- The rapid surge in fossil fuel prices has impacted prices across the globe.

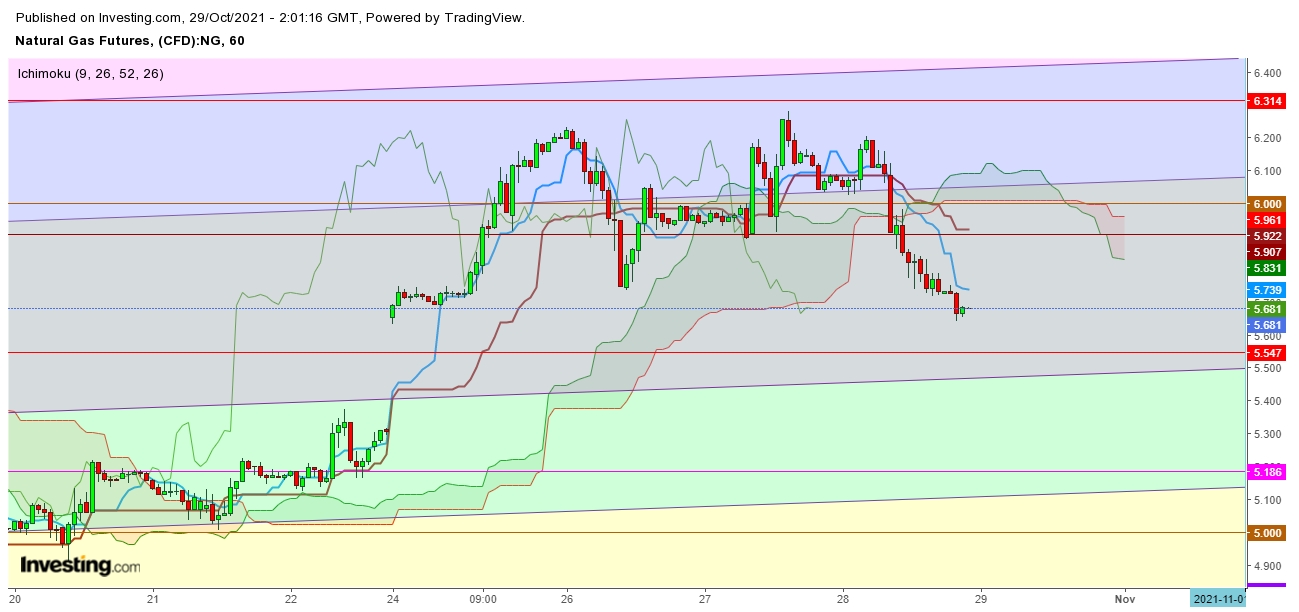

- Futile attempts to sustain above the psychological resistance at $6 indicate that a selling spree looms.

- Natural gas futures could trade in a range from $5.848 - $6.748.

- Winter forecasts could take a U-turn in the mid of November.

- Kold looks to be in the buy zone from $5.6 - $6.2.

A rapid surge in fossil fuel prices has impacted prices across the global economy. Undoubtedly the energy crisis could extend volatility while the economic recovery expects demand for natural gas could remain higher despite changing weather forecasts for winters.

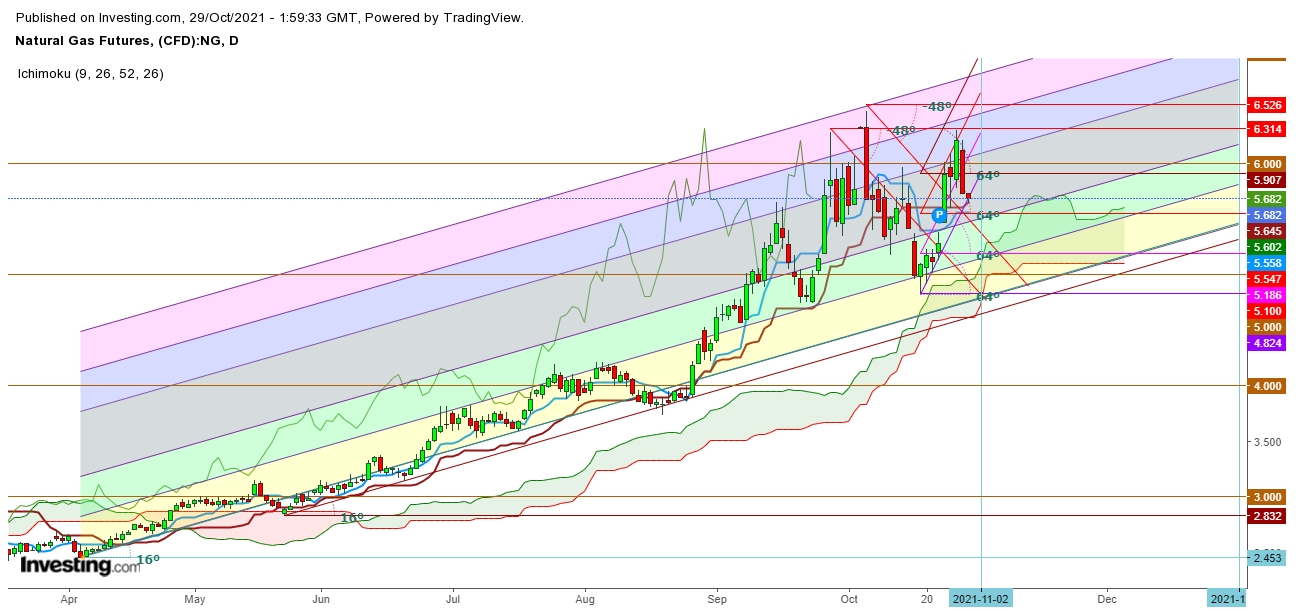

I find that the recent surge in the natural gas futures leads to repeated attempts to break the psychological resistance at $6, increasing anxiety among day-traders. But the hedge funds are still focusing on the global energy crisis to try and predict a move in natural gas prices. In the short term, the natural gas futures could trade from $5.848 - $6.748. Value buyers could step in at $5.473.

Analysis of the movements of natural gas futures reveals the growing weakness, indicating concerns over the warm winter that could drag down the natural gas futures up to $5.848 after the announcement of weekly inventory on Oct. 28. Undoubtedly, a move could test $5.477 till this weekly closing.

Post-inventory moves could test $6.5. Natural gas futures have failed to sustain above $6.3 on Oct. 28, 2021.

A move in natural gas futures above $6.4 could provide a shorting opportunity with a stop-loss at $6.8 and a target at $5.8 until the weekly closing.

Winter forecasts could take a U-turn in the mid of November. The post-inventory moves could provide an opportunity to buy ProShares UltraShort Bloomberg Natural Gas (NYSE:KOLD). KOLD's buy zone ranges from $5.6 - $6.2, after forming a double bottom at $5.66.

On the other hand, the first week of November could push the ProShares Ultra Bloomberg Natural Gas (NYSE:BOIL) towards the $47 - $38 range that could attract value buyers.

Disclaimer:

- This content is for information and educational purposes only and should not be considered investment advice or recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved, which you are prepared to lose.

- Remember, YOU push the buy button and the sell button. Investors are constantly reminded that they should do their proper due diligence on any name directly or indirectly mentioned in this article before making any investment. Investors should also consider seeking advice from an investment and tax professional before making any investment decisions. Any material in this article should be regarded as general information and not relied on as a formal investment recommendation.