The E-Mini Nasdaq 100 reversed off our 3420 key level, and has rallied over 250 points in just eight sessions. How much more is left in the tank? Here are my thoughts.

3420 Holds

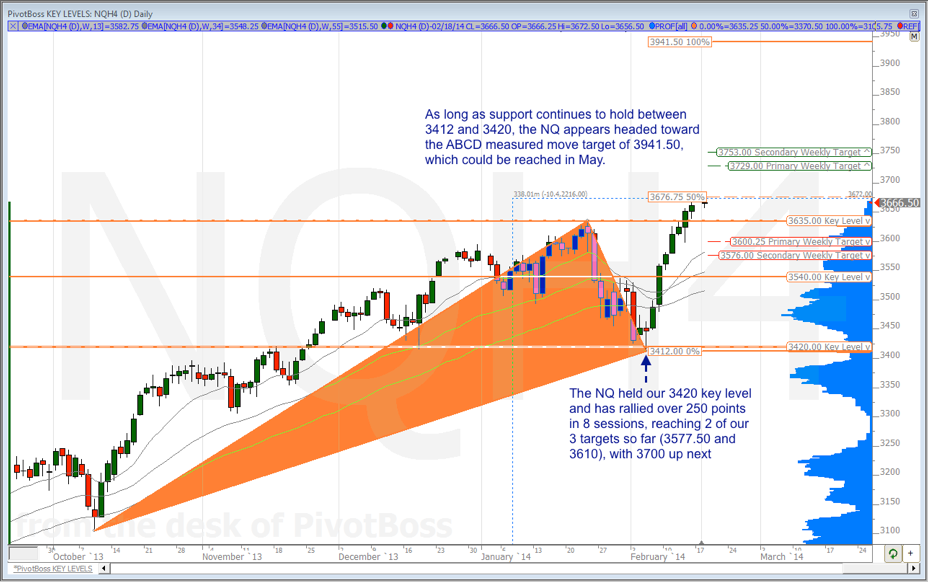

In my Jan. 28 edition of the Opening Print I wrote: “Price remains above our critical 3420 key level, which I’ve mentioned before as the level that must continue to hold if the current uptrend is to remain structurally sound…We could see another swing move higher into 3700 over the next few weeks heading into February, with scaling points at 3577.50 and 3610.”

So far, two of our three targets have been reached at 3577.50 and 3610 after the NQ held and rallied from the 3420 key level. Overall, the NQ has rallied over 250 points in just eight sessions and has pushed to new highs on the year, further demonstrating continued strength within the existing bull trend.

Will the NQ see 3700 in February? Well, let’s put it this way, the NQ has nearly two full weeks to push just 28 points past the current high of 3672 to reach 3700. Add to this the fact that the NQ is averaging 52.25 points per day on a 10-day average range basis, and we could see 3700 by lunchtime Tuesday.

Is 3941.50 On Tap?

Forget 3700. That level seems to be a foregone conclusion. Is 3941.50 next? Well, according to my beautifully drawn harmonic triangle (a la Kathy Garber), I’d say yes.

Basically, this pattern forecasts an ABCD measured move target of 3941.50. This target could be reached sometime in the next three to four months, which could be perfect timing for a potential “sell in May and go away” play.

The key points of the triangle coincide with already well-known key levels, namely 3420 (technically 3412) and 3635. As before, 3420 remains the most important key level in the chart, with support as low as the bottom of the pattern at 3412. If the NQ continues to hold above this zone of support, the existing bull trend will continue to remain firmly intact.

The NQ recently broke above the top of the pattern at 3635, printing new highs for the year, which suggests a further continuation toward the 3941.50 target. This breach led price to within 5 points of the midpoint of the ABCD measured move projection of 3676.75, which is a point at which some initial profit-taking could take place.

However, any pullback should continue to be considered a buying opportunity so long as price remains above that 3412 to 3420 zone of support.

Looking Forward

Watch 3635 as a key pivot this week. Holding above this level, or successfully retesting it, implies further upside strength toward weekly ADR targets at 3729 and 3753. Failure to hold above 3635 suggests weakness into the downside weekly ADR targets at 3600.25 and 3576, with an important key level at 3540.

A test of the 3540 key level offers a swing buy opportunity, as this zone also shows a significant LVN that could offer support. Failure to hold 3540 likely signals a big retest of the 3420 key level, which could finally give way since it would be a third test at this price.