Overnight, natural gas broke above the $2 price level as we expected. On April 6, we published our research that natural gas was setting up a bottom pattern and that our seasonal analysis suggested April and May should prompt a price rally in natural gas pushing price levels above $2.40.

The current rally has broken above a price resistance level near $2 and the rally up to $2.40 may happen faster than we expect. Currently, our Daily Fibonacci price modelling system is suggesting the $2.35 area is the first area of resistance. Beyond that, the next level of resistance would be near $2.90. Beyond that incredible upside target, the Fibonacci Weekly data is projecting an upper target near $3.60.

We are not suggesting that natural gas could rally 90% over the next few weeks, but we are alerting you that a move to $2.40 seems highly likely after our incredible bottom call on April 6.

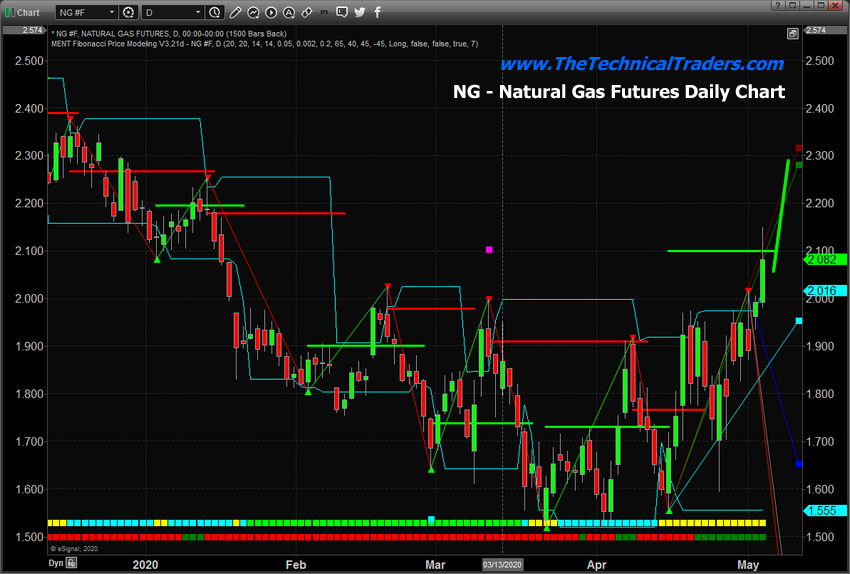

Daily Natural Gas Chart

This Daily Natural Gas chart highlights the rounded bottom setup that prompted us to make the bottom warning. Skilled traders will see an inverted head-and-shoulders pattern, where the head consists of a double-bottom pattern near the end of March and into early April. The opportunity to buy into natural gas below $1.70 presented a very clear opportunity with little risk.

Weekly Natural Gas Chart

This Weekly Natural Gas chart highlights the Fibonacci Price Modeling system's projected upside targets. The first target, near $2.40, is an easy target for a first profit level. The next upside target level

for-profits should be near the RED LINE, near $2.55. Beyond that, if natural gas continues to rally, the next area for skilled traders to pull profits would be the $2.95 level. Any move higher beyond that level would be a gift with a target level near $3.60.

Concluding Thoughts

Overall, this has been an excellent trade. We got our members into this trade fairly early and are already pulling profits and trailing stops. It certainly helps to have the modelling systems and seasonal analysis tools we use to find these setups for our members – but you can do it, too. All it takes is a bit of skill and understanding of how certain markets operate within seasonal trends and setups.