Despite selling pressure, natural gas futures have been showing strength since Wednesday of last week, after testing long-term support at $4.451 as US President Biden put the blame on Putin.

U.S. President Joseph Biden announced a ban on Russian oil imports Tuesday in the wake of its invasion of Ukraine. But natural gas may be the more crucial export, as Russia has more proven natural gas reserves than any other nation. Undoubtedly, this blame game could continue to generate jolting moves in energy prices in the near future, but a sudden spike is still pending in natural gas prices.

Thursday, withdrawal of -124 Bcf was larger than the 5-year average of -89 Bcf which propelled bullish sentiments in natural gas futures. Undoubtedly, selling pressure provided stiff resistance at $4.777 ensuring a breakout soon above $6.651 during the upcoming week.

Biden and his administration have coalesced around the phrase "Putin price hike" to describe the energy inflation challenges created by Russia's invasion of Ukraine and retaliatory Western sanctions.

"I'm going to do everything I can to minimize Putin's price hike here at home," Biden said in a Twitter post on Tuesday. Already battling inflation at a 40-year high, Biden's imposed ban on U.S. imports of Russian oil, added pressure to crude prices holding near a 14-year peak. The move was likely to drive up U.S. pump prices that have already risen past $4-per-gallon in many places.

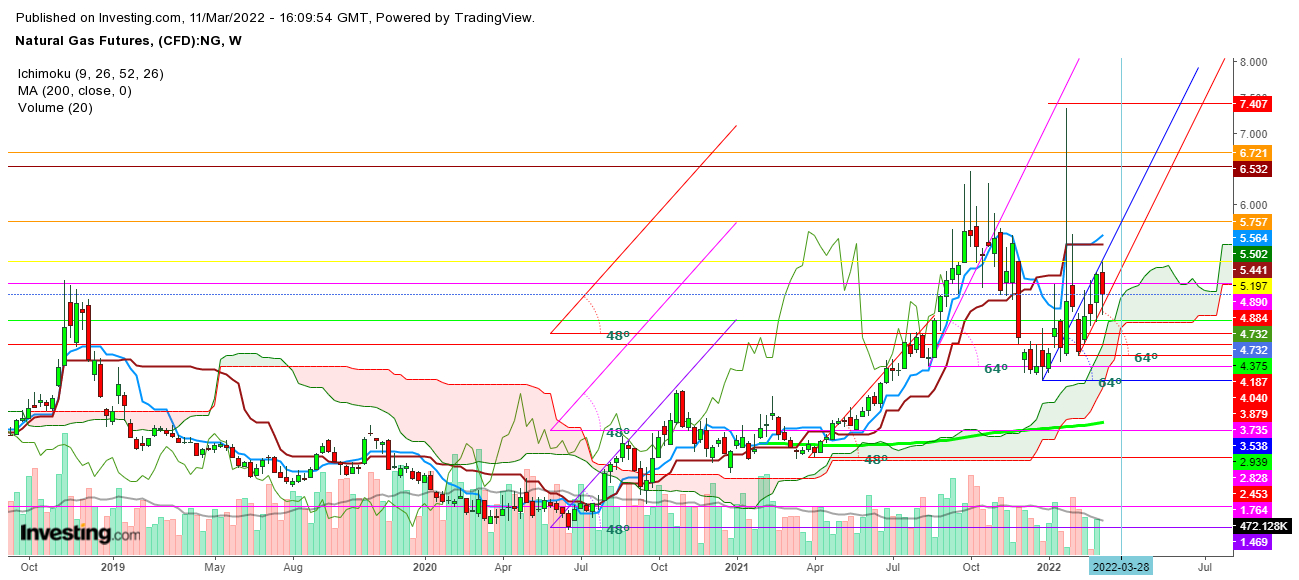

The weekly chart shows NG has been maintaining an uptrend since the first week of February and the formation of a "Bullish Crossover" would ensure a breakout during the upcoming week. Undoubtedly, the weekly closing level on Friday could be decisive for the upcoming moves as the pullback from the week’s low at $4.451 ensures a bumpy move during this week.

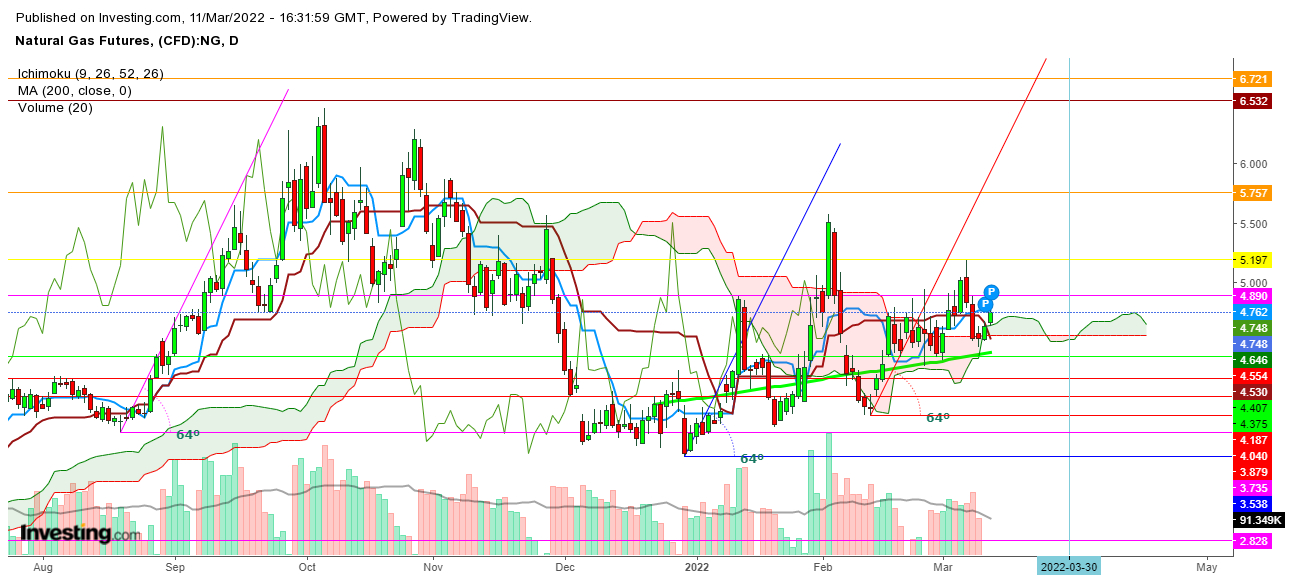

NG's daily chart shows it still holding above its 200 DMA, at $4.406, ensuring a limited downside as the Ukraine-Russia crises has propelled storage phobia among European nations, as they prepare for any contingency should energy be used as a tool to dominate the buyers.

Technically speaking, the overall geopolitical moves to stop Russia could dissuade some European and Asian countries from buying crude and gas as most are struggling with higher inflation since the advent of the pandemic.

The 'blame game' could ramp up the price of U.S. natural gas above $6.7 this month.

Disclaimer: The author of this analysis does not have any position in Natural Gas futures. Readers are advised to take any position at their own risk; as Natural Gas is one of the most liquid commodities in the world.