- US gas futures face bearish pressure as output rises, summer heat wanes

- $8.50 could be a resistance; with a break beneath $7.50 opening the door to $6.50

- Freeport stays a factor, though a faster restart of LNG plant could be bullish

The pendulum is swinging again in natural gas, and this time, it seems headed lower.

After three weeks of moving up in sympathy with the European gas crisis—America, after all, is backstopping the bloc as its most important provider of liquefied natural gas—sentiment has reversed over the past two weeks for gas futures on New York’s Henry Hub.

In the past seven sessions, the hub’s front-month tumbled on four days, with the lower end of the drop being 3% and the higher end 7%. Wednesday’s rebound, for instance, saw the price almost entirely recover.

While volatility seems to balance things out, the path of least resistance could be lower from here.

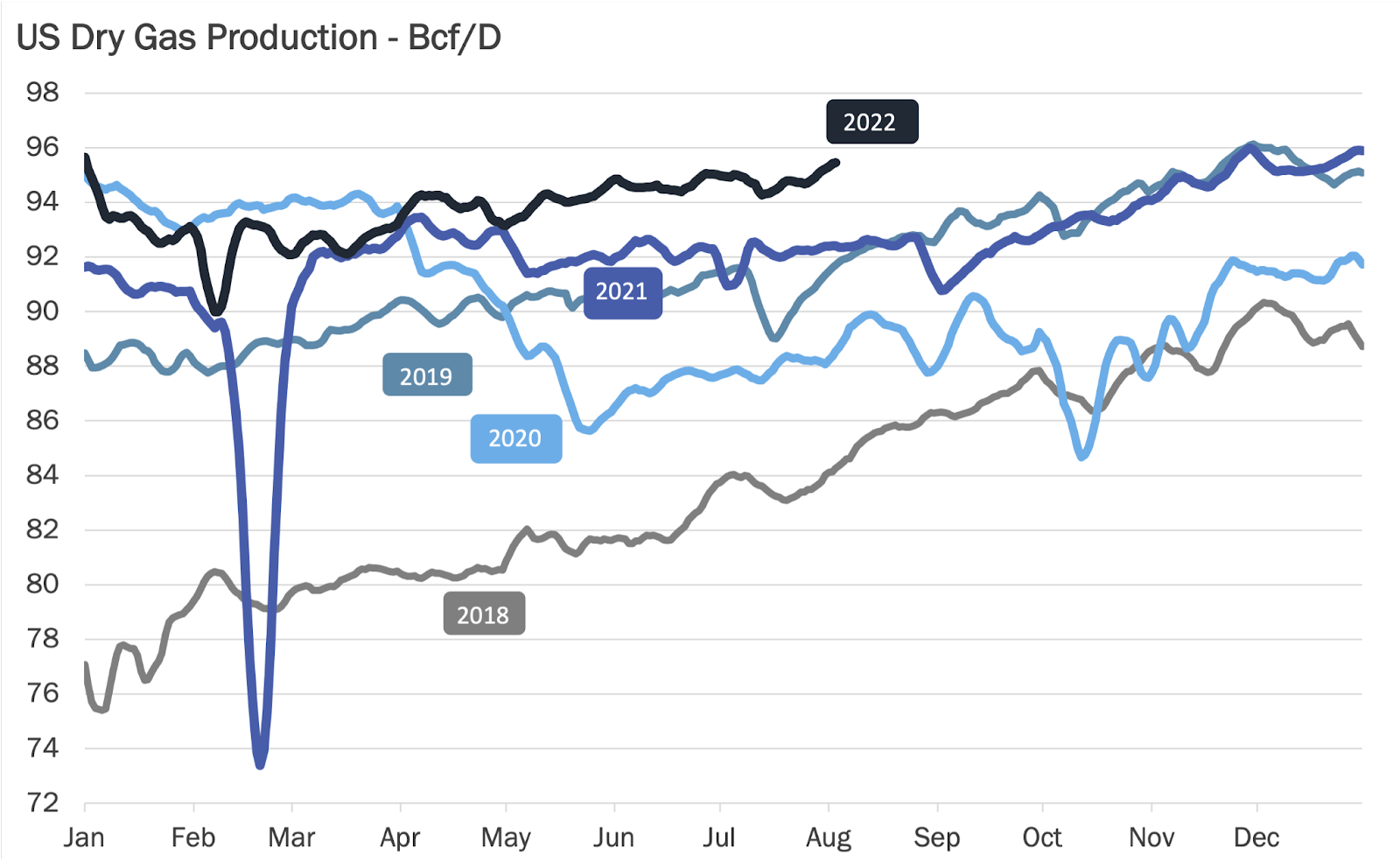

And here’s why: US gas production is rising, with output of dry gas volumes hovering above 97 billion cubic feet per day (bcf/d) during late-day flow cycles on Tuesday.

Source: Gelber & Associates

Presently, dry gas production is up greater than 3 bcf/d year-over-year and continues to flirt with record highs near 97.5 bcf/d.

This level was last exceeded on July 18, when volumes hit 97.53 bcf/d. Overall, dry gas production has managed to remain propped up in recent days (even during workweek days), compared to the last few weeks when it would decline towards 96 bcf/d during the week and then rise above 97 bcf/d on the weekends.

And why is this important?

This bump-up in daily production is a promising indication that volumes could be on the cusp of advancing to new all-time highs above 98 bcf/d in the relatively near term.

Next, summer temperatures are waning. You know that maddening heat that had Americans running their air-conditioners day and night over the past month? Well, it’s dissipating.

About the only meaningful card that gas market bulls are holding now are hot temperatures across the US and less than comfortable storage volumes.

But despite the bullishness that reemerged on the Henry Hub late last week and on Monday, it appears that overall conditions no longer have the same sort of price-supportive drivers that had influenced gas futures to highs not seen since 2008 during the spring and early summer advance.

According to the major weather forecast models, temperatures across many areas of the US are poised to descend the lower side of the seasonal bell curve as the calendar presses into mid-August and beyond.

While the southern US tier will continue to see above-average temperatures for another couple of months, the northern tier, including the upper Midwest and the Northeast, should begin to see the onset of less hot conditions, which will start to reduce gas demand for cooling purposes.

Even though the forecast for the current two-week period into the first week of August depicts above-average temperatures, there are growing signs among the major weather forecast models that the heat could begin to gradually relent by the middle of next week.

As analysts at Houston-based gas markets consultancy, Gelber & Associates, told their clients in a note on Wednesday, getting beyond $8.50 on the Henry Hub might be challenging as the days progress, especially with the Freeport LNG crisis still hanging over the market.

After the initial panic that US gas-in-storage could be as much as 15% short of five-year norms going into 2022/23 winter, the tables suddenly turned with the Freeport LNG crisis. The explosion at the Texas-based liquefied natural gas plant on June 8 idled about 2 bcf per day of supply. Gas futures on New York’s Henry Hub that day seemed headed for $10, a level unseen since 2008, but then made a stunning U-turn, crashing almost 30% by early July on news that Freeport won’t be fixed until October.

That was, of course, before Moscow’s state-owned Gazprom (MCX:GAZP) squeezed the flow on its Nord Stream pipeline to Europe to 20% of capacity last month, sending benchmark gas prices on the bloc flying, with the Henry Hub in pursuit—till now.

Said the Gelber & Associates note:

“Additional upside potential beyond the mid-$8.20s may be limited in the near term. Besides the continued loss of Freeport LNG feed gas demand, gas market players are now more fully attuned to the potential for further gas supply increases. Should this outlook [be] verified, it could result in a loosening of supply/demand imbalances, which would present a challenge to gas market bulls to keep upside pressure on prices.”

Technical charts also suggest that $8.50 would be the level for gas bulls to beat, said Sunil Kumar Dixit, chief technical strategist at skcharting.com. He adds:

“Prices need a sustained break above $8.50 for a retest of $9 and above. A break below $7.50 will change the momentum to bearish, for a drop to even $6.50.”

The Gelber & Associates note concurs with Dixit’s projections, which it said might come as weekly gas storage starts building between mid-to-late August and November 1. The firm adds:

“Should this be the case, it could result in a sizable drop in front-month gas futures later this fall [season], potentially tumbling below $7 or perhaps notably lower, depending on how aggressive production volumes grow and where gas storage totals sit in the months ahead.”

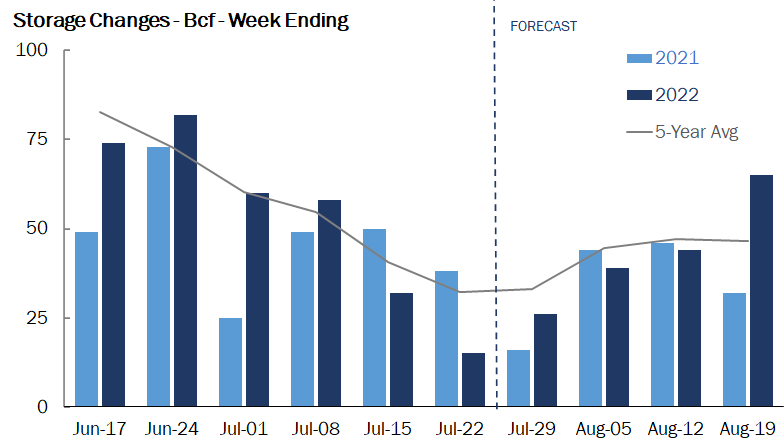

Source: Gelber & Associates

And that storage build should be at a smaller-than-usual 29 bcf for last week, as extreme heat caused power generators to burn more gas to keep air conditioners humming, according to a consensus of analysts who track such numbers.

The build compares with an increase of 16 bcf during the same week a year ago and a five-year (2017-2021) average injection of 33 bcf.

In the week ended July 22, utilities added 15 bcf of gas to storage.

The injection analysts forecast for the week ended July 29 would lift stockpiles to 2.445 trillion cubic feet (tcf), about 12.5% below the five-year average and 10.3% below the same week a year ago.

According to Reuters-associated data provider Refinitiv, there were around 105 cooling degree days (CDDs) last week, which was much more than the 30-year normal of 90 CDDs for the period.

CDDs, used to estimate demand to cool homes and businesses, measure the number of degrees a day's average temperature is above 65 degrees Fahrenheit (18.3 C).

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.