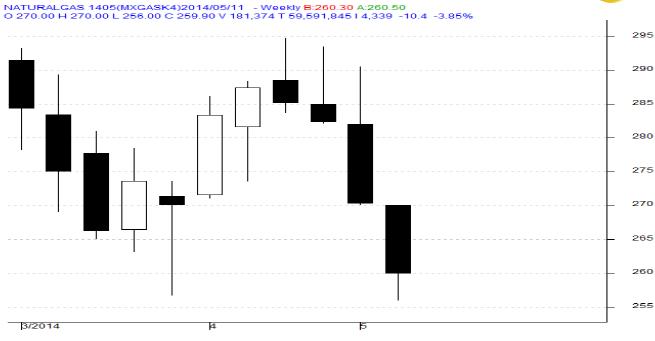

MCX Natural Gas May as seen in the weekly chart above has opened the week at 270 levels during this week the open and high levels were the same. During this week as expected prices could not able to sustain on the higher levels and corrected towards the contract low of 256 levels. In mid of the week prices bounced from near to the support zone of 256 - 255 levels towards 268 levels and finally closed at 3.85% lower at 259.90 levels. On weekly basis again we saw that prices has formed “Big Bearish candlestick” pattern which indicates the bearish trend.

For the next week we expect Natural Gas prices to find support in the range of 256 - 255 levels. Trading consistently below 255 levels would lead towards the strong support at 248 levels.

Resistance is now observed in the range of 268 - 270 levels. Trading consistently above 270 levels would lead towards the strong resistance at 278 levels, and then finally towards the major resistance at 285 levels.

MCX / NYMEX Natural Gas Trading levels for the week

Trend: Down

S1 - 255 / $ 4.30 R1 - 268 / $ 4.60

S2 - 250 / $ 4.10 R2 - 278 / $ 4.90

Weekly Recommendation: Sell MCX Natural Gas May between 266 - 268, SL - 278, Target – 250 / 248.