Upon analyzing the natural gas futures in different time frames since the last week of Dec. 2023, I anticipate that the natural gas futures could repeat the moves seen in the last week of Dec. 2024, mainly due to persistently warmer conditions across the US, in addition to dry weather.

According to AccuWeather reports, most locations this upcoming week will observe high temperatures between 10 – 15 degrees F above the historical average for late February, which is closer, in comparison, to typical late-March or early April values.

On the other hand, if Russian gas flows to the European market would ease global competition for liquified natural gas, leading to lower natural gas prices.

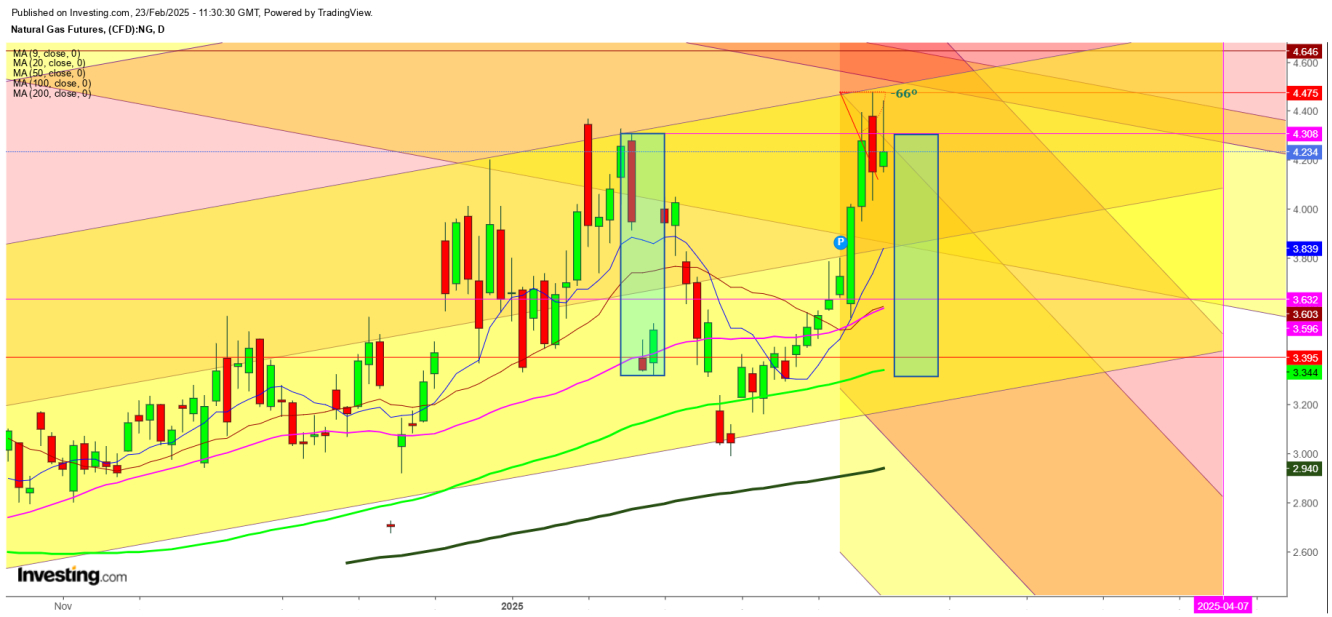

Technically, the movements of the natural gas futures confirm this bearish pressure as the upside seems to be capped at last week’s high at $4.476, followed by a sharp sell-off that resulted in a weekly close at $4.234 after testing the week’s low at $3.554.

Technical Levels to Watch

On the weekly chart, natural gas futures are likely to start the next week with a gap-down opening while an opening above the last week’s closing could result in a bouncing move from the immediate support at 200 DMA at $3.907.

I anticipate that the natural gas futures could continue to remain volatile, if sustained above the pivotal point at $3.907, selling likely to follow in case of any upward move from the significant resistance at $4.646 as the bullish crossover formation by a bullish cross by 50 DMA which has come above the 100 DMA in the first week of this month that resulted in an advent of a price rally from $3.174.

However, a gap-down opening by the natural gas futures below the significant support at 200 DMA at $3.907 could turn this support into a tough resistance amid growing weather concerns and geo-political moves.

On the daily chart, natural gas futures are consistently facing selling pressure above the immediate resistance at $4.312 during the last three trading sessions while the formation of an exhaustive hammer last Friday, after Thursday’s bearish candle indicating the continuation of exhaustion during the next week, perhaps the same as seen on Jan 17 – 21, 2025.

Takeaway for the Traders

Traders must take a cautious approach before creating any position in natural gas due to the expected surge in volatility next week.

Undoubtedly, volatile moves will provide both the long and short position which must be accompanied by strict stop-loss orders.

Disclaimer: Readers are advised to take any position in natural futures at their own risk as this analysis is only based on the observations.