While writing my last analysis, I felt the wobbly price movements by natural gas constantly showed selling sprees last Wednesday. But, the traders continued to overlook this changing price trend despite changing weather in most parts of the US.

On Thursday, weekly inventory announcement confirmed this weakness with the build-up of 125 Bcf. Natural gas showed some strength despite growing weakness and tested a high at $6.775 after hitting a low at $6.335.

On Friday, the natural gas bears found this opportunity to go trigger shorts that pushed natural gas back to test the day’s low at $6.409 before closing the day at $6.451.

Natural gas could have more downside from here as the chilly early season cool shots will track across the Midwest & East with rain and snow showers and chilly lows of 15°F to 40s and highs of 40s and 50s. The rest of the US will be nice to warm with highs of the 60s to 80s, including the Southwest.

This will keep the demand low this week and could be lower during the next week as the rest of the US will be nice to warm with highs of the 60s to 80s besides locally hotter 90s from California to Texas the next few days.

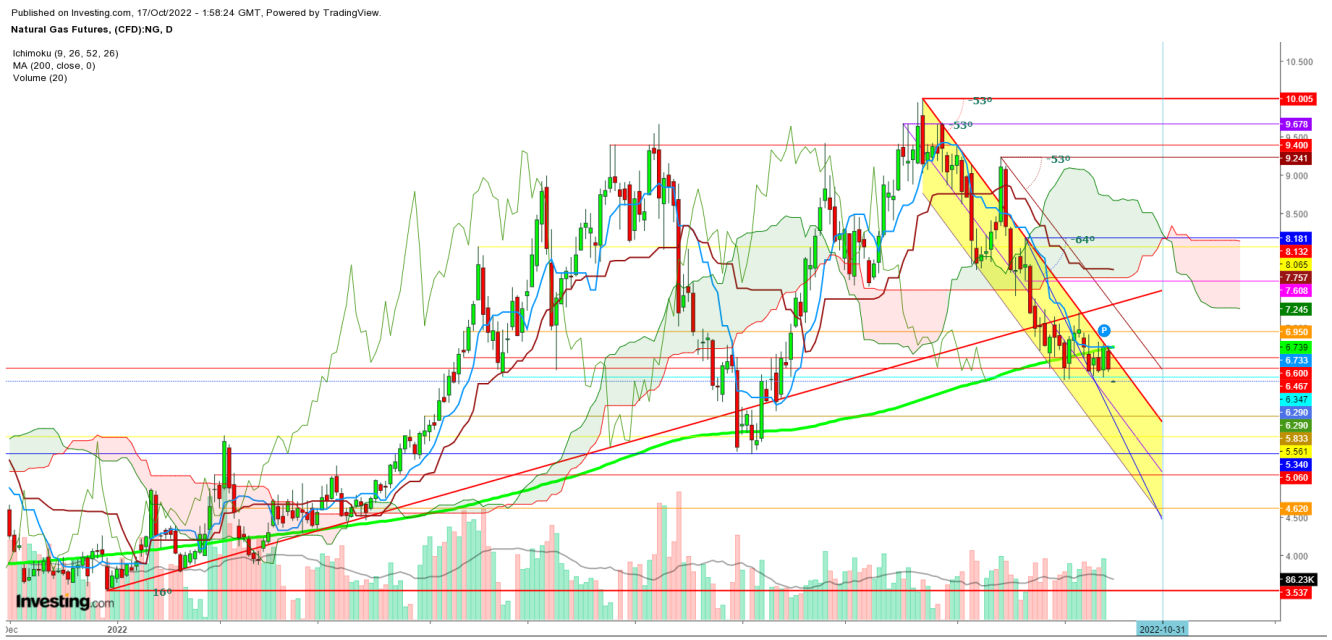

Technically, I had predicted this weekly opening gap-down in my video attached below, as the cooler weekends were enough to create this gap. If natural gas does not find a move to fill this gap by Tuesday, it could confirm more downside during this week.

In an hourly chart, natural gas found some reversal from the day’s low at $6.227. However, the selling pressure is still visible on the price movements as natural gas is currently trading at its month’s low, which makes the situation more vulnerable for the natural gas bulls.

The next target for the natural gas bears could be at $5.586 and the third at $4.226 this week, but the wild price swings could continue to increase confusion among the traders.

Disclaimer: The author of this analysis does not have any position in Natural Gas. Readers are advised to take any position at their own risk, as Natural Gas is one of the most liquid commodities in the world.