Analyzing the movements of the natural gas futures pre and post-weekly inventory time frames indicate continuity of wild price swings to continue till this weekly closing as both the bears and bulls have turned aggressive to capture the driving seat.

Wednesday, natural gas bulls come out of their den at $7.565 to drive the price up to the day’s peak at $8.447. No doubt this move attracted big bears to thrash bulls.

But I find momentum still looks in favor of the bulls despite the announcement of today’s weekly inventory that shows a build of +41 Bcf, larger than the market expectations of +32 Bcf and slightly larger than the 5-year average of +33 Bcf to improve supplies from 2,416 Bcf to 2,457.

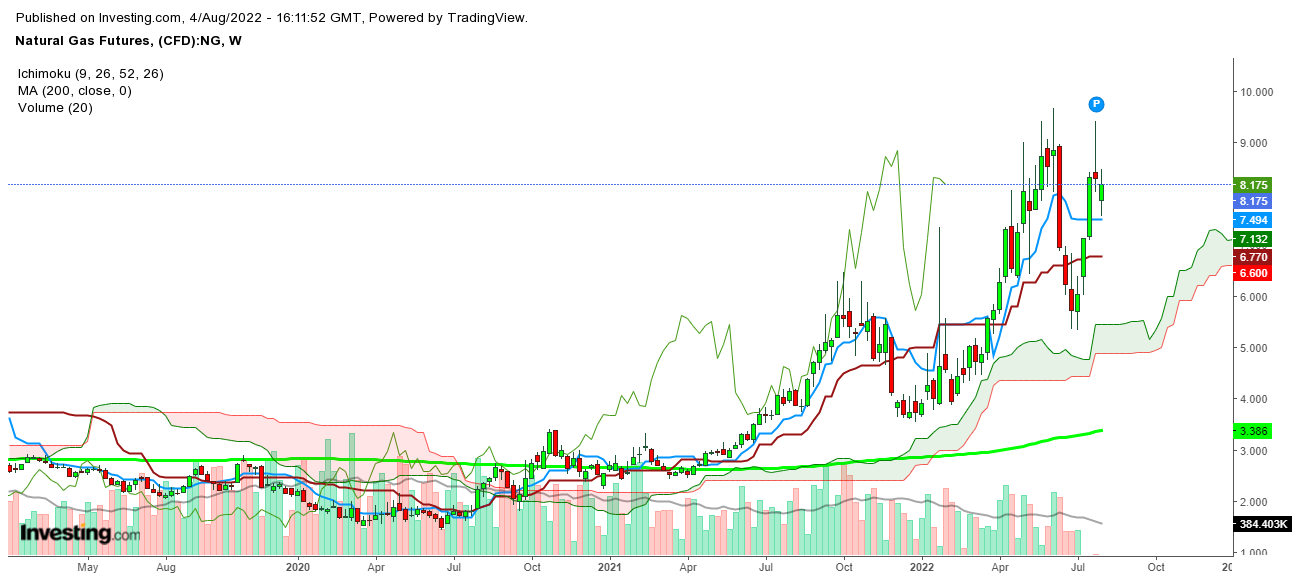

Technically speaking, on the weekly chart, the commodity is facing stiff resistance at $8.2. I find that this could result in a steep slide if the price finds a sustainable move below $7.777 in today’s trading session, as the big exhaustive candle during the past week will continue to encourage the bears to sell rallies below $8.549.

On the daily chart, natural gas futures are currently finding stiff resistance at 9 DMA, currently at $8.484. They could hit the 26 DMA shortly if not able to hold $7.948 in today’s trading session, as the selling is clearly visible on every upward move.

I find a breakdown below 26 DMA could drag down the futures up to the lower band of ‘Ichimoku Clouds’ currently at $6.817 before this weekly closing.

Finally, I conclude that only a weekly closing by the Natural Gas Futures above $8.064 could confirm the continuity of the bullish trend during the upcoming week.

Disclaimer: The author of this analysis does not have any position in Natural Gas futures. Readers are advised to take any position at their own risk; as Natural Gas is one of the most liquid commodities of the world.