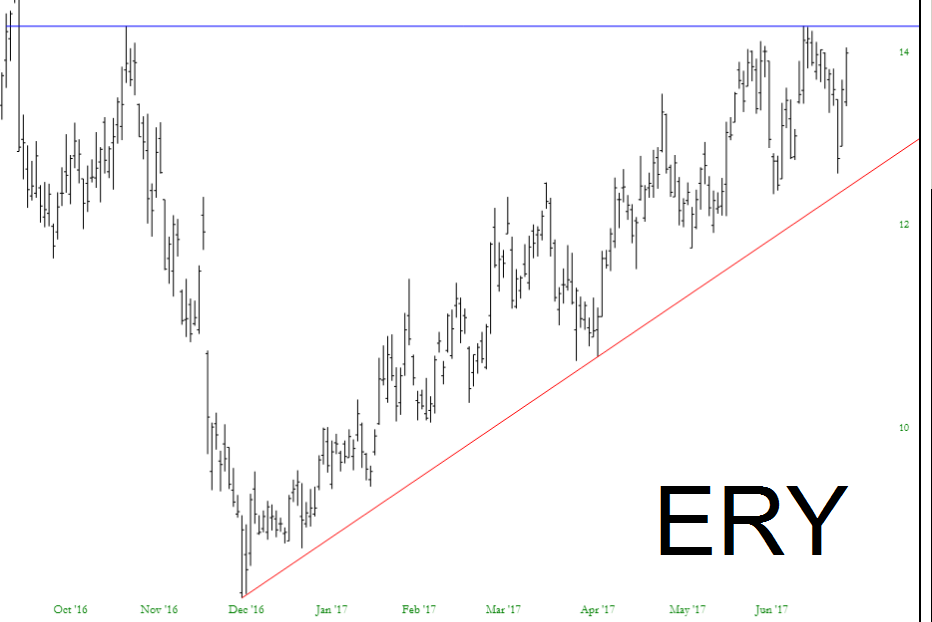

I have three positions, all of them profitable. They are all longs but they are ultrashorts, which means I am cursing the bulls. In spite of being near lifetime highs in equities, my positions are surging.

First is ERY, the triple bearish-on-energy, which is benefitting from crude’s resumed fall; a crucial breakout is represented by the horizontal:

There’s also triple-bearish-on-junior-miners (NYSE:JDST), which I believe has the greatest potential percentage gains of any of these three. This could be just the beginning of something much larger:

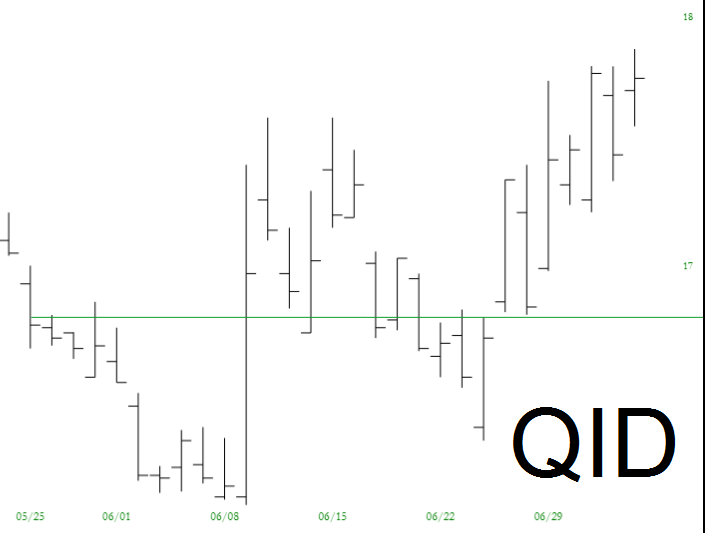

Finally, there's ultrashort-on-Nasdaq (NYSE:QID), which I feel is most vulnerable right now, but obviously I have tight stops on all three of these positions, so I’ll just take the risk:

I’m particularly excited about gold — which, in my regular portfolio, is my largest short position.