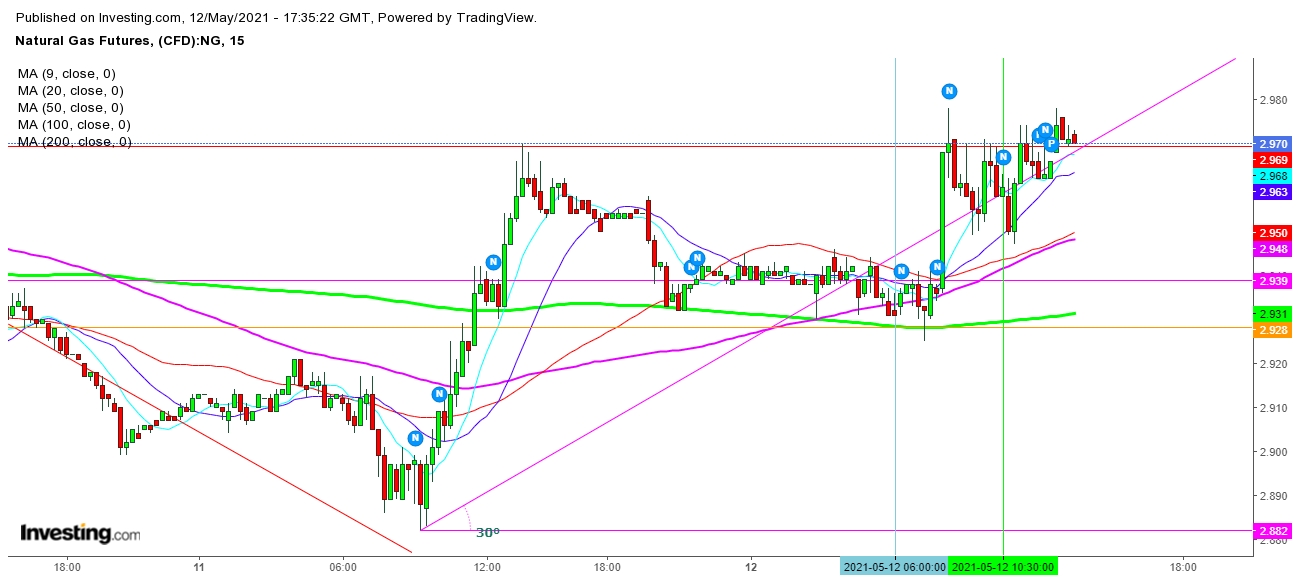

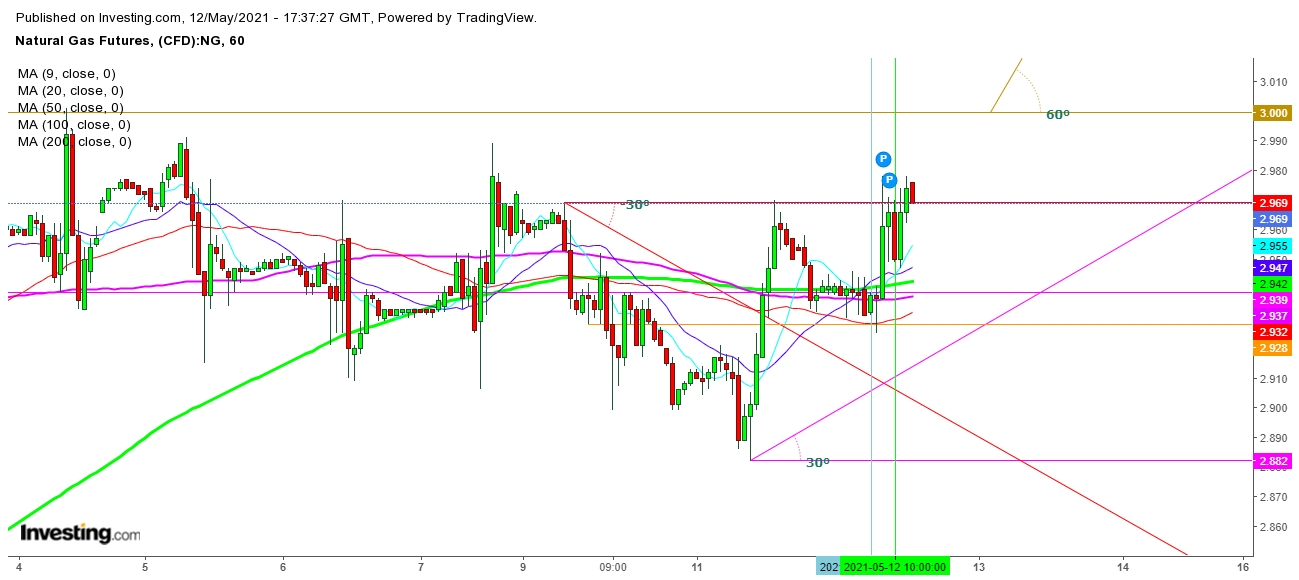

Natural gas futures are currently trading at a decisive juncture that could tilt the directional move to remain upward, despite the weather announcement for the normal than hot weather conditions could further delay cooling demand.

But technically, a sustainable move above the psychological resistance at $3 before the announcement of weekly inventory on Thursday could propel this move to neglect the stockpiles. If the natural gas futures sustain above $3.056 till this weekly closing, natural gas bulls could turn more aggressive during the upcoming week.

Undoubtedly, the natural gas futures have found a strong base at $2.889 that could continue to provide strong buying support shortly. But if the futures find a breakdown below this level, a steep reversal could push the natural gas futures once again above $3. I find that the current trend looks full of bullish sentiments that could encourage natural gas bulls to test $3.155 during the upcoming week.

The weekly closing level of natural gas futures could play a pivotal role in deciding the opening price level on the first trading session of the upcoming week that could generate a gap-up at the start of the upcoming week. I find that a formation of bullish crossover during this week could continue to propel bullish sentiments ahead.

Disclaimer: The author of this analysis does not have any position in Natural Gas futures. Readers are advised to take any position at their own risk; as Natural Gas is one of the most liquid commodities of the world.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.