Mylan N.V. (NASDAQ:MYL) and partner, Biocon Ltd. announced that the FDA Oncologic Drugs Advisory Committee (ODAC) unanimously recommended approval of its biosimilarversion of Roche’s (OTC:RHHBY) breast cancer drug Herceptin (trastuzumab).

In fact, the FDA’s ODAC voted 16 to 0 in favor of biosimilar candidate, which has been developed to treat HER2-positive breast cancer that is a more aggressive form of the disease.

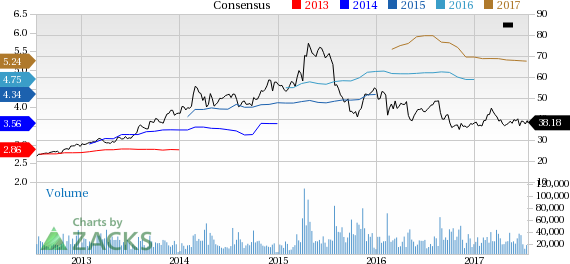

Notably, shares of Mylan inched up about 0.41% following the news release. However, the company has outperformed the Zacks categorized Medical-Generic Drugs industry in the year so far, with the stock gaining 2.8% against the industry’s decline of 0.3%.

Meanwhile, the data presented to ODAC included results that showed that the proposed biosimilar trastuzumab is highly similar to Herceptin, in line with the FDA’s assessment provided in the pre-meeting briefing documents. Per ODAC, there is no clinically meaningful difference between Mylan’s biosimilar candidate and Herceptin in terms of safety, purity and potency.

Biosimilar trastuzumab is also under review by regulatory authorities in Australia, Canada, Europe and several emerging markets.

While this is good news for Mylan, it is a blow for Roche because Herceptin is one of its key drugs. Last week, another biosimilar of Roche was put under review by the ODAC. Amgen (NASDAQ:AMGN) and its partner, Allergan plc. (NYSE:AGN) announced that the supplemental biologics license application (sBLA) for its candidate, ABP 215, a biosimilar to Roche’s another cancer drug Avastin, will also be reviewed by ODAC.

Both Herceptin and AVastin are key drugs for Roche and biosimiar versions of these drugs, once approved, will hurt the sales of the drugs.

Zacks Rank

Mylan currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

Allergan PLC. (AGN): Free Stock Analysis Report

Amgen Inc. (AMGN): Free Stock Analysis Report

Mylan N.V. (MYL): Free Stock Analysis Report

Original post

Zacks Investment Research