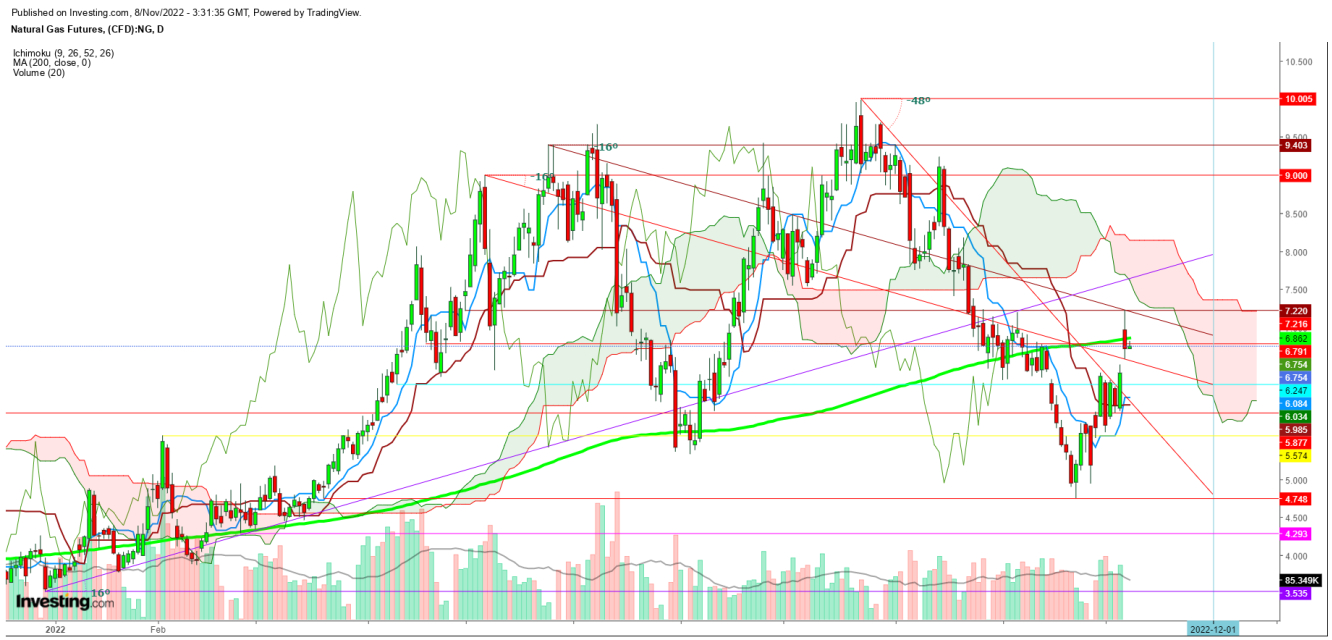

After a weekly opening gap, natural gas rallied on Monday but faced stiff resistance at $7.220, resulting in a steep slide before closing the day at $6.712.

Tuesday could be a turning point if the weekly opening gap is filled with a sustainable move below the significant support at $6.247 as natural gas is trading below the 200 DMA in a daily chart.

In a daily chart, 200 DMA still looks to be a stiff resistance as seen between Oct. 10-14 before a steep slide up to $4.783 on Oct. 24.

The prices could see more downward pressure as British Prime Minister Rishi Sunak is poised to announce a major gas deal with the U.S. after the COP27 climate change summit.

This deal could take a week or two before reaching the final stage and could result in wild price swings.

Natural gas could find more exhaustion as the United States wants Europe to come out of the energy trap created by Russia.

In a weekly chart, the price faces stiff resistance at 9 DMA as the formation of a ‘bearish crossover’ could continue to have an impact.

The prices could see a breakdown on Tuesday before 10:30 a.m. below the significant support at $6.247 if not sustained above the immediate support at $6.512.

Disclaimer: The author of this analysis does not have any position in Natural Gas. Readers are advised to take any position at their own risk, as Natural Gas is one of the most liquid commodities in the world.