In a 1959 speech, John F. Kennedy famously said:

“When written in Chinese, the word ‘crisis’ is composed of two characters—one represents danger and one represents opportunity.”

Although today, it is widely recognized that this is not the correct interpretation of the Chinese characters, President Kennedy’s wisdom about a crisis yielding unique opportunities may be more important than ever.

Thus the case with Wednesday’s explosion at Freeport LNG on the Texas Gulf Coast that will shut one of the largest liquefied natural gas exporting plants in the United States for three weeks at least.

The blast literally blew a major source of supply which European LNG buyers had been counting on amid their boycott of Russian gas due to the Ukraine invasion. Freeport accounts for around 20% of all U.S. LNG processing and lately has also been catering to surging Chinese demand for liquefied natural gas.

The plant can process up to 2.1 billion cubic feet of natural gas per day (bcfd), and at full capacity can export 15 million tonnes per annum (MTPA) of the liquid gas. U.S. LNG exports hit a record 9.7 bcfd last year.

In March, some 21 LNG cargoes were loaded at the facility, carrying an estimated 64 billion cubic feet (bcf) of gas to destinations in Europe, South Korea, and China, according to the U.S. Department of Energy. That's up from 15 cargoes in February and 19 in January.

Freeport LNG currently ships about four cargoes a week and a three-week shutdown will take at least 1 million tonnes of LNG off the market.

"This is a significant production outage at a major U.S. facility," Alex Munton, director of global gas and LNG at research firm Rapidan Energy, said in comments carried by Reuters.

He added: "It's going to mean one thing—shortages” in global LNG.

On the flip side though, the Freeport shutdown opens up an unexpected relief valve in the extremely tight domestic U.S. market for dry—or regular—natural gas.

Freeport Blast Not A Long-Term Game Changer

With less supply going toward LNG—which is meant for export only—U.S. utilities will have more gas on their hands over the next few weeks to burn for power generation, provide cooling to overheated U.S. cities, especially those in Texas, and add to storage.

It’s not a long-term game-changer for sure. The U.S. gas storage deficit is at more than 300 bcf over a five-year average. The max that could be diverted to the domestic market from a three-week shutdown of Freeport would be about 45 bcf.

Yet, in an acutely stressed market looking for just about any additional supply, it’ll be a welcome relief—underscoring Kennedy’s now-legendary characterization of a crisis for one being a boon for another.

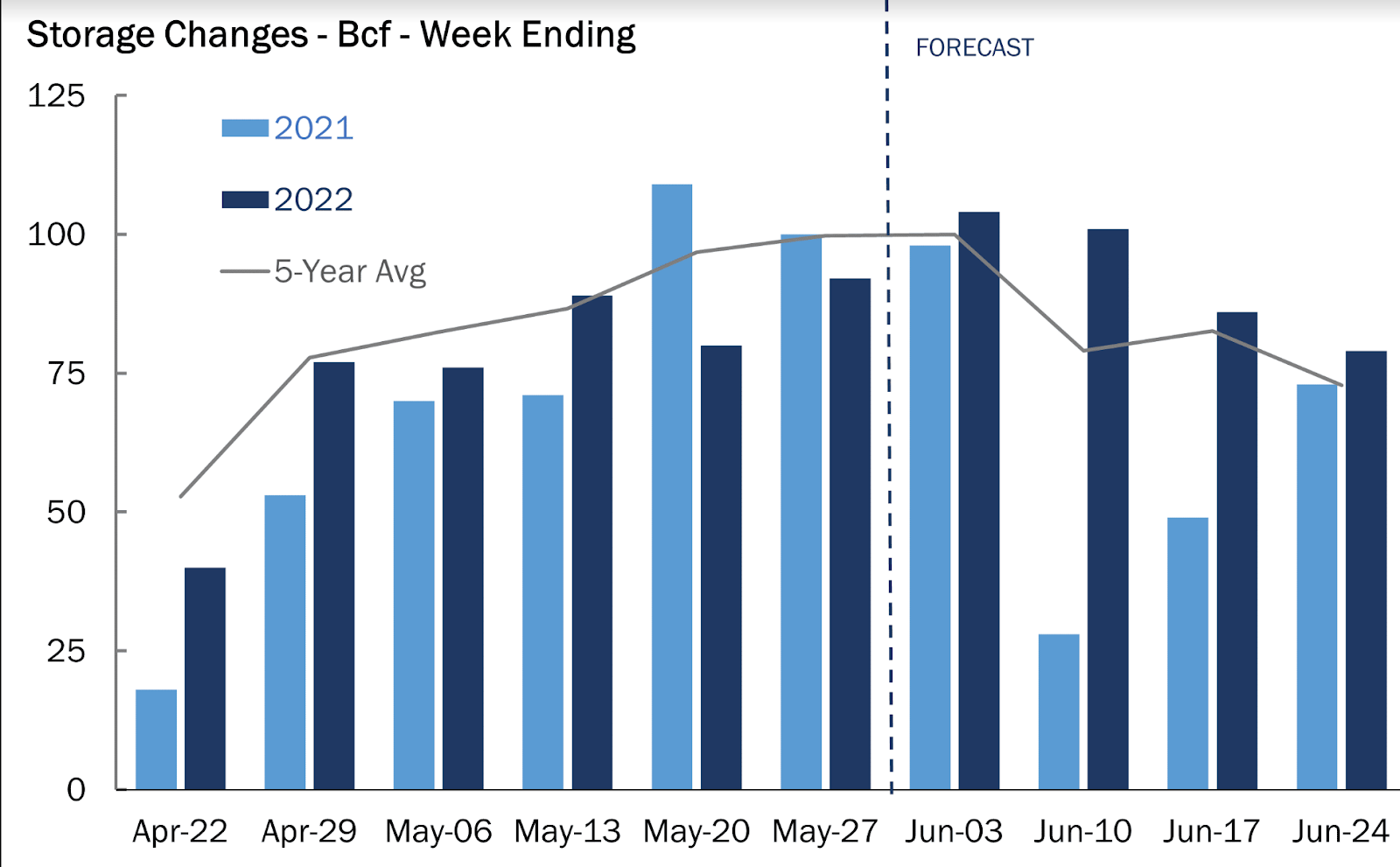

Source: Gelber & Associates

Notwithstanding the Freeport incident, U.S. utilities likely added a smaller-than-normal 96 bcf of natural gas to storage during the week ended June 3 after unseasonable heat across the United States that presumably raised cooling demand, according to a consensus of analysts’ estimates tracked by Investing.com.

The projected injection compares with the build of 98 bcf seen during the same week a year ago and a five-year (2017-2021) average injection of 100 bcf.

In the prior week, utilities added 90 bcf of gas to storage.

If accurate, the injection analysts forecast for the week ended June 3 would lift stockpiles to 1.998 trillion cubic feet (tcf), about 14.6% below the five-year average and 16.6% below the same week a year ago. The U.S. Energy Information Administration will report the official stockpile number in its weekly update on gas storage due at 10:30 AM ET (14:30 GMT).

According to data from Reuters-associated Refinitv, there were around 57 cooling degree days (CDDs) last week, which was more than the 30-year normal of 48 CDDs for the period.

CDDs, used to estimate demand to cool homes and businesses, measure the number of degrees a day's average temperature is above 65 degrees Fahrenheit.

Like all commodity crises, the one at Freeport was reflected almost immediately in market prices of natural gas—in this case, on the New York Mercantile Exchange’s Henry Hub.

After blowing past 14-year highs of above $9 for three straight sessions on the back of the unyielding storage squeeze, the rally in Henry Hub’s front-month gas came to a screeching halt on news of the Freeport explosion.

In Thursday’s New York pre-open, the front-month contract, for delivery in July, was down 38 cents, or 4.4%, to $8.27 in Asian trade.

Compared with Wednesday’s 2008 high of $9.66, it was a decline of almost $1.40, or 14.5%, in just 24 hours.

“Although the long-term implications were still unknown…Freeport…took a hatchet to natural gas futures,” naturalgasintel.com said, analyzing the impact.

While it won’t lead to structural improvements in U.S. gas storage, the Freeport incident could make up some interesting supply additions in the near term, said James Bevan, vice president of research at Criterion Research.

Added Bevan:

“Assuming the worst-case scenario is a complete facility outage through the end of October, Freeport LNG’s incident could push back an average of 1.95 bcf/d to the grid and add 285 bcf to storage. Even a two-month outage through July 2022 would add 105 bcf to inventories.”

Bevan also noted other interesting factors such as Freeport’s power consumption, which when fully operational, pulls 690 megawatts off the Texas grid.

Texas Is Baking

That could be another major relief to Texas, which is baking with triple-digit temperatures now that could lead to record-breaking electricity demand this weekend as those in the Lone Star State turn their air-conditioners on max to escape the punishing heat.

Nearly 80% of Texas continued to experience at least moderate drought, according to the U.S. Drought Monitor. About 18% of the state is currently in the midst of an exceptional drought, which is the highest category possible.

The record-breaking heat was boosting gas demand across Texas, leaving little excess supply for storage, where inventories have struggled to climb out of the deep hole following the winter season.

“Very dry conditions at the surface give the atmosphere the ability to warm up faster and more intensely than it would normally,” AccuWeather said.

The weather forecaster said stifling heat was sending temperatures soaring as much as 15 degrees above normal for several cities across Texas. San Antonio, for example, has been sweltering in record heat for several consecutive days. New records officially were established from Sunday to Tuesday, including back-to-back readings of 104 on Monday and Tuesday.

“In San Antonio, more record heat for the upcoming weekend and early next week will make this first half of June one of the hottest in recent memory,” AccuWeather senior meteorologist Bill Deger said. Records could be tested for several days, he added.

Yet, despite Henry Hub’s slump on Thursday, gas prices could quickly rebound, heading back into $9 territory, say analysts.

Despite Drop, Prices Could Rebound Quickly

This is because the LNG outage, no matter its duration, is likely to boost global prices since fewer U.S. cargoes would be available to the market. Europe will continue pulling in cargoes to replenish storage inventories ahead of next winter, while Asia demand is starting to ramp up for the summer. Any potential upside could spill into the U.S. market, even temporarily.

“Henry Hub’s sudden drop may have provided the rebalancing required for the daily stochastic reading of natural gas, which had approached overbought levels,” said Sunil Kumar Dixit, chief technical strategist at skcharting.com.

If the drop was exaggerated for any reason, it could touch the 50-Day Exponential Moving Average of $7.85 and the horizontal support of $7.50, and even reach the 100-Day Simple Moving Average of $6.50.

“Stochastic divergence on weekly and monthly charts can trigger exhaustion in the pre-Freeport rally,” Dixit said.

The run-up could resume after consolidation at between $8.10 - $7.50 or a leg lower to between $7.50 and $6.50, he said, adding:

“Fresh buying is likely to emerge from value areas, to restart towards $9.65.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.