Natural Gas futures price have come down after touching the highest level of the season at $3.627, but in this process it seems to be going to form an "Exhaustive Candle" in Weekly Chart as it did on December 28th, 2016, but the afterward moves were quite sharply downward. Now, I find the price movement repetition seems to be the next course of action. I find the Natural Gas futures price have already priced in all the supportive news flow at the current level of $3.529 and has been facing continuously a stiff resistance from the peak levels.

I find the following factors which seem to be valid reasons of beginning of a downward move from current levels:-

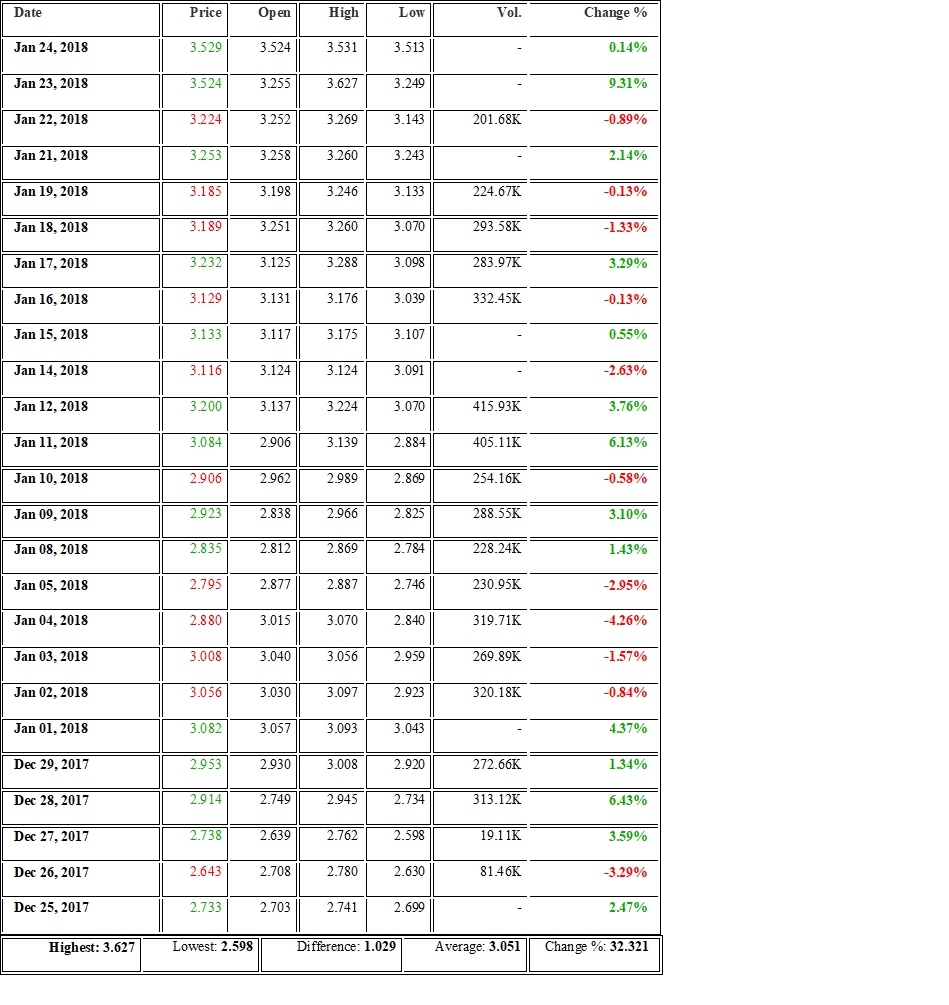

1. Natural Gas futures price is currently trading with a gain of 33% in a month time, which makes it a valid reason to come down sharply, especially when all the positive news flow have already been factored in at the current price.

2. Natural Gas futures price can hardly ignore the other impacting factors like inflationary level, crude price levels, gasoline production, dry natural gas production and mainly the level of US Dollar Index futures.

3. Finally, the numbers of fresh buyers, especially at the highest level are evident enough or going to disappear all of sudden.

4. If the Natural Gas futures price finds absence of fresh buyers above $3.527, it will suddenly be a beginning of a sharp downward move, soon after the announcement of impending inventory on January 25th, 2018.

5. I find the current level is much attractive for more new bears in thick number. I find the evidence of presence of bears in good number since last six hours from now.

6. Expectations for more weekly withdrawal and more colder weather from the flip-flop weather announcements seem to be fading soon.

Natural Gas Futures Historical Data

Conclusion

On analysis of the movement of Natural Gas futures price in daily chart, I find the probabilities of repetition of same formation of "Exhaustive Candle" are evident enough to form the same downward pattern during the upcoming weeks as the weekly withdrawal trend is expected to be going to turn into weekly injections from the mid of February 2018.

Disclosure

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.