Let me show you 3 headlines I ran across last week:

“Tax Cuts and Confidence Drive Surge of Payouts”

—Barron’s“Global Dividends Break New Record in 2017, With More to Come for the Year Ahead”

—Institutional Asset Manager“Trump’s Tax Cuts in Hand, Companies Spend More on Themselves Than Wages”

—New York Times

What do they have in common?

They’re all blaring out the fact that American companies have so much cash that they can’t ship it out to investors fast enough! Funny thing is, the herd is completely ignoring this fact. Check this out:

The Black Sheep …

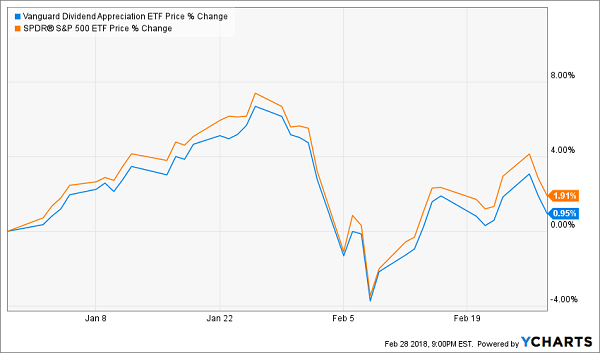

We’re looking at the performance of the Vanguard Dividend Appreciation (NYSE:VIG), a good benchmark for stocks that consistently grow their dividend payouts, compared to the benchmark SPDR S&P 500 ETF (NYSE:SPY) as of March 1.

It may not seem like much of a gap on this chart, but SPY’s gain was double that of VIG since January 1. Why? Because like a bird mesmerized by its own reflection, the masses can’t look away from this:

… Meets the Belle of the Ball

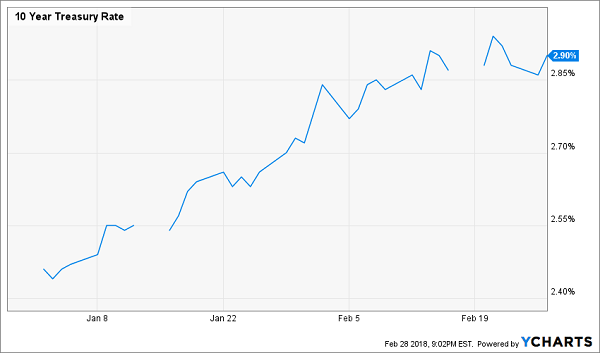

I’m sure I don’t have to tell you that interest rates have soared so far this year, with the yield on the 10-Year Treasury Note sitting just under 3%.

Result? Some folks are pondering moving away from dividend growers and into these so-called “safe” investments.

That’s a huge mistake. Because they’re forgetting the one thing people always overlook: inflation!

In January, it was running around 2.1%. Chop that out of the so-called “high” 10-Year Treasury yield, and you’re left with a pathetic 0.8%. Suddenly that “safe” 2.9% yield on the 10-Year doesn’t look so safe anymore, does it?

Our Opportunity Arrives

Funny thing is, the crowd is heading for the exits just as the band is getting warmed up: according to asset-management firm Janus Henderson, dividends surged 7.7% last year, to a record $1.3 trillion, with more gains ahead this year, thanks to strong earnings and tax reform in the US.

The takeaway: it’s only a matter of time before the herd realizes its mistake and piles back into stocks paying 5%+ dividends and/or growing their payouts at double-digit rates.

Let’s beat them to the punch with the 3 names I’ll show you below. All of them are doing two crucial things that, when taken together, set you up for a soaring income stream and quick triple-digit share-price gains:

- Pay “accelerating” dividends: When your stocks drop ever-growing dividend hikes every year, you won’t have to worry about inflation, like our beleaguered fixed-income investor does.A bonus? A rising dividend puts a 100% predictable lift under share prices, as I’ll show you with Royal Caribbean Cruises Ltd (NYSE:RCL) below.

- Buy back shares: With soaring earnings and an extra kick from tax reform, many companies (including the 3 below) are buying up their own stock, boosting earnings per share—and share prices—as they do.

So let’s move on to our 3 buys, starting with…

IR: A “Boring” Stock With “Locked in” Double-Digit Growth

Ingersoll-Rand (IR) is as unsexy a stock as you’ll find. The 145-year-old company makes air compressors, heating and cooling systems, pumps and golf carts.

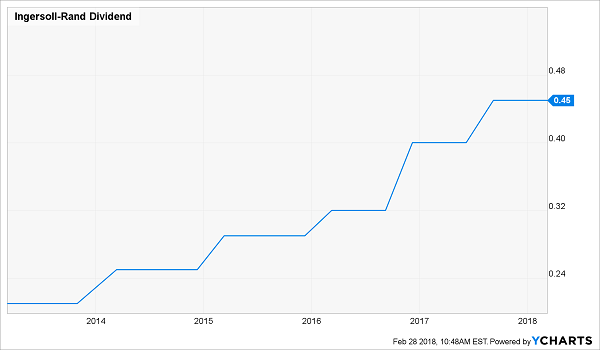

The 2.1% dividend yield might also make your eyes glaze over, but don’t be fooled: management has more than doubled the payout in just the past five years.

A Dividend Double

There’s a lot more where that came from, thanks to the company’s surging revenue (up 10% in the fourth quarter) and adjusted earnings per share (EPS; up 21%).

IR’s ace in the hole is its dominant Trane and American Standard heating and air-conditioning brands. All told, the company’s HVAC segment chips in an outsized 76% of sales, and it’s red hot, with revenue up 8% in Q4.

Surging construction across the globe is keeping IR’s furnace factories humming, while more homeowners trade up to more efficient models. You can see that in IR’s new bookings, which spiked 10% in Q4.

No wonder the Street sees a 15% EPS gain this year. That, plus IR’s low payout ratio—just 33% of free cash flow (FCF) and earnings has gone out as dividends in the last 12 months—makes another big dividend hike a lock as soon as August.

Oh, and you can grab IR cheap, at just 16.5-times forward earnings, a five-year low. That disconnect between IR’s growth potential and sunken P/E simply can’t last.

RCL: Payout Growth Will Go On

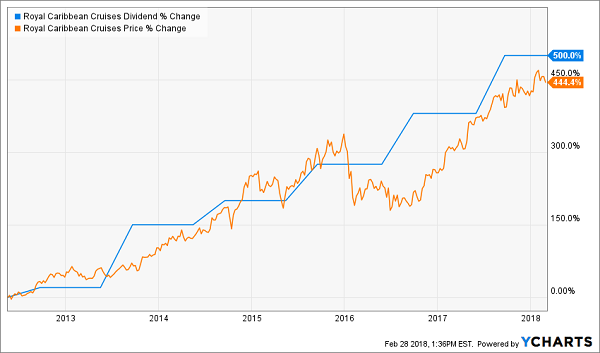

Royal Caribbean Cruise Lines (RCL) is a perfect illustration of the price-lifting power of a soaring dividend payout. Take a look at this chart—the pattern is clear:

Dividend Fills RCL’s Sails

Ever since RCL started cranking up its dividend in earnest in early 2012, the share price has risen almost in lockstep!

That’s no coincidence—I’ve seen this pattern in dozens of dividend stocks. In fact, the correlation is usually a lot closer, so the fact that the share price is “only” up 444% in that time, compared to a 500% jump in the dividend, tells me that we have a lot more upside to come!

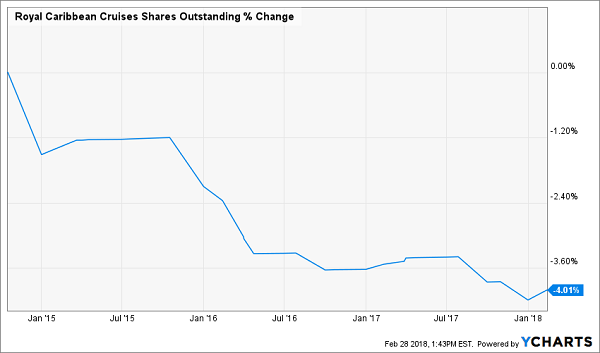

RCL’s management agrees. They’ve been jumping on the cruise line’s ridiculously cheap valuation (just 13.8-times forecast EPS) to snap up its stock since late 2014:

Management Buys Cheap

Before I move on from dividends, here’s what a 500% payout jump means to you: the stock yields just 1.9% as I write, but if you’d bought back in February 2012—just six years ago—you’d be yielding an incredible 9.8% on your original buy today!

As with Ingersoll-Rand, the ridiculous mismatch between Royal Caribbean’s growth and current valuation is one reason why it should be on your list.

Here are two more:

- More dividend growth ahead: RCL pays out a ridiculously low 18.9% of FCF as dividends and only 27% of earnings. That means it could double its payout tomorrow and still be at or below my roughly 50% “safe zone”!

- Big profits in ’18: Carnival (LON:CCL) says it has more bookings on the slate for 2018 than it did last year, when bookings hit record highs, thanks to flush clients in the US and Europe. For 2018, it’s calling for adjusted EPS of $8.55 to $8.75, with the midpoint up 15% from 2017.

Now let’s move on to…

ETN: Catch the Street Napping

Eaton Corporation PLC (NYSE:ETN) announced a mammoth 10% dividend hike on investors last week—doubling the 5% increase the maker of engines, controls and hydraulic systems rolled out last year.

The rise was enough to push the stock’s yield up from 2.9%, based on the old quarterly payout, to 3.3% on a forward basis—a 14% shift!

The Street’s response? The stock dropped 1.5% on the day.

But that will change as the size of the hike sinks in and investors bite, driving the share price up and bringing the yield back toward the 3% it’s averaged over the last five years (because you calculate yield by dividing the payout into the current share price).

“Stuck” Yield Masks Strong Payout Growth

This phenomenon, by the way, is precisely why your favorite dividend-paying stock always seems to yield the same, even after a string of payout hikes like Eaton has brought in (the payout’s up 43% since 2013).

But the Street is sometimes a little slow to catch on, creating a nice—if short—buying opportunity.

Of course, that’s not the only reason to like Eaton: the company also saw strong gains across its segments (electrical products, electrical systems and services, hydraulics, aerospace and vehicles) in Q4, driving a 7% rise in the top line and a 15% rise in adjusted EPS.

For 2018, ETN is calling for a 10% jump in EPS over 2017. That, plus its easily manageable payout ratio (56% of FCF and 27% of earnings) sets it up for another double-digit payout hike a year from now.

7 More “Rising-Rate Buys” to DOUBLE Your Money Fast!

Eaton, Ingersoll-Rand PLC (NYSE:IR) and Royal Caribbean are just the start—I’ve uncovered 7 more “hidden yield” stocks just like these poised to DOUBLE your money every six years (or less) while TRIPLING your retirement income.

Here’s a glance at just 3 of the 7 dividend-growth plays I’ll reveal when you click here:

- The “boring” company that’s cashing in on Chinese water demand. This is one is even more boring than Ingersoll-Rand (if you can believe it)! It makes the humble water heater, an appliance you only notice when it breaks down. But its dividend hikes are anything but subtle: the payout has soared 167% in just 4 years! And there are far bigger hikes ahead!

- The 800% Dividend Grower. This unsung company has boosted its dividend eightfold since a new management team took over 4 years ago! This stock is a complete no-brainer for anyone looking to get bigger and bigger dividend checks from here out.

- A “double threat” income-and-growth stock that rose more than 252% the last time it was anywhere near as cheap as it is now!

- PLUS 4 more off-the-radar dividend growers that are flashing “buy” now!

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."