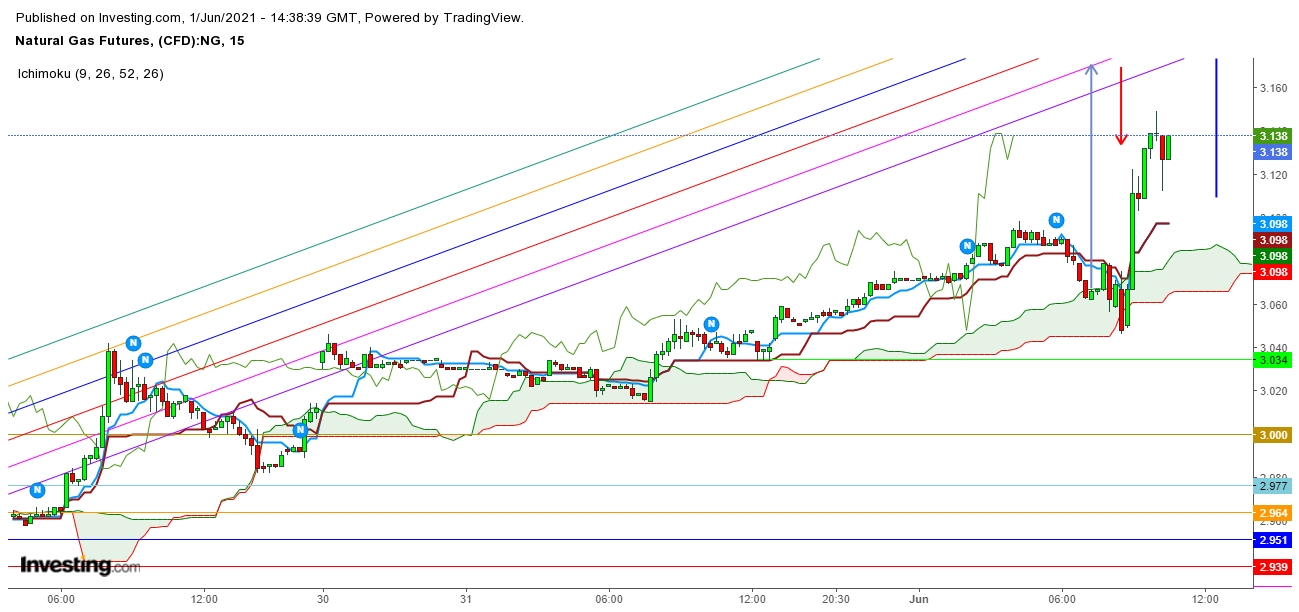

The movements of natural gas futures since the announcement of storage declaring an injection of 115 Bcf that resulted in a knee-jerk reaction in natural gas futures that witnessed a steep fall from $3.014 up to $2.914 over the following two hours. Undoubtedly, the reversal was equally strong from there and continued on Friday while natural gas regained its position at $3.942 before closing the last week at $3.012.

The natural gas futures started this week with a gap-up opening at $3.032 and tested a high at $3.046 before filling the opening gap. This is evidence of growing bullish sentiments in natural gas futures. The reason for this growing strength could be the entry of big bulls who love to trade natural gas well above the psychological support at $3.

Generally, the demand and supply equation defines the directional moves of natural gas. But, once in a while, the demand and supply equation could be influenced by other factors that could change the equation. This is the case here as while the whole world has been enduring the denting impact of Covid-19 since January 2020, hopes for a speedy recovery have started to pop up with the decision to unlock industrial production amid lockdowns in different parts of the world. Vaccination efforts could also boost the hopes for economic recovery over the upcoming weeks.

I find that the natural gas futures could find a more sustainable move above $3.150 shortly. Undoubtedly, natural gas could be a good friend of bulls during the upcoming weeks to form a seasonal peak in October-December 2021.

Disclaimer: The author of this analysis does not have any position in Natural Gas futures. Readers are advised to take any position at their own risk; as Natural Gas is one of the most liquid commodities of the world.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Natural Gas Becomes Friend Of Bulls Above $3

Published 06/02/2021, 06:40 AM

Natural Gas Becomes Friend Of Bulls Above $3

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.