Mylan N.V. (NASDAQ:MYL) and Japan-based Otsuka Pharmaceutical signed a license agreementto commercialize Deltyba (delamanid) in low- and middle-income countries, including South Africa and India. The drug is approved for treatment of pulmonary multidrug-resistant tuberculosis (MDR-TB) in adults.

Deltyba was developed and is currently marketed by Otsuka.

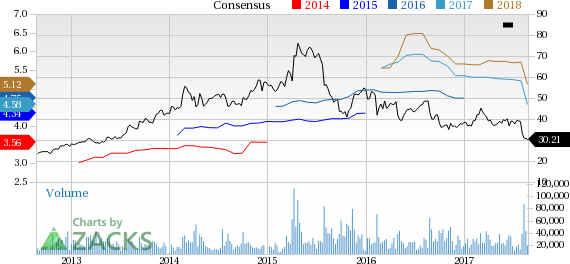

Mylan’s shares have underperformed the industry so far this year. The company has lost 20.8% while the industry lost 19.9% in that period.

Per the agreement, Otsuka granted exclusive license to Mylan to prioritize access to Deltyb in South Africa and India. The agreement also allows both the companies to initiate a technology transfer plan to enable Mylan to manufacture and distribute Deltyba in additional countries where Otsuka may expand its commercial presence.

However, no financial terms were discussed in the release.

Deltyba was studied in a phase II trial for around 33 months in combination with a World Health Organization (WHO) recommended optimized background regimen (OBR). The data from the study showed statistically significant over placebo. Moreover, Deltyba also lowered mortality rate in patients when administered for at least six months. Data from the phase III study is expected in 2018.

As per WHO, South Africa and India are among the highest-burden countries for MDR-TB and TB/HIV co-infection. It is estimated that more there were more than 150,000-plus new cases of MDR-TB/rifampicin-resistant TB in 2015 in these countries.

Deltyba has been approved by Drug Controller General of India and the registration process is underway in South Africa.

Deltyba is approved in EU, Japan, the Republic of Korea, Hong Kong, Turkey and India. Successful commercialization of the drug in these countries and other countries upon receiving approval will help Mylan in the long run.

However, Mylan is facing a tough year. Ongoing challenges in the U.S. and uncertain regulatory environment in the region has led the company to defer all major launches in the country. It has also lowered its annual guidance for 2017.

Moreover, the FDA issued a complete response letter to Mylan’s abbreviated new drug application (ANDA) for the generic version of GlaxoSmithKline's (NYSE:GSK) Advair earlier this year while accepting Sandoz's ANDA for the same. The potential approval of Sandoz’s, a subsidiary of Novartis AG (NYSE:NVS) , ANDA will hurt Mylan. Also, in Apr 2017, Mylan received a warning letter from the FDA for its manufacturing facility in India.

Zacks Rank & Stock to Consider

Mylan has a Zacks Rank #5 (Strong Sell).

A better-ranked stock in the pharma sector is Corcept Therapeutics Incorporated (NASDAQ:CORT) , which carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Corcept’s earnings estimates increased from 26 cents to 42 cents for 2017 and from 49 cents to 70 cents for 2018 over the last 30 days. The company delivered an average earnings beat of 29.17% in the four trailing quarters. The stock is up 98.8% so far this year.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

Novartis AG (NVS): Free Stock Analysis Report

GlaxoSmithKline PLC (GSK): Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT): Free Stock Analysis Report

Mylan N.V. (MYL): Free Stock Analysis Report

Original post

Zacks Investment Research