Next week, the markets will put in a near-term top. Yes, it is that simple to see if you know how to read the charts. The proprietary PPT Strategies clearly show a top followed by a pull back in the first week of February. The play book is as follows. Stocks should gap higher Monday before turning choppy and weaker the rest of the week.

Just to give some background on past calls and profits. I stated at the start of 2013, the markets would push higher to the 1500 level on the S&P 500. This level corresponds to $150.00 on the SPDR S&P 500 ETF Trust (SPY). On Friday, the SPY closed at $150.25. This completed a perfect call. At this point I am turning to a more bearish view not only because the master target was hit, but because of other concerning factors. Let me lay them out below.

1. Mutual fund inflows continue at twelve year highs. Mutual funds are the primary investment tools of the average investor. Throughout history, when the average investor piles into the market, a top is very close.

2. The media is pumping the bullish view equal to each of the last major highs in the markets before a 10% correction.

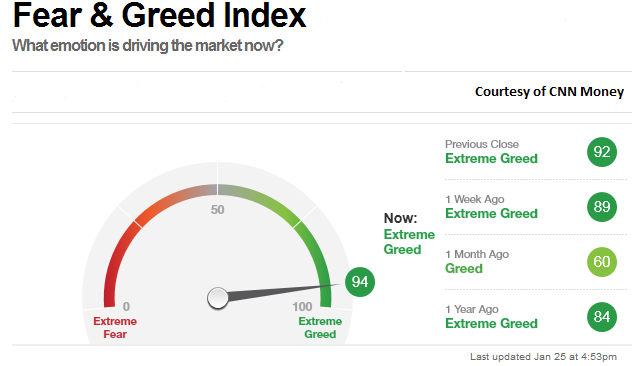

3. The greed index tracked on CNN Money is at 94. The highest it can go is 100 and the lowest is 0. Excess greed and complacency signals a top or near reversal.

4. The VIX (Fear Index) is trading at levels not seen since just before the financial collapse.

5. Friday, the NBC Nightly News lead with a story on how great the markets were and how average investors were jumping back in, fearing they will miss the big run higher. Note. The markets are already up over 100% off their 2009 financial collapse lows.

6. Many stocks like 3M Co (MMM), 3M Co (MMM), The Home Depot, Inc. (HD) and Amazon.com, Inc. (AMZN) are at all time highs. Are things that good to warrant all time highs?

These factors plus the proprietary PPT Strategy calculations say a top will be put in next week, followed by a strong pull back in the markets. The average investor is jumping in and will be raped once again, as in the past.

Related: SPDR Dow Jones Industrial Average ETF (DIA) and PowerShares QQQ Trust, Series 1 (ETF) (QQQ).

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

National News Leads With Markets, Greed Index Near 100

Published 01/27/2013, 12:14 AM

Updated 07/09/2023, 06:31 AM

National News Leads With Markets, Greed Index Near 100

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.