Myriad Genetics, Inc. (NASDAQ:MYGN) reported adjusted earnings per share (EPS) of 30 cents in the fourth quarter of fiscal 2017, down 17% year over year. However, adjusted EPS beat the Zacks Consensus Estimate of 26 cents by 15.4% and surpassed the company’s guided range of 26–28 cents.

Including one-time items, the company reported net income of $12.9 million or earnings of 19 cents per share in the quarter, exhibiting a decline of 45% and 41%, respectively.

For fiscal 2017, the company’s adjusted EPS came in at $1.05, down 36% from year-ago number. The full-year EPS figure exceeded the Zacks Consensus Estimate of $1.02.

Revenues

Total revenue rose 8% year over year to $201 million in the fourth quarter. The figure also outpaced the company’s guidance of $192–$194 million. The top line exceeded the Zacks Consensus Estimate of $194 million. Theyear-over-year rise in the top line was primarily on account of sequential growth in hereditary cancer revenues and strong results from GeneSight.

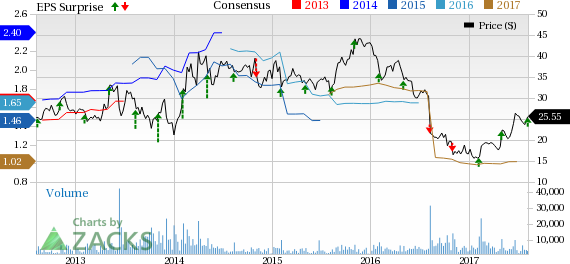

Myriad Genetics, Inc. Price, Consensus and EPS Surprise

For fiscal 2017, the company reported revenues of $771.4 million, up 2% from the equivalent figure of fiscal 2016. The top line also steered past the Zacks Consensus Estimate of $764.9 million.

Quarter in Details

Segment-wise, Molecular diagnostic tests (93.7% of total revenue) recorded total revenue of $187.9 million, up 8.1% year over year, mainly on account of an 18% rise in EndoPredict testing revenues to $2 million. GeneSight revenues grew 22% year over year to $25.5 million in the reported quarter.

In Prolaris testing space, the company witnessed more than 10% market penetration thereby, registering revenues of $2.9 million during the quarter but experienced a fall of 17% year over year. However, Hereditary cancer testing revenues dropped 5% year over year to $144.6 million but delivered a third consecutive quarter of sequential growth in testing volumes of 6% year over year.

Vectra DA testing revenues came in at $10.3 million, down 19% year over year, while other testing revenues fell 13% to $2.6 million.

On the other hand, Pharmaceutical and clinical service revenues (accounting for the rest) in the quarter were $12.6 million, showing a year-over-year decline of 1%.

Margin Trends

Gross margin in the quarter under review expanded 20 basis points (bps) to 78.8%. According to management, this improvement in gross margin can be attributed to improved efficiencies in hereditary cancer business and GeneSight laboratories.

Operating expenses rose 27% to $140.9 million owing to a 33.7% rise in selling, general and administrative (SG&A) expenses to $122.1 million. Research and development (R&D) expenses, however, declined 3.6% (to $18.8 million) in the reported quarter. Overall, operating margin contracted a stupendous 1060 bps to 8.5%.

Financial Position

Myriad Genetics exited fiscal 2017 with cash, cash equivalents and marketable securities of $150.7 million, compared with $159 million at the end of fiscal 2016. At the end of fiscal 2017, cash flow from operations totaled $106.2 million, down 36.1% from the year-ago comparable period. Consequently, free cash flow grossed $110.8 million, compared with $161.3 million in fiscal 2016.

Guidance

Myriad Genetics has provided guidance for fiscal 2018. The company currently expects revenues in the range of $750–$770 million. The Zacks Consensus Estimate of $791.2 million lies above the guided range.

On the bottom-line front, the company expects to generate adjusted EPS in the range of $1.00–$1.05. The current Zacks Consensus Estimate of $1.07 is higher than the company’s guidance.

Management has provided its outlook for the first quarter of fiscal 2018. The company estimates adjusted earnings per share of 19–21 cents on total revenue of $181–$183 million. The Zacks Consensus Estimate for adjusted EPS of 24 cents and revenues of $191.3 million exceeds the company’s guided range.

Our View

Myriad Genetics ended fiscal 2017 on a solid note, with its fourth-quarter numbers exceeding the Zacks Consensus Estimate. Thecompany particularly observed strong growth in both EndoPredict and GeneSight testing revenues along with a sequential rise in hereditary cancer volumes.

On the flip side,unfavorable foreign currency translation continues to pose a threat for the company. With a considerable portion of its revenues coming from outside the U.S, the company faces the risk of exchange rate fluctuations. Additionally, macroeconomic uncertainty and higher expenses owing to extensive pipeline of some testsmay impact the company’s margins.

Zacks Rank & Other Key Picks

Myriad Genetics has a Zacks Rank #2 (Buy). A few other top-ranked medical stocks are Edwards Lifesciences Corporation (NYSE:EW) , INSYS Therapeutics, Inc. (NASDAQ:INSY) and Align Technology, Inc. (NASDAQ:ALGN) . Notably, Edwards Lifesciences, INSYS Therapeutics and Align Technology sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

INSYS Therapeutics has a long-term expected earnings growth rate of 20%. The stock posted a stellar four-quarter average earnings surprise of 60.7%.

Align Technology has an expected long-term adjusted earnings growth of almost 26.6%. The stock has added roughly 26.7% over the last three months.

Edwards Lifesciences has a long-term expected earnings growth rate of 15.2%. The stock has gained around 5% over the last three months.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Insys Therapeutics, Inc. (INSY): Free Stock Analysis Report

Myriad Genetics, Inc. (MYGN): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

Original post

Zacks Investment Research