On Aug 11, we issued an updated research report on Salt Lake City, UT-based molecular diagnostics provider, Myriad Genetics, Inc. (NASDAQ:MYGN) . The company currently carries a Zacks Rank #3 (Hold).

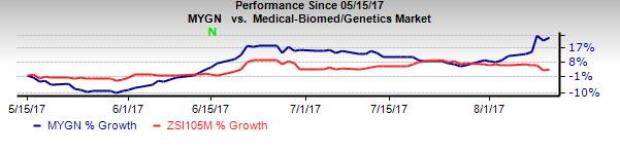

For the past three months, Myriad has been trading above the broader industry. The company has rallied 24.7%, compared with the industry’s 3.7% gain.

Myriad ended fiscal 2017 on a solid note, with its fourth-quarter numbers exceeding the Zacks Consensus Estimate. The company particularly observed strong growth in EndoPredict and GeneSight testing revenues. Also, Myriad witnessed a third consecutive quarter of rise in hereditary cancer volumes. Also, it received provincial reimbursement in Quebec for EndoPredict.

Notably, at the European League Against Rheumatism (EULAR) meeting held in June in Spain, Crescendo Bioscience, a wholly-owned subsidiary of Myriad, released new data from a meta-analysis of clinical studies. The data has demonstrated the Vectra DA test’s ability to predict a joint damage.

The same month, the company announced that its BRACAnalysis CDx companion diagnostic test has successfully identified BRCA-mutated patients with HER2- metastatic breast cancer in the OlympiAD trial, who have responded to treatment with olaparib better than standard chemotherapy.

Myriad’s collaborations with AstraZeneca and BeiGene for development of companion diagnostics also raise optimism. Moreover, Myriad continues to make progress with its kit-based versions of Prolaris and myPath Melanoma in the international market and expects to file for CE Mark for Prolaris by 2018.

Moreover, the company has introduced its ‘Elevate 2020’ program that targets to achieve $50 million of incremental operating income by fiscal 2020. Per management, the company has selected the projects that are anticipated to deliver $17 million of operating income in fiscal 2018 and another $24 million in fiscal 2019.

On the flip side, unfavorable currency translation continues to be a major dampener for the stock. Management fears that further strengthening of the dollar against foreign currencies will lead to deteriorating operating results.

Intensifying competition as well as the possibility that Myriad’s new test might not generate meaningful profits to outweigh the costs associated with its development continues to raise concern.

Zacks Rank and Key Picks

Some better-ranked medical stocks are Edwards Lifesciences Corp. (NYSE:EW) , Steris Plc (NYSE:STE) and Align Technology, Inc. (NASDAQ:ALGN) . Edwards Lifesciences and Align Technology sport a Zacks Rank #1 (Strong Buy), while Steris carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Edwards Lifesciences has a positive earnings surprise of 10.75% over the trailing four quarters. The stock has gained around 0.9% over the last three months.

Align Technology has a long-term expected earnings growth rate of 26.6%. The stock has rallied roughly 25.4% over the last three months.

Steris has a positive earnings surprise of 0.78% over two of the trailing four quarters. The stock has gained 13.1% over the last three months.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Myriad Genetics, Inc. (MYGN): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

STERIS PLC (STE): Free Stock Analysis Report

Original post

Zacks Investment Research