Do you know how much money you need to retire?

If you’re like most folks, you might think the answer is “too much,” and for good reason. It seems like every day we hear another study or pundit saying we need millions to do so comfortably.

That’s why I was surprised to see a new study from NetCredit, an online money lender, saying most people would need less than a million dollars to retire. In fact, the company said it’s possible to clock out on just $702,330 in the US as a whole, and in some states even less—like about $470,000 in Mississippi.

These numbers are a lot more encouraging than what we usually hear, but do they add up? Let’s take a look.

NetCredit gets its data from Numbeo.com, which is crowd-sourced, so its data may not be entirely representative of the average person’s reality. But it’s not completely off base, either.

The bigger potential problem is NetCredit’s method of crunching Numbeo’s numbers. NetCredit took the average life expectancy of 76.2 years and a retirement age of 61, then multiplied the average middle-class income in the area by the difference—of 15.2 years. So, for instance, it costs $701,000 a year to retire in Oregon because the average Oregonian spends $46,310 per person per year.

The issue here is that if you live longer than 76.2 years, you risk outliving your money. The same goes if you suffer investment losses—or decide to retire earlier.

Luckily, we can do better.

CEFs Could Let You Retire Anywhere on $470,000

If NetCredit says we can retire in Mississippi on $470,000, I agree. But I also think you can retire anywhere in the US on that amount. Doing so starts with buying my favorite high-yield vehicles: closed-end funds (CEFs), which can pay us not one but three ways:

- With their high dividend payouts: These funds yield 7% today, and many yield much more. The three we’ll discuss in a moment yield 11.8% on average.

- Through portfolio gains: CEFs hold stocks, bonds, real estate investment trusts (REITs) and an array of other investments, just like mutual funds and ETFs do. They also trade on public markets, just like stocks.

- Their disappearing discounts to net asset value (NAV): The discount to NAV, or the gap between the fund’s market price and its per-share portfolio value, is unique to CEFs. Buy when the discount is unusually wide and you could “ride along” as it shrinks, propelling the share price higher as it does.

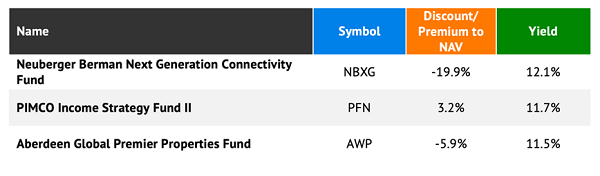

With that in mind, let’s move on to the three-CEF retirement portfolio I want to show you today:

As you can see above, all three of these funds boast high yields, with an 11.8% average payout between them. And you’re getting attractive valuations here, too, with two of our fund's sporting deep discounts to NAV and only one, PFN, with a premium (albeit a slight one).

You’re also getting some strong diversification, with Neuberger Berman Next Generation Connectivity Fund Inc (NYSE:NBXG), as the name suggests, focusing on networking companies like Analog Devices (NASDAQ:ADI), Nvidia Corp. (NASDAQ:NVDA), and Palo Alto Networks (NASDAQ:PANW). PFN, for its part, holds corporate bonds issued by quality companies like Nissan (OTC:NSANY), Ford, Albertsons, and Northwestern (NASDAQ:NWE) Bell. Finally, AWP holds a diverse collection of REITs, such as warehouse owner Prologis (NYSE:PLD), data-center operator Equinix (NASDAQ:EQIX), and Mid-America Apartment Communities (NYSE:MAA).

Moreover, all three are professionally run by firms with billions (or in PIMCO’s case trillions) of dollars in assets under management, plus deep connections in their industries.

Then there’s the dividend story.

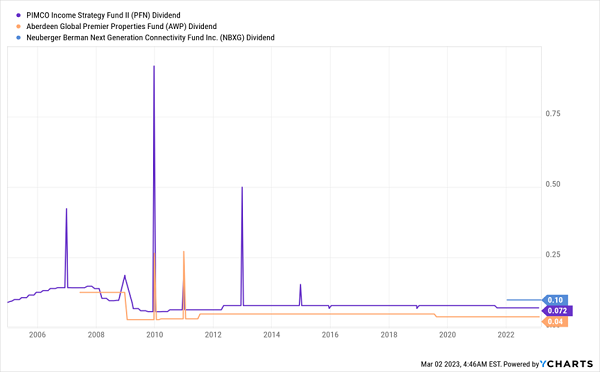

A Long History of Steady Payouts (With the Odd Special Dividend, Too)

While NBXG, whose payout is shown in blue above, is a new fund (launched a year ago), Abrdn Global Premier Properties Fund (NYSE:AWP) and Pimco Income Strategy II Closed Fund (NYSE:PFN) have histories of stable payouts going back more than a decade. Plus, as you can see from the spikes and notches in the lines above, these funds pay out some healthy special dividends from time to time, too.

The kicker? Each of these funds pays dividends monthly. So we don’t even have to worry about managing our income stream as we would with quarterly payers. Our dividends simply drop into our accounts right in line with our bills.

The bottom line here is that you could put $470K into these funds and get $4,621 per month in dividends. I’ll admit, that’s not exactly the $4,911 per month NetCredit says you need to have a comfortable retirement in Hawaii, but it’s pretty close!

More importantly, you could collect your payouts without having to touch your principal. In other words, you could live off of your $470K of savings not just for 15 years, but for many decades as these funds payout.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."