Nasdaq, Inc. (NASDAQ:NDAQ) reported second-quarter 2017 adjusted earnings per share of $1.02, beating the Zacks Consensus Estimate of 96 cents. Also, the bottom line improved 12.1% year over year.

Higher revenues as well as growth across all segments supported this upside. However, the improvement was limited by an increase in expenses.

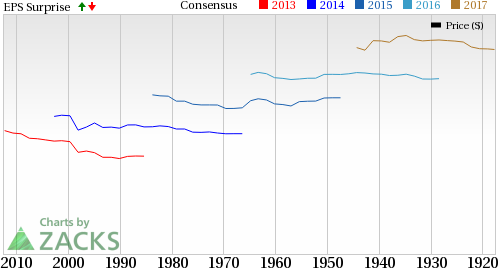

Nasdaq, Inc. Price, Consensus and EPS Surprise

On a GAAP basis, the company’s net income skyrocketed 93% year over year to 87 cents per share.

Performance in Detail

Nasdaq’s revenues of record $602 million increased 7% year over year. Revenues beat the Zacks Consensus Estimate of $595.3 million, which was primarily due to a $34 million positive impact from acquisitions and organic growth of $15 million.

Adjusted operating expenses were $315 million in the reported quarter, up 5% year over year. This was mainly due to higher operating expenses related to the acquisitions closed in 2016. As of Jun 30, 2017, Nasdaq achieved $60 million in annualized run-rate cost synergies. Besides, the company estimated $10-$20 million in additional synergies to be realized post completion of other platform consolidations.

Notably, the company tightened the upper end of its 2017 non-GAAP operating expense to the range of $1.26–$1.29 billion from $1.26–$1.30 billion guided earlier.

Segment wise, net revenue at Market Services jumped 14.4% from the year-ago quarter to $222 million. The upside was driven by higher revenues from the ISE and higher European cash equities revenues.

Revenues at Corporate Services increased 1.2% year over year to $164 million. This was mainly due to the inclusion of revenues from Boardvantage acquisitions.

Information Services revenues rose 7.5% year over year to $144 million. Higher proprietary data products revenues and higher assets under management in exchange traded products linked to Nasdaq indexes, drove the upside.

Revenues at Market Technology increased 4.3% year over year to $72 million due to organic revenue growth. Market Technology order intake totaled $64 million. The Nasdaq Stock Market witnessed 64 new listings during the first quarter, 36 of which were IPOs.

Financial Update

Nasdaq had cash and cash equivalents of $374 million as of Jun 30, 2017, down 10.5% from 2016-end level. As of Jun 30, 2017, debt decreased 15.1% over 2016-end level to $3.1 billion.

Dividend and Share Repurchase Update

The board of directors approved of a 38 cents per share quarterly dividend, which will be paid on Sep29, 2017 to shareholders of record on Sep 15, 2017.

The company had about $273 million remaining under its buyback authorization.

Our Take

Nasdaq’s results reflect a decent performance. Growth looks encouraging as the company remains focused on expansion through acquisitions and organic initiatives that enable entry and open up cross-selling opportunities into new markets. The top line should also benefit from the company’s consistent focus on its strategy to accelerate non-transaction revenue base, including technology, listing and information revenues. However, higher expenses and stiff competition remain key concerns.

Nasdaq carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other securities exchanges, MarketAxess Holdings, Inc. (NASDAQ:MKTX) will report results after the market closes today. While CME Group Inc. (NASDAQ:CME) will report results on Aug 1, Intercontinental Exchange Inc. (NYSE:ICE) will report on Aug 3.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Intercontinental Exchange Inc. (ICE): Free Stock Analysis Report

CME Group Inc. (CME): Free Stock Analysis Report

Nasdaq, Inc. (NDAQ): Free Stock Analysis Report

MarketAxess Holdings, Inc. (MKTX): Free Stock Analysis Report

Original post