Mylan N.V. (NASDAQ:MYL) is a global pharmaceutical company with a well-established generics business as well as a presence in specialty pharmaceuticals. The company’s business model includes the development, manufacturing and marketing of branded and generic drugs as well as active pharmaceutical ingredients (APIs) in North America, Europe and Rest of World. Notably, Mylan has one of the world’s largest API operations.

Mylan has been making prudent acquisitions and inking strategic deals to drive long-term growth. In Feb 2015, the company acquired Abbott Laboratories’ non-U.S. developed markets’ specialty and branded generics business. Further, in Nov 2015, it acquired certain female health care businesses of Famy Care.

However, Mylan has been under immense pressure since Aug 2016 when the company faced criticism for the price increase of EpiPen since its acquisition of the drug in 2007 from lawmakers, consumers and the common people alike.

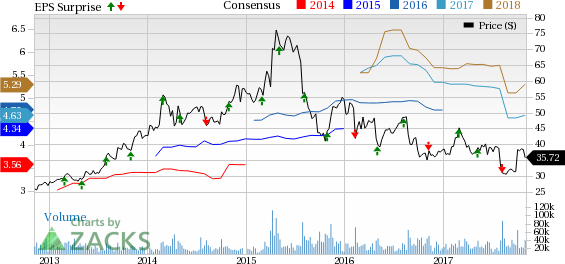

Mylan’s performance has been mixed so far, having beaten earnings estimates in two of the trailing four quarters and missing in the other two. Overall, it has delivered an average negative surprise of 0.59%.

Currently, Mylan has a Zacks Rank #2 (Buy), but that could definitely change following the company’s earnings report which was just released. We have highlighted some of the key stats from this just-revealed announcement below:

Earnings: Mylan missed on earnings. Our consensus called for EPS of $1.22, and the company reported EPS of $1.10.

Revenue: Revenues too missed expectations. Mylan posted revenues of $3 billion, compared to our consensus estimate of $3.08 billion.

Key Stats: Challenges in North America continue to impact performance. During the quarter, the company also witnessed accelerated deceleration of EpiPen sales - both from the launch of an authorized generic as well as the contraction of the overall epinephrine auto-injector market.

Pre-Market Trading: Shares are trading down in pre-market trading.

Check back later for our full write up on this Mylan earnings report later!

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Mylan N.V. (MYL): Free Stock Analysis Report

Original post

Zacks Investment Research