- Short-lived, non-intense cold snap seen impacting eastern third of US next week

- Weather models likely to show temperatures at mildly above average conditions

- Technicals suggest gas under $6 in weeks ahead, in $5.70 to $5.40 range

Against a backdrop of ever-climbing production, longs in natural gas are struggling for ways to keep the market above $6 pricing. Their jobs would be a lot easier if an early blast of winter-like cold hit.

On Tuesday afternoon, bulls in the game thought they got just that when signs of a very bullish model run of the Global Forecast System (GFS) surfaced.

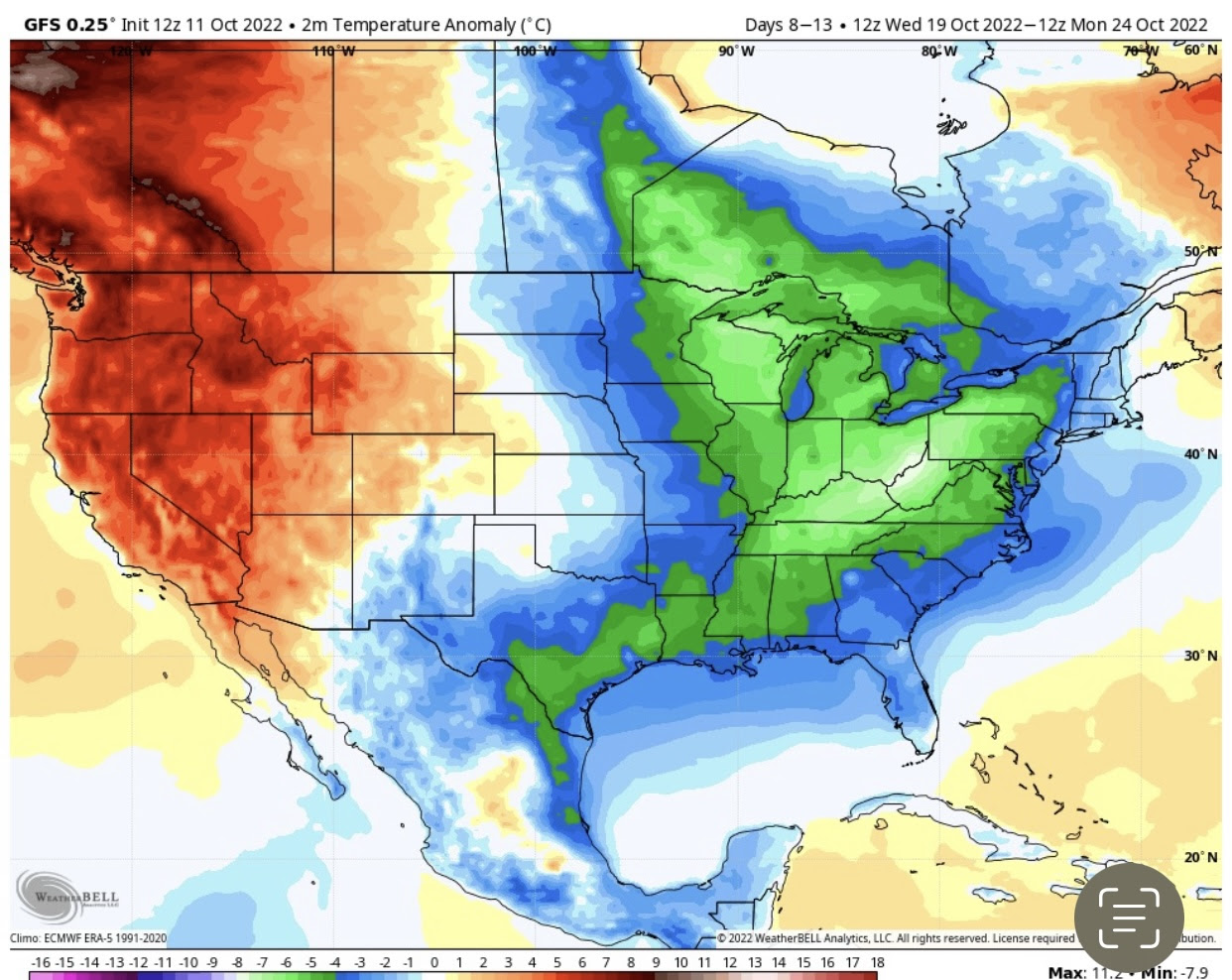

The GFS weather model depicted a monster cold front plunging down the US midsection, blanketing nearly all of the eastern US and most of the central US, including Texas.

This report caused an abrupt halt to the lower-trending front-month gas contract on the New York Mercantile Exchange’s Henry Hub, rescuing it from a morning low of $6.362 per million metric British thermal units to hit an intraday high of $6.671.

By the close of the day, the November 2022 gas futures contract gained 16.1 cents to close at $6.596.

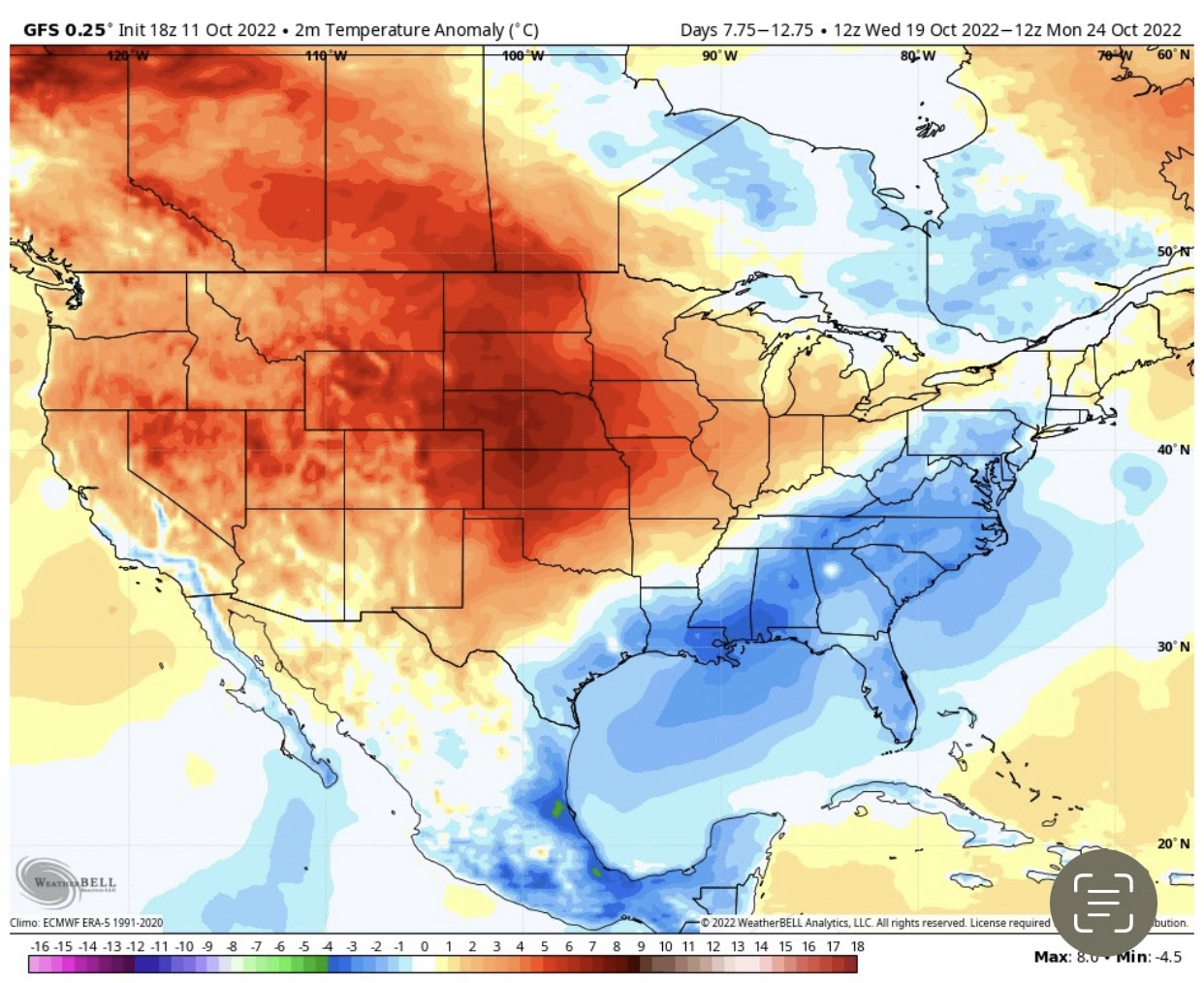

However, as is very common with the GFS operational model, the mega-chilly outlook had backpedaled during the evening run of the model, which rendered the earlier bullish response a head fake.

Analysts say that while temperatures will see a short-lived, non-intense cold snap next week that will impact parts of the eastern third of the United States, the major models, including the industry gold-standard European model ECMWF have high confidence that temperatures will rapidly transition back to mildly above-average conditions.

Those who have studied GFS models over time also say the weather model has a history of producing anomalous model runs, which will garner knee-jerk reactions from the oil and gas futures market, only to be subsequently corrected.

Alan Lammey, analyst at Houston-based gas markets consultancy Gelber & Associates, devoted a section of the firm’s client brief on Wednesday to caution about the perils of betting the house on GFS signals. He wrote:

“The GFS has a history of producing anomalous model runs, which will garner knee-jerk reactions from the oil and gas futures market, only to be subsequently corrected.”

“This sort of situation with the GFS operational model occurred several times over the course of the 2022 hurricane season, where the model was insistent that there would be major hurricane hits on Texas and Louisiana, yet there was little to no support from other models, such as the ECMWF. These bogus GFS forecasts would be proven inaccurate and caused needless gas futures market price volatility.”

Gelber’s graphics (kindly extended to Investing.com) depict two GFS operational models. Model 1 is of Tuesday’s incredibly cold 12z run that elicited such a bullish response from gas futures prices. Model 2 is the evening run of the same GFS operational model, but it clearly shows that the afternoon run of the model was completely bogus.

Source: Gelber & Associates

The GFS-driven swings in Henry Hub pricing came as the market braced for another weekly update of US gas storage from the Energy Information Administration.

For the just-ended week to Oct. 7, US utilities likely added 113 billion cubic feet (bcf) to storage, according to industry analysts tracked by Investing.com.

That would compare with the build of 86 bcf during the same week a year ago and a five-year (2017-2021) average increase of 82 bcf.

In the week ended Sept. 30, utilities added 129 bcf of gas to storage.

The forecast for the week ended Oct. 7 would lift stockpiles to 3.229 trillion cubic feet (tcf), about 3.8% below the same week a year ago and 6.5% below the five-year average.

There were around 24 cooling degree days (CDDs) last week, which was lower than the 30-year normal of 31 CDDs for the period, Reuters-associated data provider Refinitiv said.

CDDs, which are used to estimate demand to cool homes and businesses, measure the number of degrees a day's average temperature is above 65 Fahrenheit (18 Celsius).

Sector analyst Leticia Gonzales, who blogs at naturalgasintel.com, said in Tuesday's post:

“While weather models continued to bring the two-week outage into clearer focus, Thursday’s government inventory report was expected to provide the next catalyst for prices.”

“Most market expectations were for a build in the 120s bcf to 130s bcf, potentially setting up another all-time fall record if it were to come in higher than last week’s 129 bcf build. Either way, it most likely would crush the five-year average injection of 82 bcf and continue to chip away at the triple-digit storage deficit that has plagued the market all summer.”

Lammey of Gelber concurs with that, adding:

“The bigger picture continues to be undoubtedly bearish for the US natural gas market. The mixture of dry gas production wobbling near 100 bcf/d, widespread mild temperatures, a November temperature outlook that is downright bearish, and aggressively growing gas storage all indicate that NYMEX gas futures prices will be seeking lower territory.”

“It is still not out of the question that gas futures prices will tumble down to the $6.00 area or lower in the weeks ahead, with technical aiming at downside objectives in the neighborhood of $5.70 to $5.40.”

Sunil Kumar Dixit, chief technical strategist at SKCharting.com, has a somewhat similar outlook.

Dixit says so long as Henry Hub’s front month stays above the previous week's low of $6.40, a short-term rebound towards $7.10, $7.40, and $7.90 was possible, as weekly stochastics appeared supportive. He cautioned:

“A sustained break below $6.40 will, however, trigger a deeper correction towards $5.50.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.