U.S. stock index futures ended mixed on Tuesday with the March E-mini NASDAQ finishing the weakest. The index felt the brunt of a sharp sell-off in Apple (AAPL) which closed below the psychological support level at $500.00. Volume was light, however, as many traders sat on the sidelines ahead of corporate earnings later this week or the break could have been worse.

Also weighing on the market was lower demand for higher yielding assets triggered by a weaker euro and concerns that the Democrats and Republicans have reached an impasse regarding the debt ceiling hike negotiations.

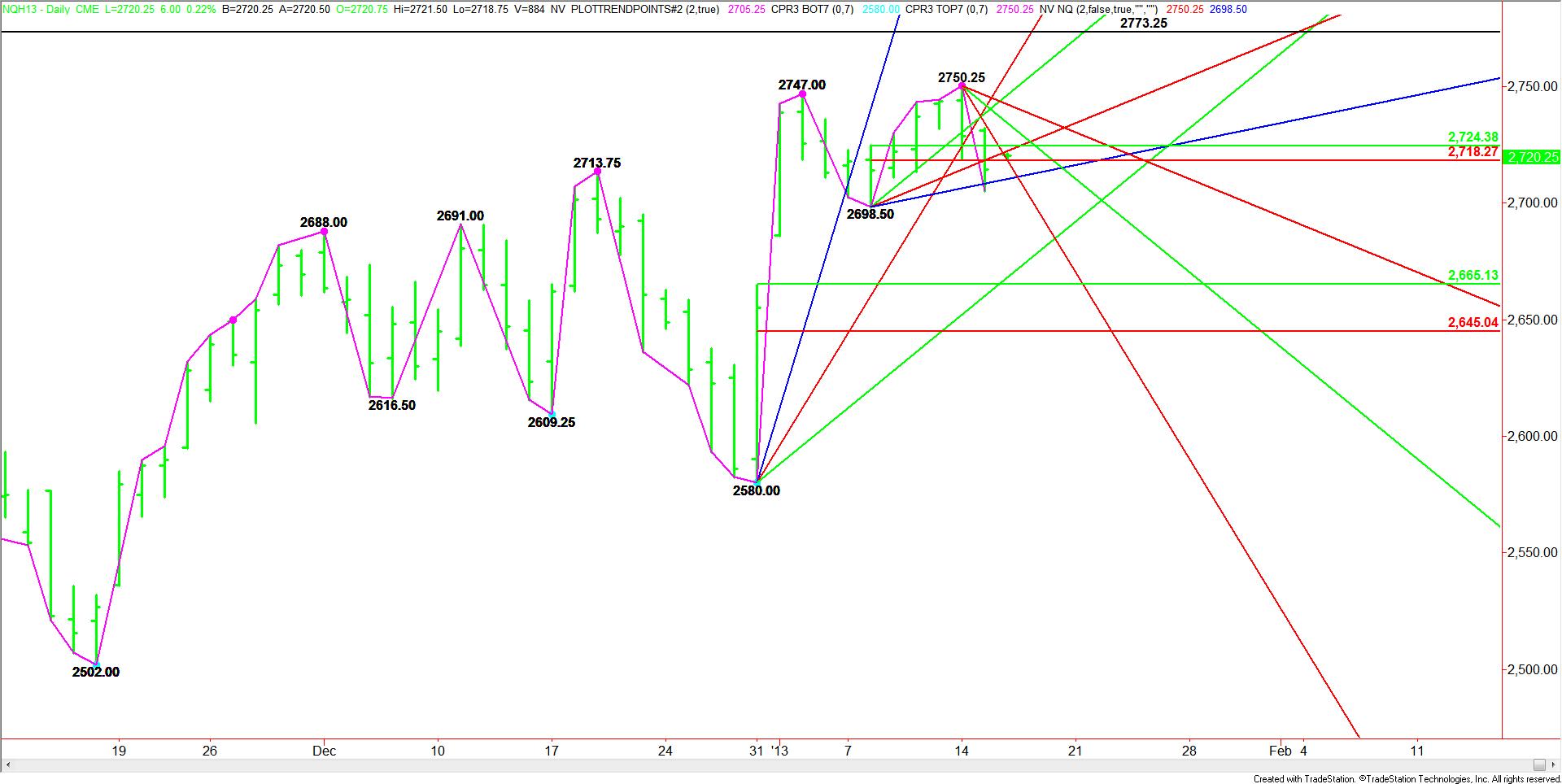

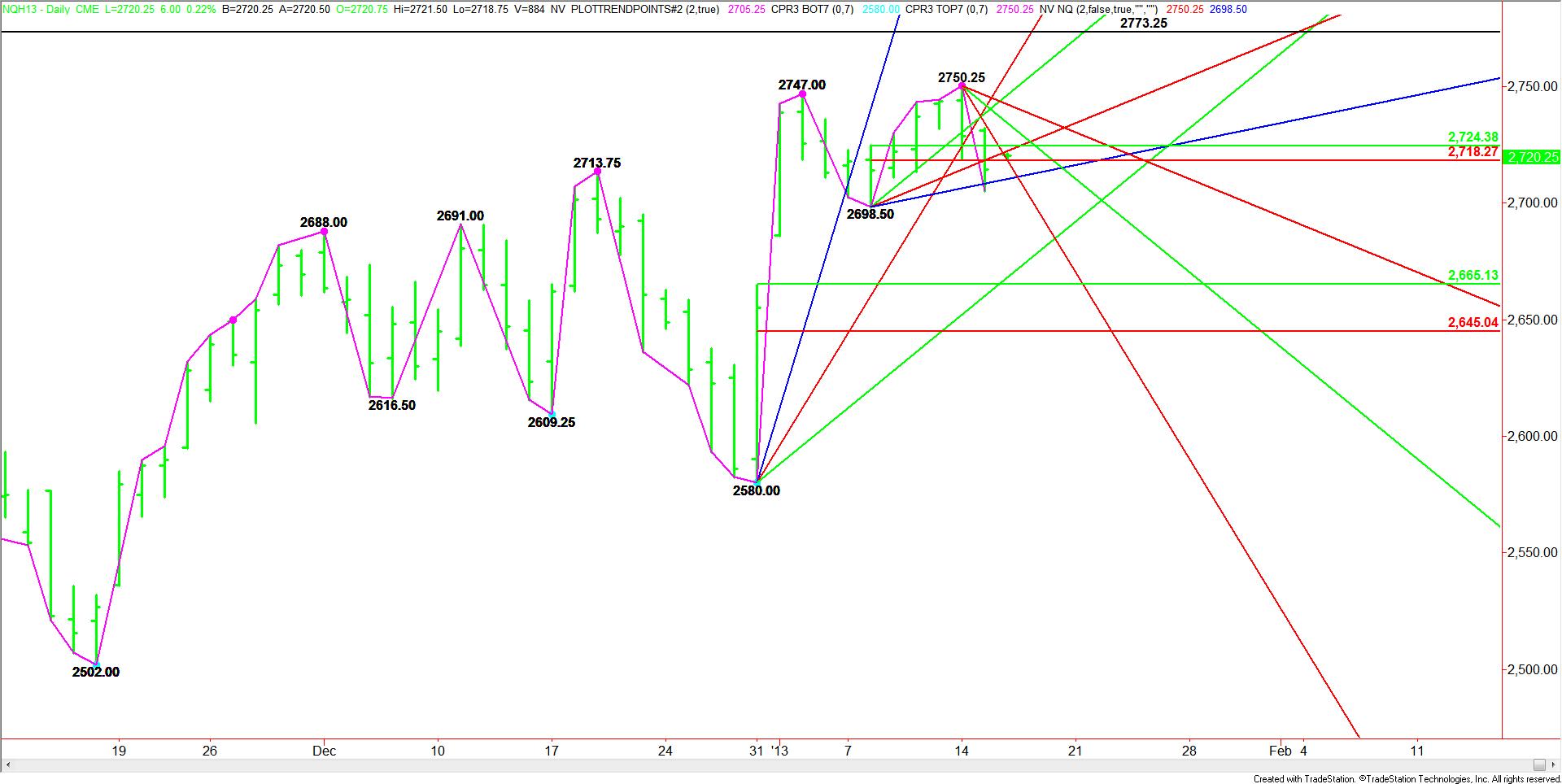

Technically, the main trend is still up but the weak close at 2720.25 has the index in a position to take out the last swing bottom at 2698.50. A trade through this level will turn the main trend down. Early signs of weakness on Tuesday included the breaking of a key uptrending Gann angle and the failure to support the market on a test of a retracement zone at 2724.25 to 2718.25.

An uptrending Gann angle at 2708.50 stopped the break on Tuesday, shortly before the main bottom. This angle moves up to 2710.50 on Wednesday and should be considered key support and a level that could trigger the start of a steep decline.

Any of the resistance angles from the 2750.25 top could stop an intraday rally. These come in at 2718.25, 2734.25 and 2742.25. Based on the short-term range of 2750.25 to 2705.25, a new retracement zone has formed at 2727.75 to 2733.05. The best possible resistance cluster is 2733.05 to 2734.25. If the trend is getting ready to turn down then the next rally should stop in this zone.

Based on the main range of 2580.00 to 2750.25, the next major downside target is 2665.25 to 2645.00

Also weighing on the market was lower demand for higher yielding assets triggered by a weaker euro and concerns that the Democrats and Republicans have reached an impasse regarding the debt ceiling hike negotiations.

Technically, the main trend is still up but the weak close at 2720.25 has the index in a position to take out the last swing bottom at 2698.50. A trade through this level will turn the main trend down. Early signs of weakness on Tuesday included the breaking of a key uptrending Gann angle and the failure to support the market on a test of a retracement zone at 2724.25 to 2718.25.

An uptrending Gann angle at 2708.50 stopped the break on Tuesday, shortly before the main bottom. This angle moves up to 2710.50 on Wednesday and should be considered key support and a level that could trigger the start of a steep decline.

Any of the resistance angles from the 2750.25 top could stop an intraday rally. These come in at 2718.25, 2734.25 and 2742.25. Based on the short-term range of 2750.25 to 2705.25, a new retracement zone has formed at 2727.75 to 2733.05. The best possible resistance cluster is 2733.05 to 2734.25. If the trend is getting ready to turn down then the next rally should stop in this zone.

Based on the main range of 2580.00 to 2750.25, the next major downside target is 2665.25 to 2645.00