Price-action analysis of natural gas futures since Oct. 6 reveals that exhaustion has continued from the seven-year peak at $6.526. As a result, prices fell to $5.505 on Oct. 15, despite a lesser weekly injection than expected.

A potential global energy crisis before winters has had countries rushing to prevent prolonged power outages that could delay global economic recovery. Asian spot gas prices traded above $37 per million British thermal units (mmBtu) after reaching a record high of over $56 earlier this month.

Chinese buyers are scouting for both near-term shipments to cover demand this winter and long-term imports. Natural gas will be crucial for Beijing to reach its 2060 carbon-neutral goal, and its demand will grow steadily through to 2035. A Chinese importer said,

"There is a lot of hype in the market, and nobody knows for sure how long this supply crunch would last. For companies that do not have new demand in the next year or two, it's better to wait."

At the peak of the Sino-US trade war in 2019, gas trade came to a standstill for a while. And Liquified Natural Gas (LNG) export facilities can take years to build, and several projects in North America are expected to be functional by 2025.

Talks with US suppliers began early this year but sped up in recent months amid one of the worst crunches in decades. Natural gas prices in Asia have jumped more than fivefold this year, sparking fears of power shortages in the winter.

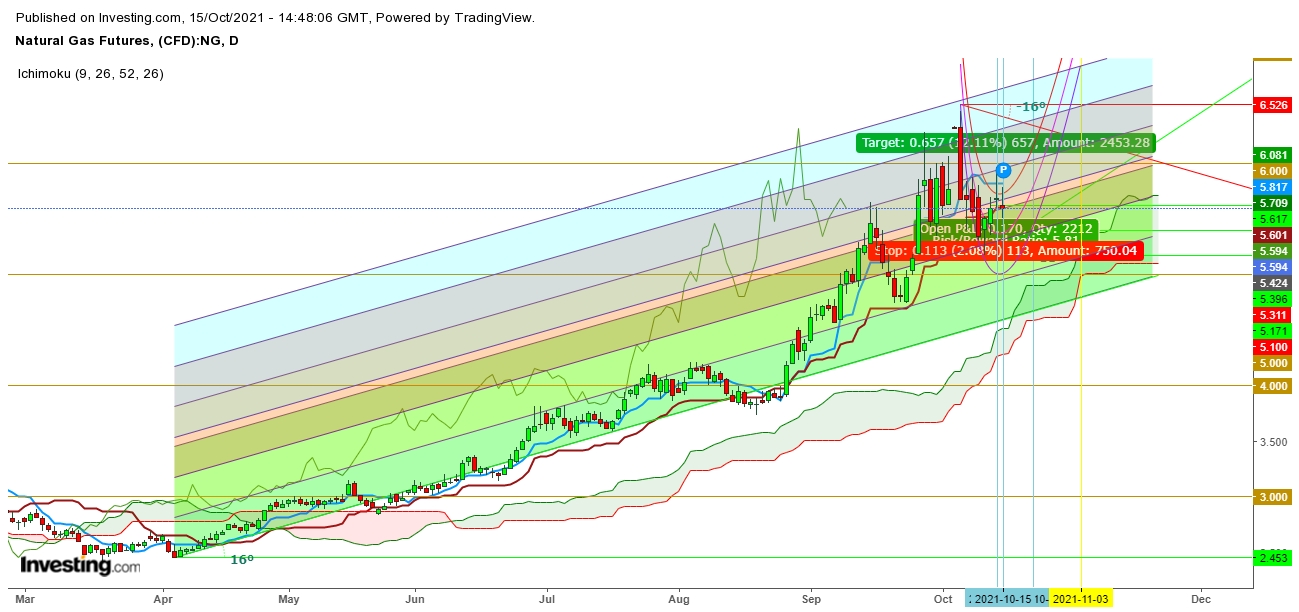

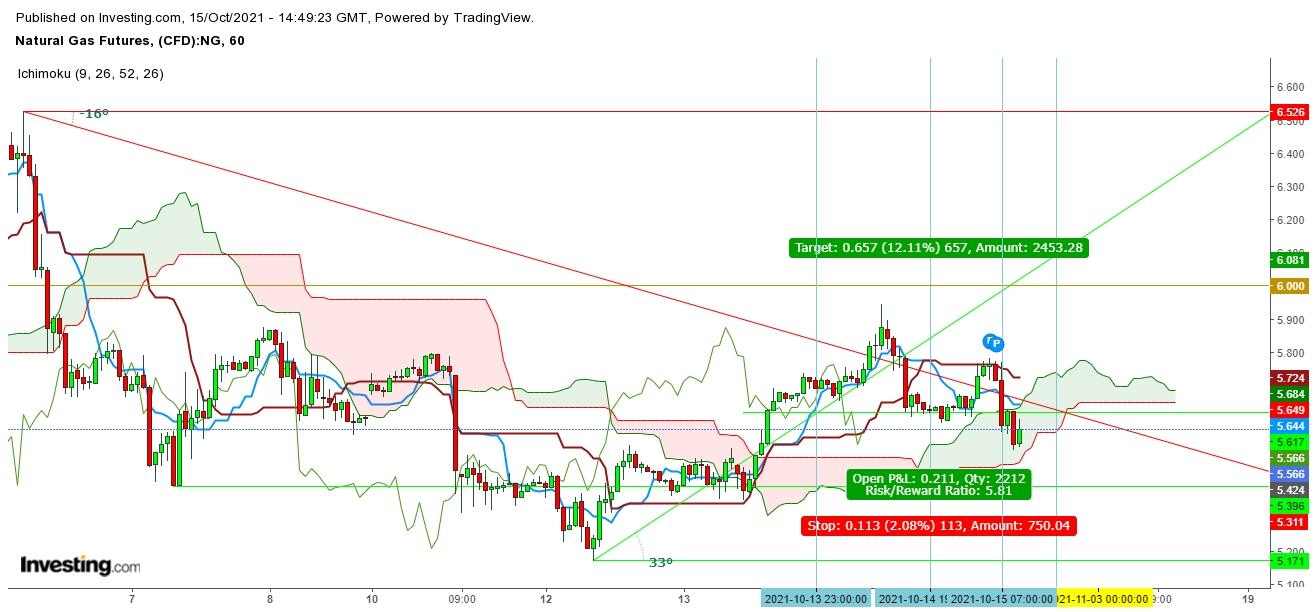

Technical View

An exhaustive candle formed in the daily chart on Thursday, indicating bearish pressure on natural gas prices. This could provide an opportunity to go long from $5.424 with a stop-loss at $5.311, targeting $6.5 next week.

The daily chart shows that natural gas futures are still sustaining an uptrend, which confirms a steep reversal from the current levels.

A gap-up opening on Monday will be a bullish signal amid growing volatility.

The trend in the daily chart confirms a steep reversal from the current levels. A gap-up opening on the first trading session of the upcoming week will ensure the repetition of bullish moves amid growing volatility.

Disclaimer:

1. This content is for information and educational purposes only and should not be considered as investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.