After a near invincible run for most of the second quarter, Q3 begins with natural gas heading for its sharpest weekly loss since April.

And for good reason too: The next couple of weeks might not be as hot as is typical.

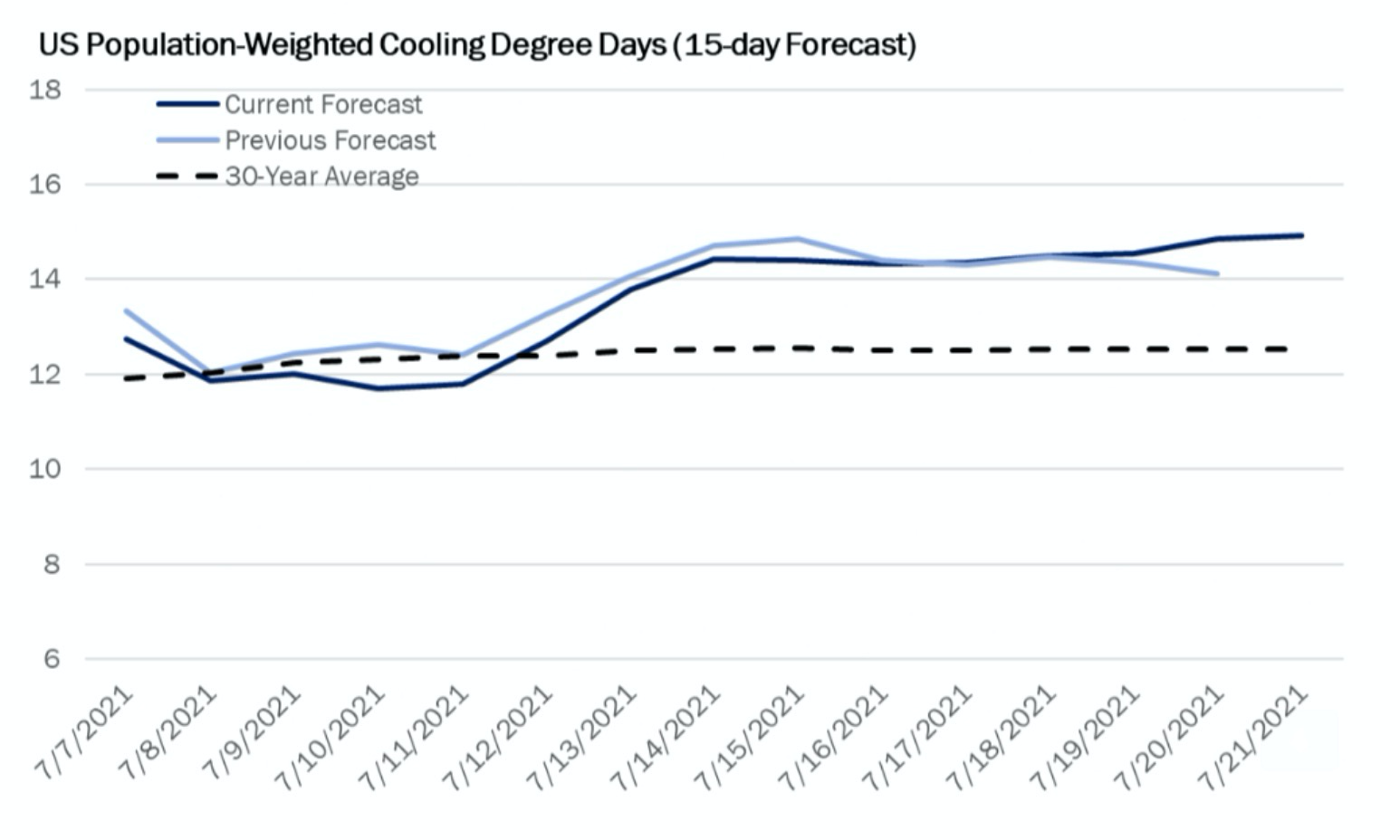

US weather models suggest that most areas, except for Texas and the Southeast, will be warmer than normal six to fifteen days from now. But the hottest temperatures will stay bottled in the western US and lead to a relatively flat population-weighted outlook for cooling.

Charts courtesy of Gelber & Associates

Front-month gas futures settled below $3.60 per mmBtu, or million metric British thermal units, on the New York Mercantile Exchange’s Henry Hub for the first time in nine days on Wednesday.

As we cautioned last week, some gas analysts have been bracing for the return of volatility—an inherent nature of this market that has been conspicuously missing for some time to the surprise of its long-time followers.

We also asked the question: after a blowout second quarter, does this natural gas rally still have legs?

More precisely, will the rally be running on slightly slower legs after this, given the natural fatigue from one-way price direction juxtaposed against forecasts for runaway summer heat across the United States?

Dan Myers of Houston-based gas markets consultancy Gelber & Associates is among the analysts who think so.

In a note issued to clients of the consultancy and shared with Investing.com, Myers said:

“Since late last Friday, one persistent change has been the arrival of milder weather forecasts which look to contain demand for the foreseeable portion of July.”

Myers said fundamentals in the natural gas market remain relatively steady as flows across pipelines continued to normalize from expected and unexpected shifts going into the extended holiday weekend of July 4.

He added:

“Model runs further backed off cooling demand expectations in the near-term, with the incursion of rains from Tropical Storm Elsa limiting temperatures up the Eastern Seaboard.”

This sets the market up for swings in natural gas storage numbers due from the Energy Information Administration’s weekly over the next few weeks.

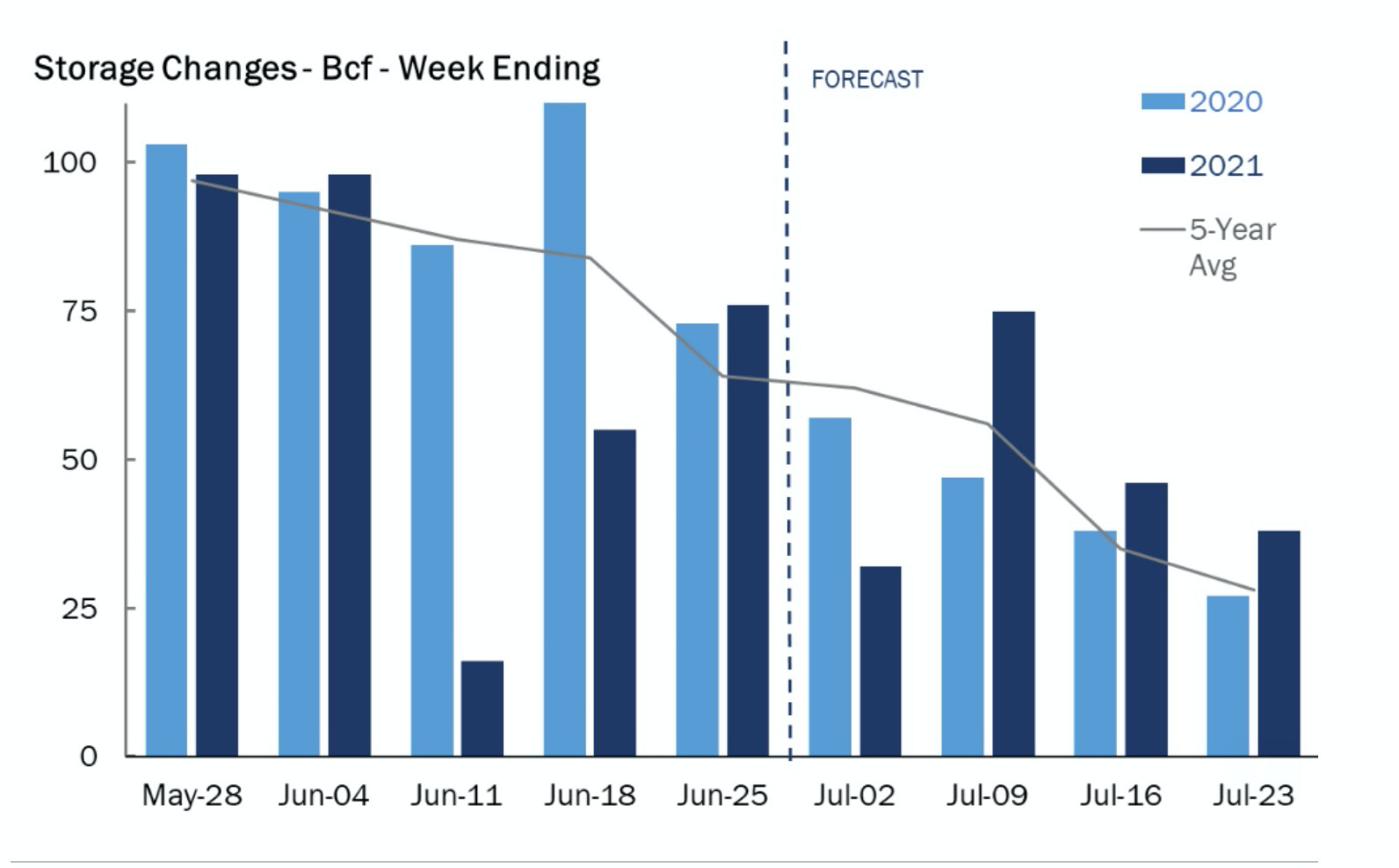

In today’s report, the EIA is expected to cite a storage injection of just 34 bcf, or billion cubic feet, for the week to July 2—virtually half of the 76 bcf draw recorded during the week to June 25—according to forecasts from analysts tracked by Investing.com.

Gelber & Associates’ estimate for last week’s supply injection comes in at the lower end of the industry estimates, at 32 bcf.

Myers wrote:

“Although G&A expects a very constrained, bullish injection to come out of last week’s record heat and reduced supply levels, the market already did much of the work to bake this into recent price spikes.”

“For coming storage weeks, we are forecasting injections of 75, 46, and 38 bcf respectively for the weeks ending July 9,16, and 23.”

If the higher storage projections hold, then Henry Hub’s front-month contract could be searching for support at former resistance levels at $3.40 mmBtu and below, he added.

To be sure, the front-month for natural gas is still up 40% at least since the end of 2020, hitting a 2-½ year high of $3.822 per mmBtu Monday.

But price attrition is expected to accelerate further out on the calendar, with the EIA itself saying in its July Short-Term Energy Outlook published Wednesday that it expected Henry Hub spot prices to fall to $3 by 2022.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.