Nabriva Therapeutics plc (NASDAQ:NBRV) announced results from a phase III study where lefamulin demonstrated non-inferiority to Bayer AG’s (OTC:BAYRY) Avelox in treating patients with community-acquired bacterial pneumonia (“CABP”).

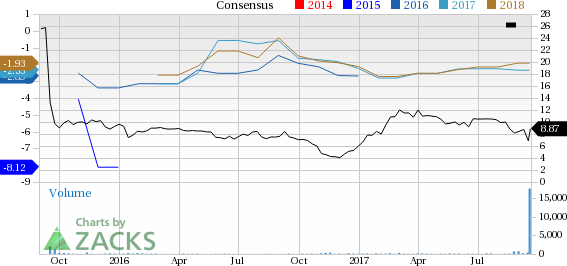

Shares surged 37% on Monday, including after-market gains, since the announcement of the news. In fact, Nabriva’s shares have outperformed the industry with a gain of 48.8% so far this year. The industry gained 15.6% in the period.

LEAP 1, the first of the two phase III studies on lefamulin, compared intravenous (IV) or oral administration of the candidate to IV/orally administered Avelox, with or without adjunctive linezolid, in CABP patients. The study achieved the FDA set endpoint of non-inferiority (12.5%) in early clinical response (“ECR”) over 72 to 120 hours after the start of the therapy in intent to treat (“ITT”) patients. Lefamulin also met the non-inferiority margin of 10% set by the European Medicines Agency.

Lefamulin achieved an ECR rate of 87.3% compared with 90.2% for Avelox. Also, an investigator assessed clinical response rate was 81.7% for lefamulin compared with 84.2% for Avelox in modified ITT patients.

The company is also conducting a second phase III study, LEAP 2, which compares oral administrations of lefamulin and Avelox in patients with moderate CABP. Nabriva expects the enrollment to be completed in the last quarter of 2017 with top-line data expected in March 2018.

The company estimates that there are 5 million people treated for CABP in the United Sates. Although there are a significant number of CABP patients in the country, there are several companies that sell or develop treatments for the indication. Paratek Pharmaceuticals, Inc. (NASDAQ:PRTK) announced non-inferiority of its phase III candidate, omadacycline, to Avelox in April 2017. Cempra, Inc. (NASDAQ:CEMP) is also developing solithromycin for treating CABP.

Nabriva has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

4 Promising Stock Picks to Keep an Eye On

With news stories about computer hacking and identity theft becoming increasingly commonplace, the cybersecurity industry looks like a promising investment opportunity. But which stocks should you buy? Zacks just released Cybersecurity: An Investor’s Guide to Locking Down Profits to help answer this question.

This new Special Report gives you the information you need to make well-informed investment choices in this space. More importantly, it also highlights 4 cybersecurity picks with strong profit potential.

Get the new Investing Guide now>>

Bayer AG (DE:BAYGN) (BAYRY): Free Stock Analysis Report

Nabriva Therapeutics AG (NBRV): Free Stock Analysis Report

Paratek Pharmaceuticals, Inc. (PRTK): Free Stock Analysis Report

Cempra, Inc. (CEMP): Free Stock Analysis Report

Original post

Zacks Investment Research