Before we get into the 2014 picks, below are the 2012 and 2013 picks with their associated review posts.

2012 picks – 2012 review

2013 picks – 2013 review

To recap, we returned 20% in 2012 and over 80% in 2013, crushing the market both years, beta adjusted.

As a small caveat regarding my 10 stock picks for the year. Nowhere outside of these yearly posts would I ever pick a single stock under the assumption that you must hold it the entire year, that’s just insane. The only risk management involved in these picks is an understanding of the cyclical phase I believe the broader market is in, and broader secular trends within different industries. If I felt the market as a whole was going to suck in 2014, you would not see high beta names on this list. While I think it’s a flawed exercise to judge the portfolio as a whole at the end of the year given the extremely arbitrary 10 stocks and 1 year holding period, if you really want to do that, the returns should be measured beta adjusted against the S&P 500 as a relative return strategy.

While it’s relatively self evident what my strategy is given the picks on this list, just to be clear, I am a momentum trader. I look for high growth names that have the opportunity to return at least 50% each year. This means that while I think XOM is a strong pick this year, it an’t going up 50%, hence it’s not making the list. Some of the attributes that I look for include: accelerating revenue growth, early stage companies that are about to start growing EPS after just focusing on revenues, strong technical patters and relative strength, new innovative products, large secular trends in their industry, and stocks that are not yet owned by a ton of institutions but have the ability to become cult stocks in the coming year. At the end of the day it’s all just numbers and letters, the only thing that matters to price is whether more people want to own the stock now than they did yesterday.

I also want to briefly thank my intern Alex Zhong for his help on the research side for this year’s picks. Alex is currently a sophomore at NYU and has a bright future ahead of him. Just please don’t let him become an investment banker, someone please hire him for an analyst position at a fund so that his work ethic, extremely polite attitude, and talent do not go to waste.

So here are your top trends and picks for 2014:

Because most people don’t actually know what Bitcoin US Dollar, (BTC/USD) is at a fundamental level, how it actually works, they miss the true innovation of the protocol itself. 2014 is going to be all about the Bitcoin protocol as a means for verifying everything via the blockchain. Yes, the price of Bitcoin will most likely surge as well, my guess is as good as anyone else’s as to how high, but I would not be surprised to see $10,000 by the end of 2014. Look for dozens of startups which use the Bitcoin protocol to be funded by VCs and for many of them to succeed in beginning to replace older institutions. The other day I saw a startup which is trying to build a new way of voting online by verifying with the blockchain, it’s genius. This protocol will revolutionize so many things, and this is the year that you will see and hear all about it. Use the private market valuation of Coinbase as your privately tradable asset.

It took a while for International Business Machines, (IBM) to get its act together, because it’s IBM and it operates on a completely different timeframe than anyone else. The company which is headquartered literally down the block from where I grew up in Chappaqua, NY, made huge strides this year in commercializing their Watson analytics engine. But the real promise of Watson is not what they can do with it, it is what everyone else can do with it. Finally towards the end of the year IBM opened the Watson API to third party developers, in a limited way. This sets the ground for 2014 to be the year in which developers get their hands on the amazing Watson engine and build a host of amazing apps with their intelligence layer. Don’t sleep on how important this advance is, and how long it took for IBM to get this into everyone’s hands. Will the market give IBM the credit it deserves this year in terms of a rising multiple, maybe, maybe not, that’s a tough one to call, but if a few apps built with Watson get out there and become popular which I think they will, yes you will see IBM’s stock benefit.

The food service industry will be reshaped head to toe in 2014. It’s been many years in the making, with fits and starts, but it feels as if 2014 will be the year when it really happens. We already have Seamless, Grubhub, Yelp Inc, (YELP), and OpenTable Inc, (OPEN), but we’re about to see the next big wave which is going to connect everything. You’re going to see a wave of iPads hit restaurant tables and replace waiters, variable pricing models for high traffic restaurants, people cooking meals in their homes for each other, chefs that will cook meals in your home for your party on demand, and much easier ways to buy fresh produce and meat. There is so much waste in our food system right now that will be taken out with better logistics, collaborative consumption, and verticalized remnant labor apps. This is the year. Use the private market valuation of Blue Apron as your privately tradable asset.

And now for the 10 stock picks…

HomeAway (AWAY) – Rising EPS and Revenue estimates, check. History of beating expectations, check. Accelerating revenue growth and the ability to turn on the EPS spigot, check. Great chart that is set to take out the IPO highs and increasing institutional involvement in the stock, check. But the real reason I’m picking AWAY this year is due to the incredible momentum shown by Airbnb and my belief that they will be coming public sometime towards the end of 2014 at greater than $10B valuation. One great strategy that I’ve employed many times is to buy the publicly traded company that is in the same industry as the even better private company that will soon IPO. Why? Because investors use the public company as a proxy, and the IPO of the better company naturally draws attention and capital to the public one. The major secular trend here is in collaborative consumption and it is huge. I like Airbnb 1,000,000 times more than AWAY as a trade, but AWAY should continue to put up great numbers and see great returns in 2014.

Bitauto (BITA) – For the second straight year I’m going with BITA. It returned us over 300% in 2013, and is still just a $1.2B market cap. As it always does, liquidity has followed price and funds are just beginning to jump in as the stock meets certain thresholds that the big boys need to see before putting capital to work. That should add up to another huge year. Instead of rewriting the theses, I’m just going to copy paste the exact text from last year, because it still applies.

China is making a monumental mistake in encouraging the growth of its domestic auto market. They had the opportunity to build cities from scratch that didn’t rely on fossil fuels for transportation. While central planning does cut through red tape and allow for the quick implementation of economic strategy, it also opens you up to huge errors. Bitauto is one huge way to take advantage of this error. The company provides a web site that allows Chinese to get transparency on auto pricing. This is a huge theme of mine, where there is the opportunity for more pricing transparency it will take place eventually. The Chinese are buying autos hand over fist and this site will be widely used.

The company had its IPO in 2010 and hasn’t fared well since as all things China, especially on the internet have been thrown out with the bathwater. This one has a real business behind it and has been growing revenue consistently at around 60% YOY for the last 8 quarters and is well profitable now. At a $300M market cap and trading 16X earnings it’s not richly priced. (still not richly priced after last year).

WisdomTree Investments (WETF) – I’m not sure people respect how many small asset management firms out there are simply running so called “smart beta” strategies and charging 2% of AUM to their clients each year. It’s soooooooo many. Hell, that’s basically what most large mutual funds are as well. While WETF is not the leader in this category, I like how it is currently positioned to take advantage of what is going to be a massive trend towards using these “smart beta” ETFs instead of having your individual manager run the screens and pick the stocks themselves. These guys are going to suck up a ton of assets this year, which is the basis for the growth of the business, hence why I’m picking it. At a $2.3B market cap it is about 1/9 of the size of Invesco which is the leader in the industry. I also like the massive volume that has come into the stock in the last few months, funds are getting behind it, and that’s what you like to see at the beginning of a big trend.

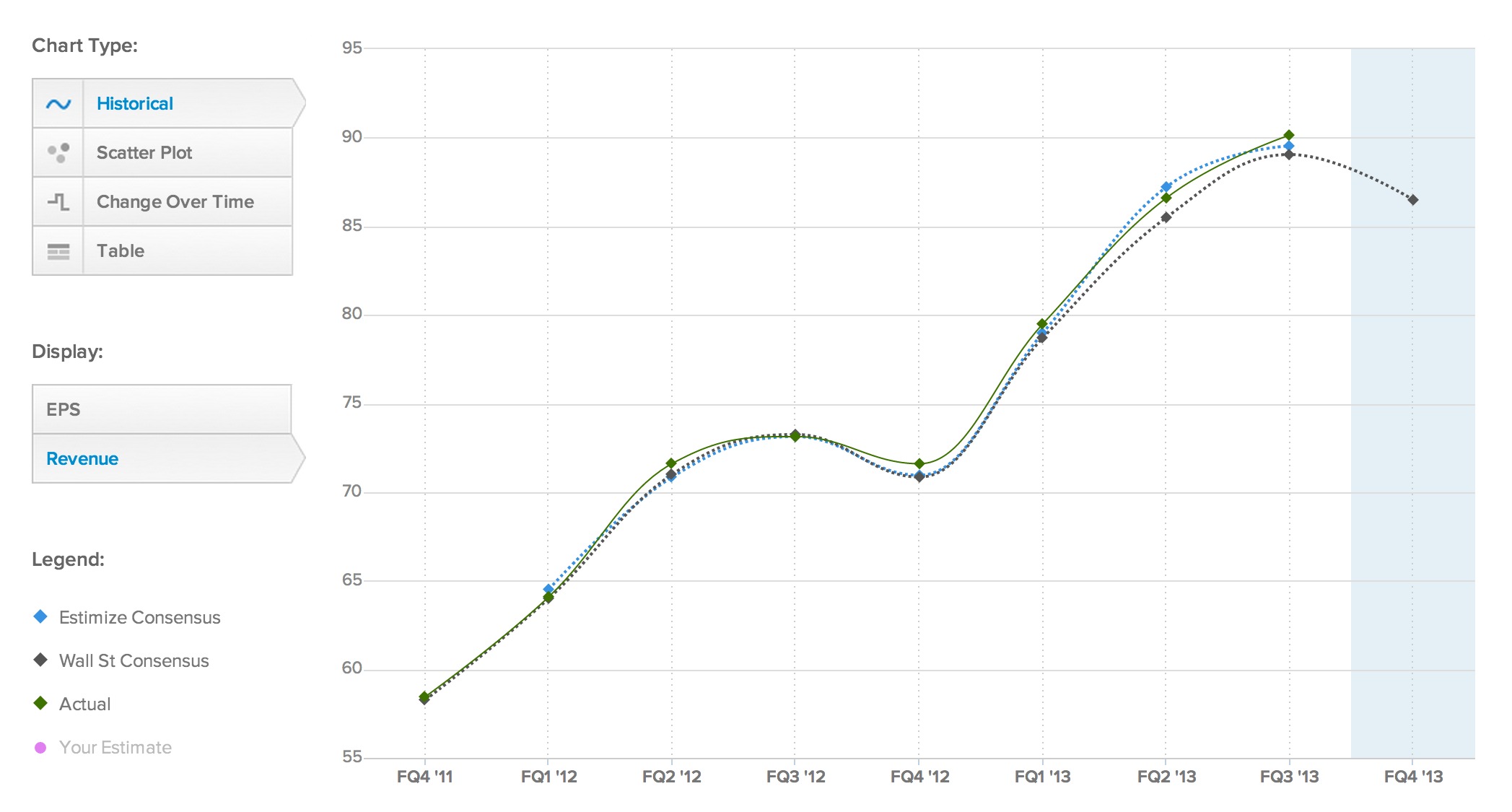

Align Technology (ALGN) – This is a stock that I had on the short list last year but didn’t pick. I was a bit concerned with some very tough comps that ALGN was up against in the first half of the year. Well, they obviously handled those well, and the stock was up over 100% in 2013. I like the cyclical trend of people fixing their teeth as the economy improves and people have more disposable income. I also like ALGN’s technology. But mostly I just love the growth numbers and the way the chart sets up. Specifically the way the stock has handled the big breakaway gap from October on huge volume. It’s consolidated well and I feel it should provide a huge base for the next big leg up. Those breakaway gaps are often signs of much more to come. They have also crushed accelerating revenue estimates the last 4 quarters.

PGT Inc. (PGTI) – Some of you may look at this pick and be a little perplexed as PGTI does not come from an industry which I would normally place a big bet on. It’s really the sum of the parts with this trade that add up to something that could really surprise a lot of people this year. Let’s go through the list. For beginners, revenue acceleration has gone from nothing to 45% over the last 4 quarters. The company windows and doors which fits with my home renovation thesis of 2014. With interest rates rising you are going to see less people move and more people renovate their homes, especially to make them more energy efficient. PGTI came public at the height of the housing boom in 2006 at around $14 a share and went straight down from there trading below $1 in 2009. The fundamentals of the company are incredibly strong and the stock has made its way all the way back. And over the last 6 months the chart has been chewing through all of that major resistance from the IPO price. Just take a look at that massive volume that’s come in. My bet is that early in 2014 the market chews through the last of the resistance and off goes the stock. For a company growing revenues at 45% YOY it only trades at 26 times earnings, that’s not rich enough. Management owns 71% of the company and there still aren’t that many funds in this one. This thing is like a loaded gun, look for a huge breakaway gap that gets it going.

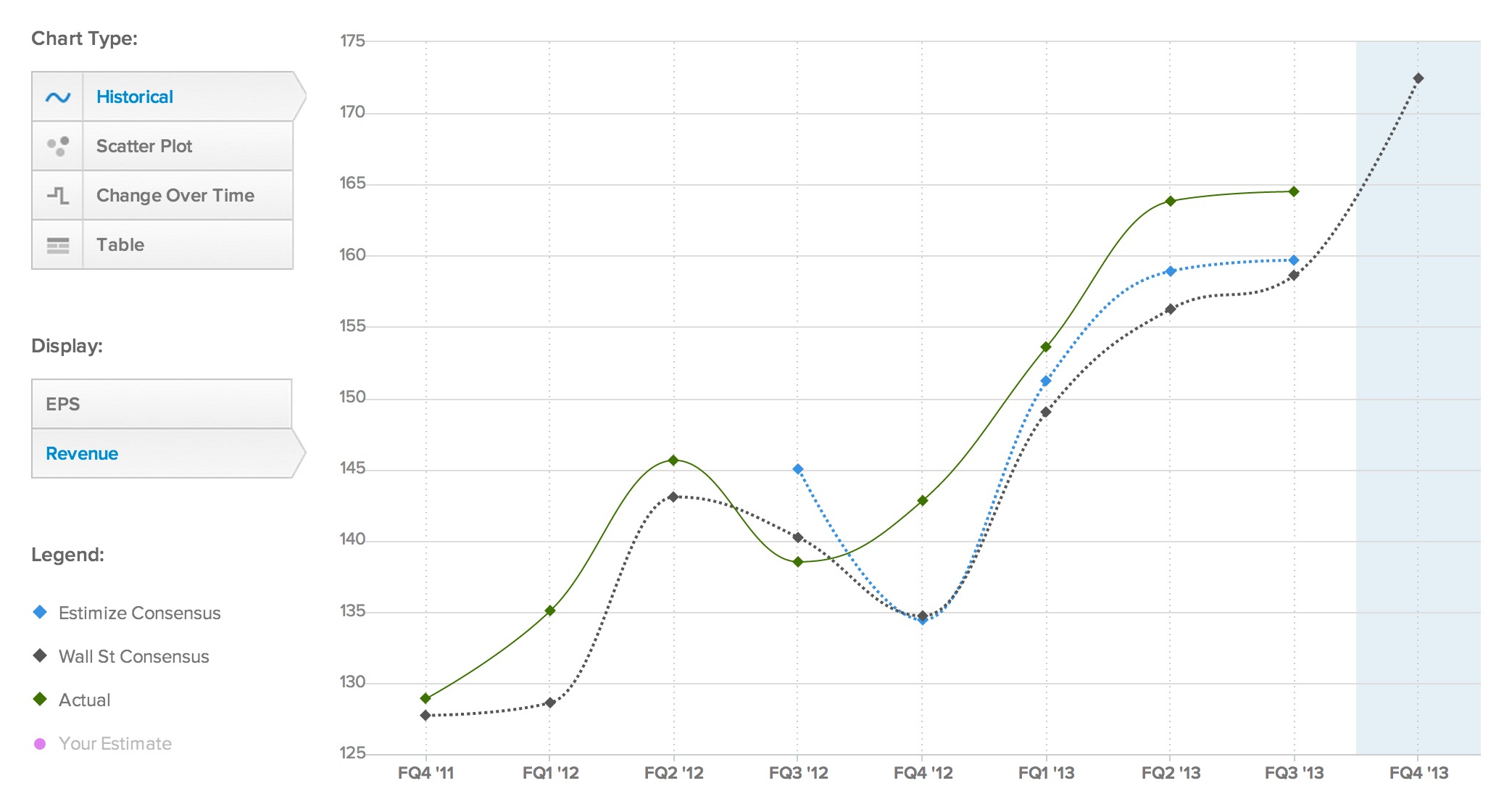

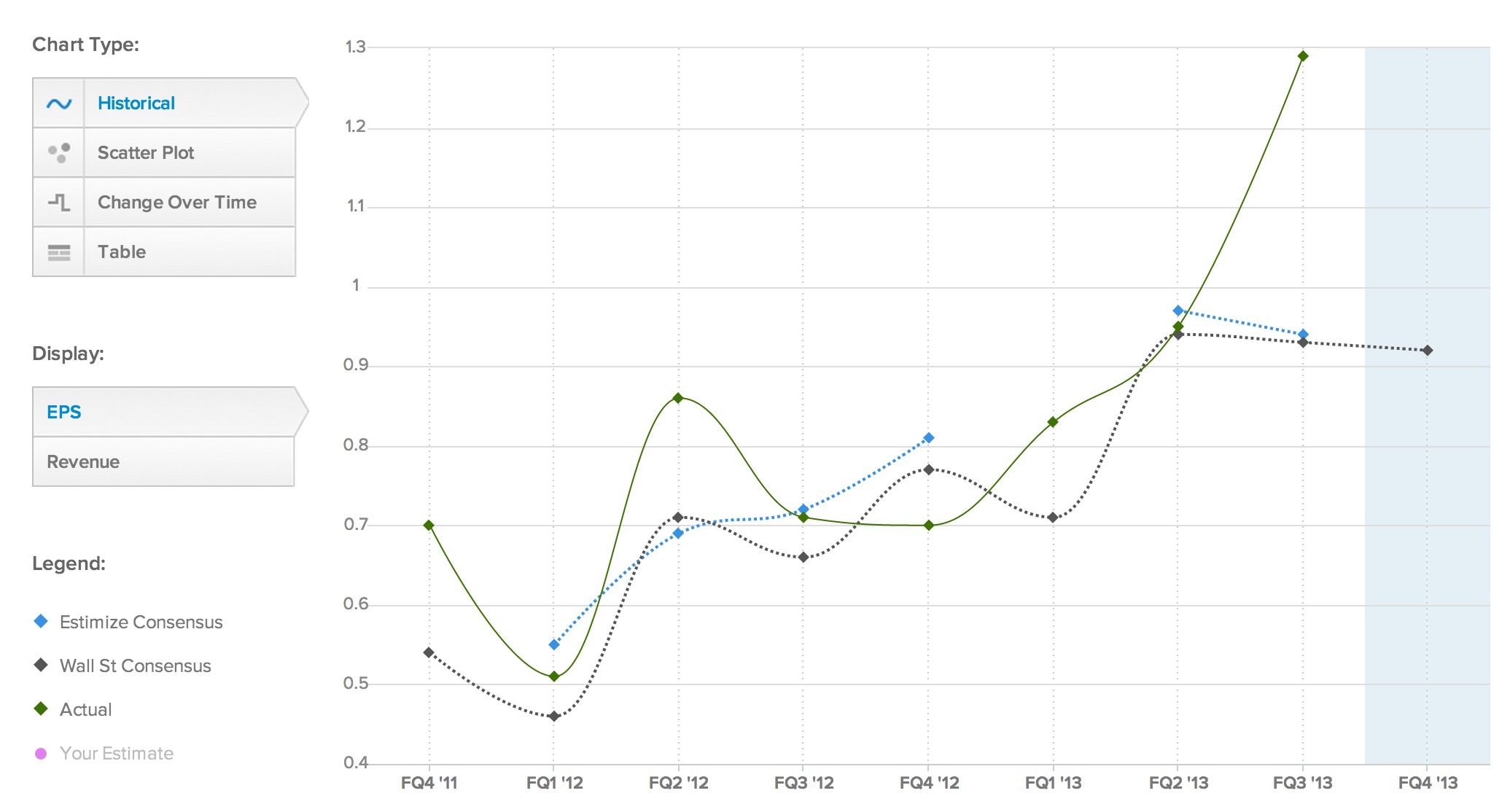

Athenahealth (ATHN) – Another stock that was on the short list last year and didn’t make it, but went on to perform incredibly well. ATHN almost doubled last year, and I think it’s just getting going. At a $4.9B market cap this medical software company has a lot of room, especially given the massive secular momentum in this industry. Everything is moving in its direction as the government and everyone else is trying to cut costs, medical software will be a huge piece of that. They had some hiccups in the revenue growth rate the latter half of 2012 which led to a bumpy road for the stock, but revenue growth has accelerated well and the pattern on the chart looks great. I especially like the big breakaway gap that closed at the highs from October. The stock has put in a really nice flag since and I see much higher prices here in the first half of 2014. Maybe the only bearish thesis here is the company’s ability to drive EPS growth from that revenue, which it hasn’t done a great job of. But I see that as more fuel for the fire when it happens this year.

I A C Corp. (IACI) – Why the hell does IACI trade at 18 times earnings? I just don’t think that the market quite understands the power of the portfolio of tech companies that Barry Diller has put together at IAC. They own so many amazing online dating properties and constantly innovate. I think it’s mostly because there is no big web platform brand to attach to the stock, it’s a portfolio company that incubates these things. And it trades at only a $5.6B market cap. That’s insane, and I think this is the year that IACI comes out of the shadows and shines. The huge breakaway gap that closed at the highs a few weeks ago is just the start, this thing is going to be a monster this year. What will also help is that IACI is up against some significantly lower revenue growth comps from last year than it was from 2012. That should help get the stock going as well due to accelerating revenue growth.

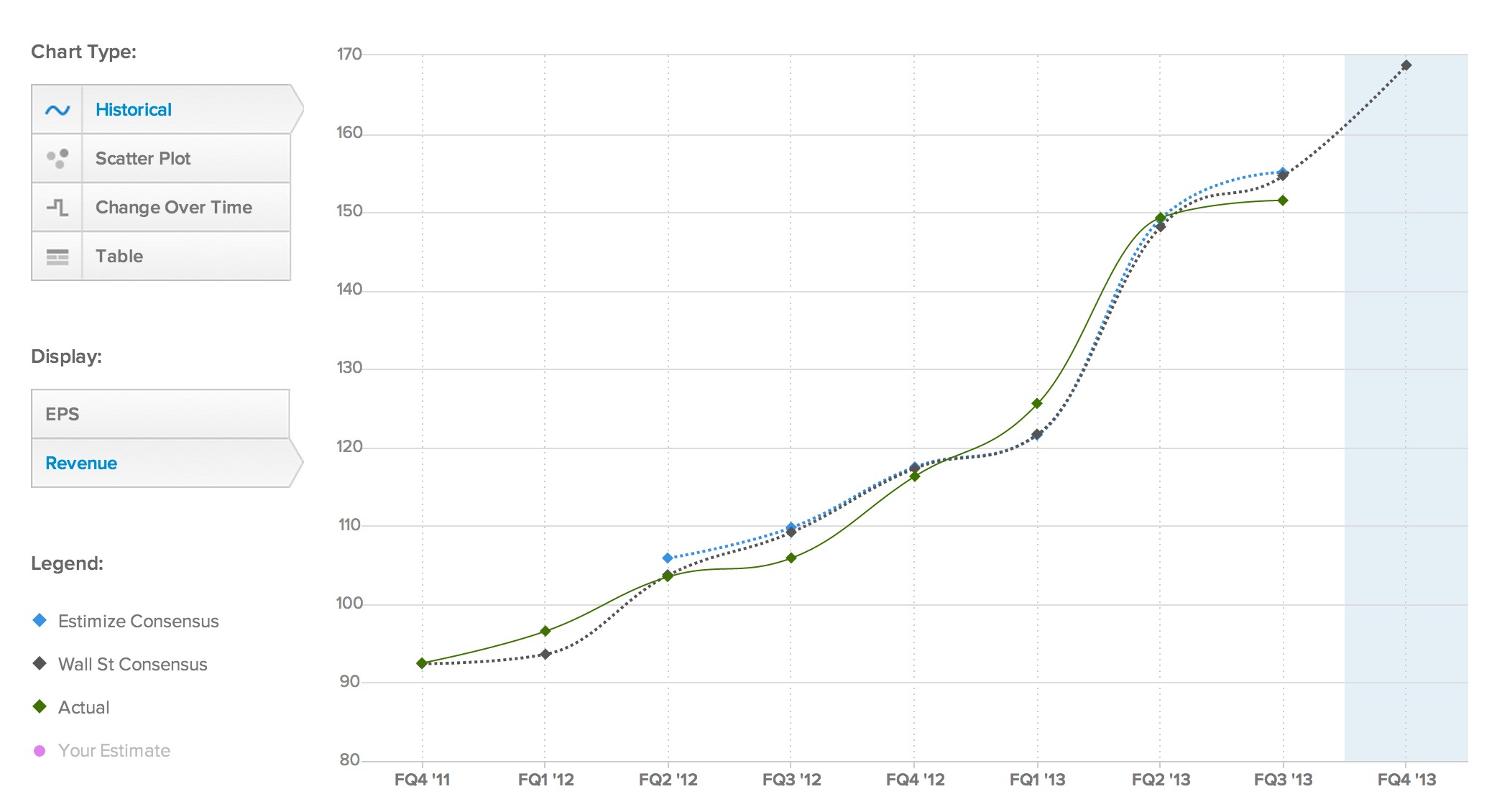

Workday (WDAY) – When high revenue growth companies disrupting their industry go from negative net income to putting up positive EPS numbers, a lot more investors get involved and the stock is going to surge. WDAY is about to see this happen, just as one of my picks for 2013, LinkedIn did this year. At 76% YOY, WDAY’s revenue growth is accelerating, and I don’t see it slowing down here. They are taking advantage of a corporate environment where everything is moving to the cloud to save money and increase margins. But most of all, I love the cup and handle pattern in the chart that just looks ready to explode.

PROS Holdings (PRO) – Playing on an important big data theme, PRO is positioned really well in the space and more companies will be looking to use their software to understand their sales process by using their own data. Again, this is about corporations squeezing every ounce out of the businesses without adding people or making CapEx bets. The company is still very small at a $1.1B market cap, so a lot of room to grow, with very strong revenue growth. Look for the general “big data” theme to drive this one as access to intelligence analytics becomes a reality for many firms this year.

Under Armour (UA) – For the 3rd year in a row I’m going with UA, under the thesis that this is the next Nike. I’ve been dead on correct so far, and there’s nothing out there that tells me I won’t be again in 2014. They have THE BEST products, they trade at only a $9.1B market cap, with YOY revenue growth at 26%. NKE is a $69.5B company growing revs at 8% YOY. Which would you rather own? UA is just starting to go international which is going to be huge for them. They’ve been able to go from making one line of products to dozens successfully. Don’t get too cute, just own the stock, don’t trade it, it’s the next Nike, except the make even better products and their marketing is amazing.

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see the Disclaimer page for a full disclaimer.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

My 10 Stock Picks And Top Trends For 2014

Published 12/30/2013, 01:48 AM

Updated 07/09/2023, 06:31 AM

My 10 Stock Picks And Top Trends For 2014

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.