The chemical industry has so far enjoyed a positive run this year, helped by an upswing in the world economy and continued strength across major end-use markets such as construction, electronics and automotive.

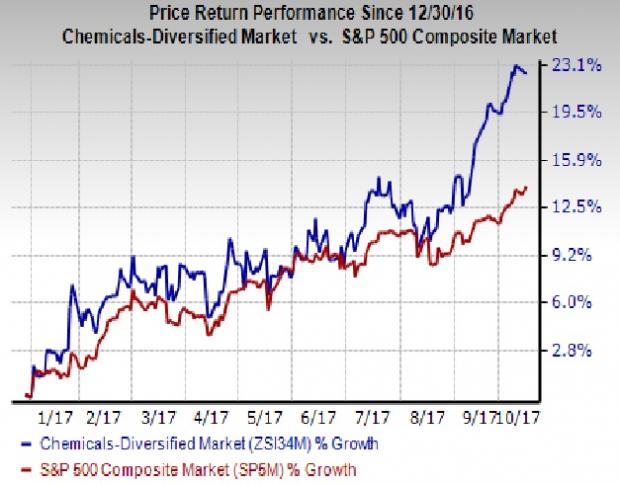

The Zacks Chemicals Diversified industry has outperformed the broader market year to date. The industry has gained around 22.6% over this period, higher than S&P 500’s corresponding return of roughly 14%.

Notwithstanding a few headwinds including the impact of the devastating Hurricane Harvey, chemical companies are expected to continue the earnings momentum witnessed in the second quarter into the September quarter as the fundamental driving factors remain firmly in place.

Strategic Actions to Reap Margin Benefits

Strategic measures including productivity improvement, pricing actions, portfolio restructuring and earnings-accretive acquisitions are expected to drive the performance of chemical makers in the third quarter. Cost-cutting measures and productivity improvement actions by chemical companies should continue to yield industry-wide margin improvements in the September quarter.

Chemical companies also continue to shift their focus on attractive, growth markets in an effort to whittle down their exposure on other businesses that are grappling with weak demand. Moreover, they remain actively focused on mergers and acquisitions to diversify and shore up growth. Synergies from acquisitions should lend support to earnings in the third quarter.

Moreover, a number of chemical makers are taking appropriate pricing actions (reflected by hikes in chemical prices in the recent past) in the wake of a sharp rise in raw materials costs. This is also expected to support their margins in the third quarter.

Strength Across Key End-Markets

Chemical makers continue to see strong demand from construction and automotive sectors – major chemical end-use markets. The automotive sector continues its good run, supported by an improving job market, rising personal income, improved consumer confidence, low fuel prices and attractive financing options.

A recovery across housing and commercial construction markets has been another tailwind for the chemical industry. The underlying trends in the housing space remain healthy, backed by steady buyer demand, low mortgage rates, rising rent costs and easy loan availability.

Harvey-Stoked Disruptions Pose a Concern

Hurricane Harvey weighed on U.S. chemical production during the third quarter, knocking off a sizable chunk of production capacity. The U.S. chemical industry saw flat production in August as activities in the Gulf Coast were interrupted by Harvey, according to a recent report from the American Chemistry Council (ACC), a chemical industry trade group.

The Gulf Coast is the epicenter of the U.S. specialty chemicals and petrochemicals industry. Harvey led to the shutdown of several chemical plants along the Gulf Coast.

In particular, the storm ravaged Texas that accounts for nearly three-quarters of the U.S. production of ethylene, which is among the world’s most important petrochemicals and a basic ingredient for final products ranging from plastic bottles to tires to polyester fabric. Many chemical plants producing ethylene are located near the Gulf Coast’s concentration of petroleum facilities.

According to IHS Markit, 54% of total U.S. ethylene production capacity was hit by Harvey. A number of major chemical producers had to shutter or cut back ethylene production, leading to reduced supply of this major chemical. As such, the impacts of disruptions caused by Harvey may pose some earnings headwinds for U.S. chemical makers in the September quarter.

Picking the Winning Stocks

While the chemical industry still remains saddled by a few challenges, the industry’s momentum is expected to continue in the third quarter on continued strength across major end-markets. Amid such a backdrop, a sneak peek at the space for some potential winners backed by a solid Zacks Rank could be a great idea for investors looking to gain from the third-quarter earnings season.

With the help of the Zacks Stock Screener, we have shortlisted chemical stocks that have an estimated year over year EPS growth of 5% or more for the to-be-reported quarter. Further, these stocks carry a Zacks Rank #1 (Strong Buy) or #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

5 Stocks to Scoop Up

Below we discuss five chemical stocks that are worth investing in before the third-quarter earnings season hits full throttle.

The Chemours Company (NYSE:CC)

Delaware-based Chemours sports a Zacks Rank #1. The stock has an estimated EPS growth of 65.6% for the third quarter. Moreover, it delivered average positive earnings surprise of 12.1% over the trailing four quarters. The stock has also gained a staggering 149.5% year to date.

The company should gain from its transformation initiatives, cost reduction actions, strength across its portfolio, improving end market conditions and increased customer adoption of both Ti-Pure titanium dioxide and Opteon refrigerants.

Kraton Corporation (NYSE:KRA)

Our next pick in the space is Texas-based Kraton, armed with a Zacks Rank #1. The company has an expected EPS growth of 60.3% for the third quarter. It also delivered average positive earnings surprise of 16.5% over the trailing four quarters. Moreover, the stock has gained around 44.1% so far this year.

Kraton should benefit from a favorable raw material pricing environment, positive underlying business momentum and its actions to steer organic growth in key markets through state-of-the-art innovation and infrastructure.

Kronos Worldwide, Inc. (NYSE:KRO)

Headquartered in Dallas, TX, Kronos is another attractive choice with a Zacks Rank #2. The company has an expected EPS growth of 121.1% for the third quarter. It delivered average positive earnings surprise of 76.1% over the trailing four quarters. The stock has also gained 108.5% year to date.

Kronos should gain from higher demand for titanium dioxide, improved selling prices, higher production volumes and implementation of certain productivity-enhancing projects at some facilities.

Huntsman Corporation (NYSE:HUN)

Texas-based Huntsman sports a Zacks Rank #2. The company has an expected EPS growth of 32.2% for the third quarter. It also delivered positive earnings surprise in each of the trailing four quarters with an average beat of 26.4%. The stock has also gained 43.5% so far this year.

Huntsman should continue to gain from strong underlying fundamentals and its downstream strategy. Moreover, strength of the company’s global polyurethanes business and sustained recovery of the performance products unit are expected to lend support to its third-quarter earnings.

Innospec Inc. (NASDAQ:IOSP)

Headquartered in Englewood, CO, Innospec carries a Zacks Rank #2. The company has an expected EPS growth of 9% for the third quarter. It delivered positive earnings surprise in three of the trailing four quarters with an average beat of 7.8%. The company should continue to gain from its well-balanced portfolio, margin contributions from new technologies and strength across its Performance Chemicals and Oilfield Services units.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Huntsman Corporation (HUN): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Innospec Inc. (IOSP): Free Stock Analysis Report

Kraton Corporation (KRA): Free Stock Analysis Report

Original post

Zacks Investment Research