Stocks looked so, so good going into the week but then began to crumble and later on in the week, tumble.

I did a lot of selling and have on a few stocks now as the market has turned and one we sold late Thursday plummeted nearly 27% Friday alone.

You can always buy a stock back, so when I see the warning signs I don’t hesitate for long to do some selling.

Now we have to watch and see if we get a nice V type of bottom or if this weakness will spread and we look to get short.

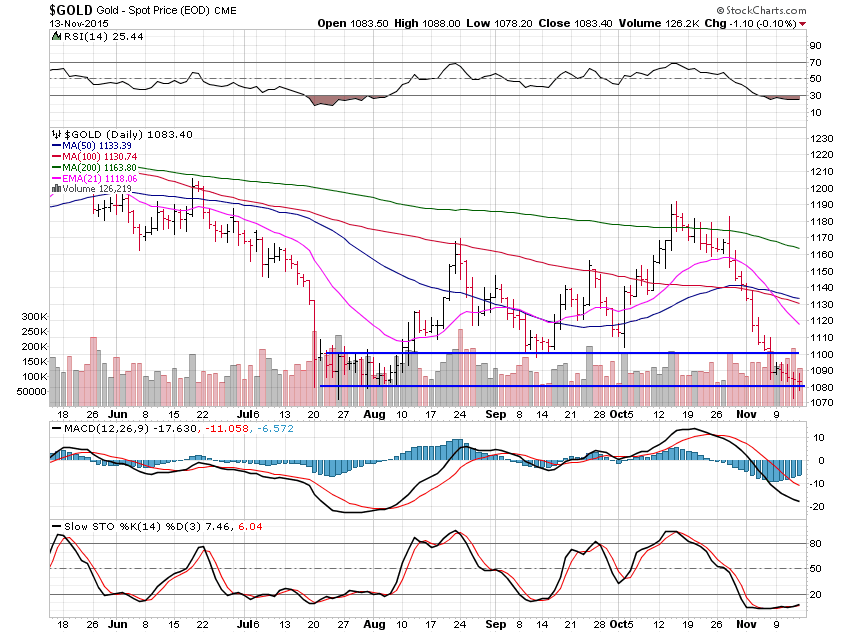

As for the metals, gold and silver are holding support areas I talked about here last week but are setting up for a next wave lower.

Gold lost 0.51% this past week and did try to breakdown but is holding support so far.

It looks like a bear flag is forming now near $1,080 but we may see a range between there and $1,100.

We’d have to break above $1,100 for the short-term trend to change back to up.

I still do not think the major low is yet in place.

Silver lost a hefty 3.46% this past week and is also holding a support area, for now.

$14.25 is holding well for now but a bear flag appears to be forming and we could see a range trade between $14.25 and $14.50, which would have to be bested in order for the short-term trend to change back to up.

I do not see the major low as being in place yet.

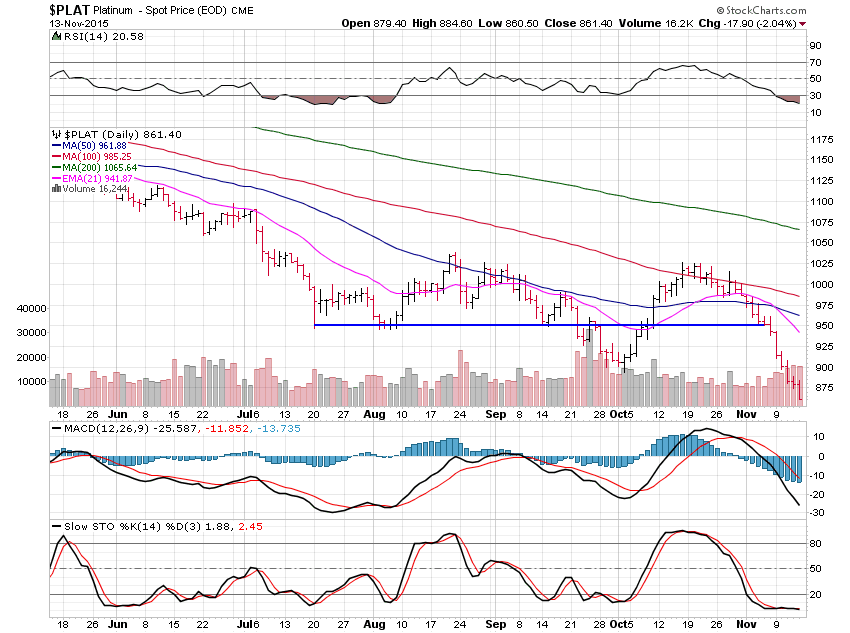

Platinum lost a large 8.60% this past week as it broke hard below the support level I showed here last week at $950.

Major support on the monthly chart is right here at $885 so expect some consolidation now.

The next major support level remains $750 but I imagine we have a good chunk of consolidating to get done first.

Palladium lost a massive 13.19% on the week and is near major support now at $525.

Nasty stuff for palladium indeed and I’m looking for a good amount of consolidation here at the $525 area before we likely move lower once again.

Support below is $480 then $390.