Since the submission of my last analysis, I find that Natural Gas Futures has been witnessing bouts of short-covering-small-rallies since the announcement of natural gas inventory from the level of $2.540 – a level where the Natural Gas bears are forced to cover their shorts before the bulls start fire works during the week of February 18th, 2018.

Observations

On analysis of the movement of Natural Gas futures price in different chart patterns which I have noted in my last few analyses, I find the reflection of the following factors upon the movement of Natural Gas futures price:

1. Antagonistic Weather model: Natural gas seems poised to create a sudden flip-flop during the upcoming weeks, as the forecast remained bearish till February 15th and then a potential flip seems to be taking place afterward.

2. The U.S. Energy Information Administration said in its weekly report that natural gas storage in the U.S. fell by 194 billion cubic feet (bcf) in the week ending Feb. 9, above forecasts for a withdrawal of 183 bcf. That compared with a decline of 119 bcf in the preceding week, a fall of 114 bcf a year earlier and a five-year average drop of 154 bcf.

3. Natural Gas Bullish Storage Data: Last hour’s short-covering and growing demand is evidence enough for natural gas bulls to take command.

4. Evidence of confusion among natural gas bears due to their reluctance to create fresh shorts at the level of $2.540.

Conclusion

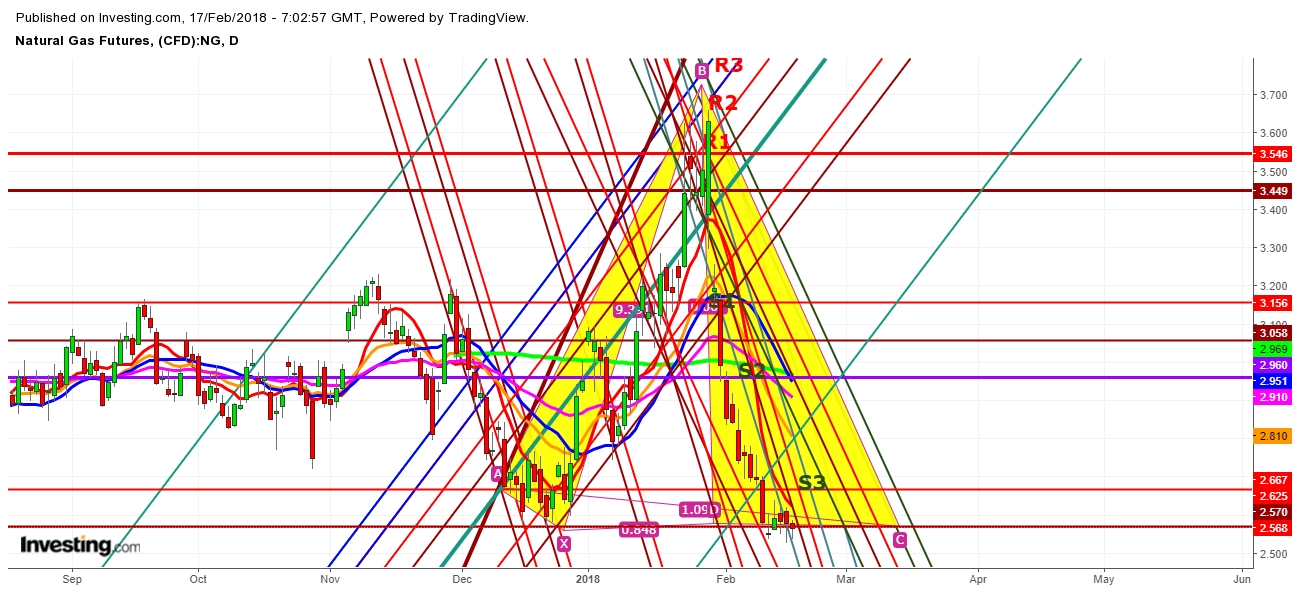

1. History has witnessed several examples of steep reversals from the tops, when everybody wanted to create fresh buy positions at peaks; and on the other side, formation of explosive bounce from the lowest levels, when everybody was full of fear, even not to dare creating fresh long position at the lowest level.

2. Natural gas bears have completed their cocoon, and have been trapped inside, even ready to destroy their own cocoon themselves, which is evident from the put/call ratio for February contracts (0.77) and for March contracts (0.81) which explore more possibilities of a strong rally for some time before February 22nd, 2018 due to option expiration.

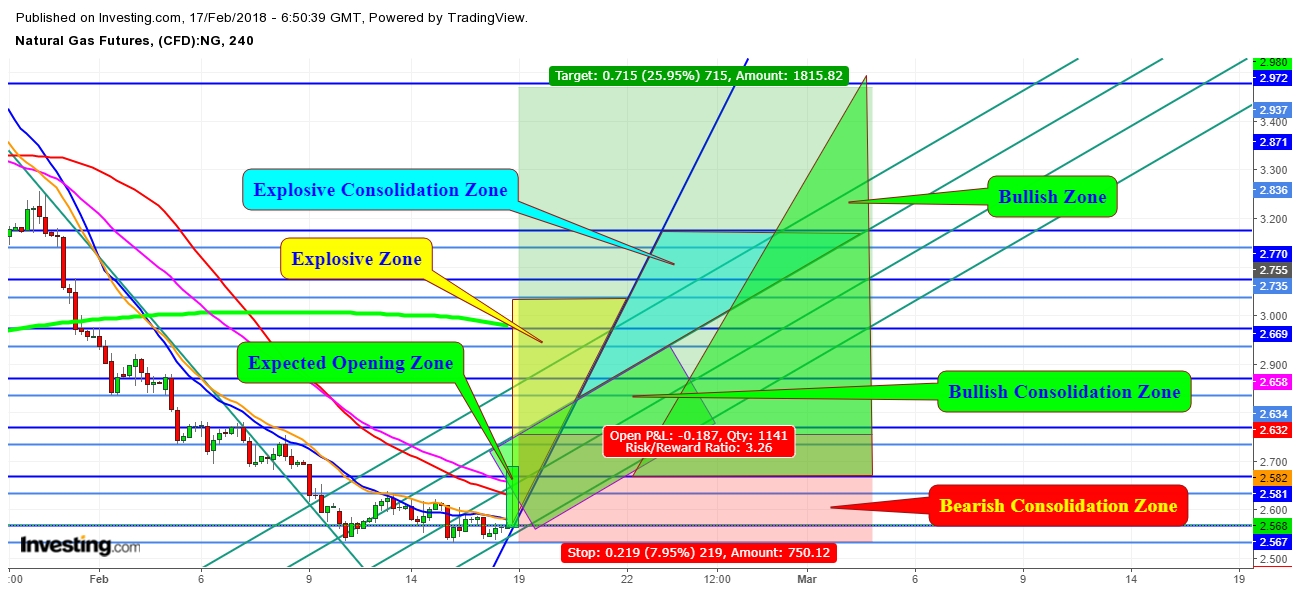

3. Gap-up opening on the first trading session for the Week of February 18th, 2018 will confirm the first blast in this bears’ cocoon.

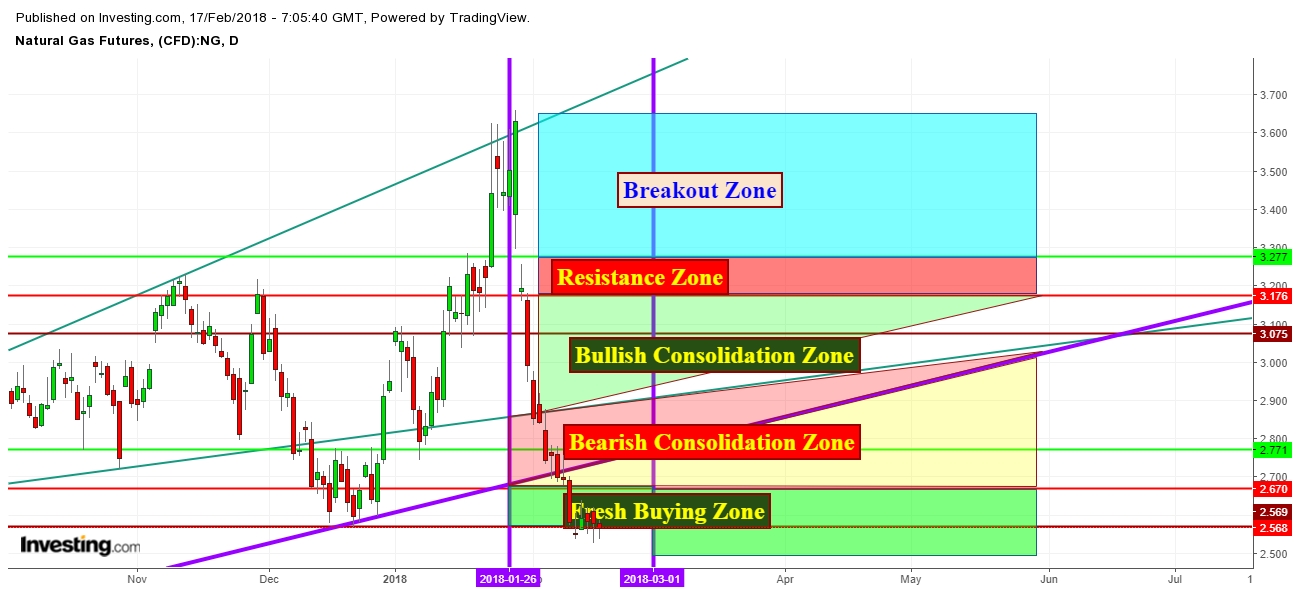

4. Finally, I conclude expected trading zones from February 18th – March 22nd, 2018.