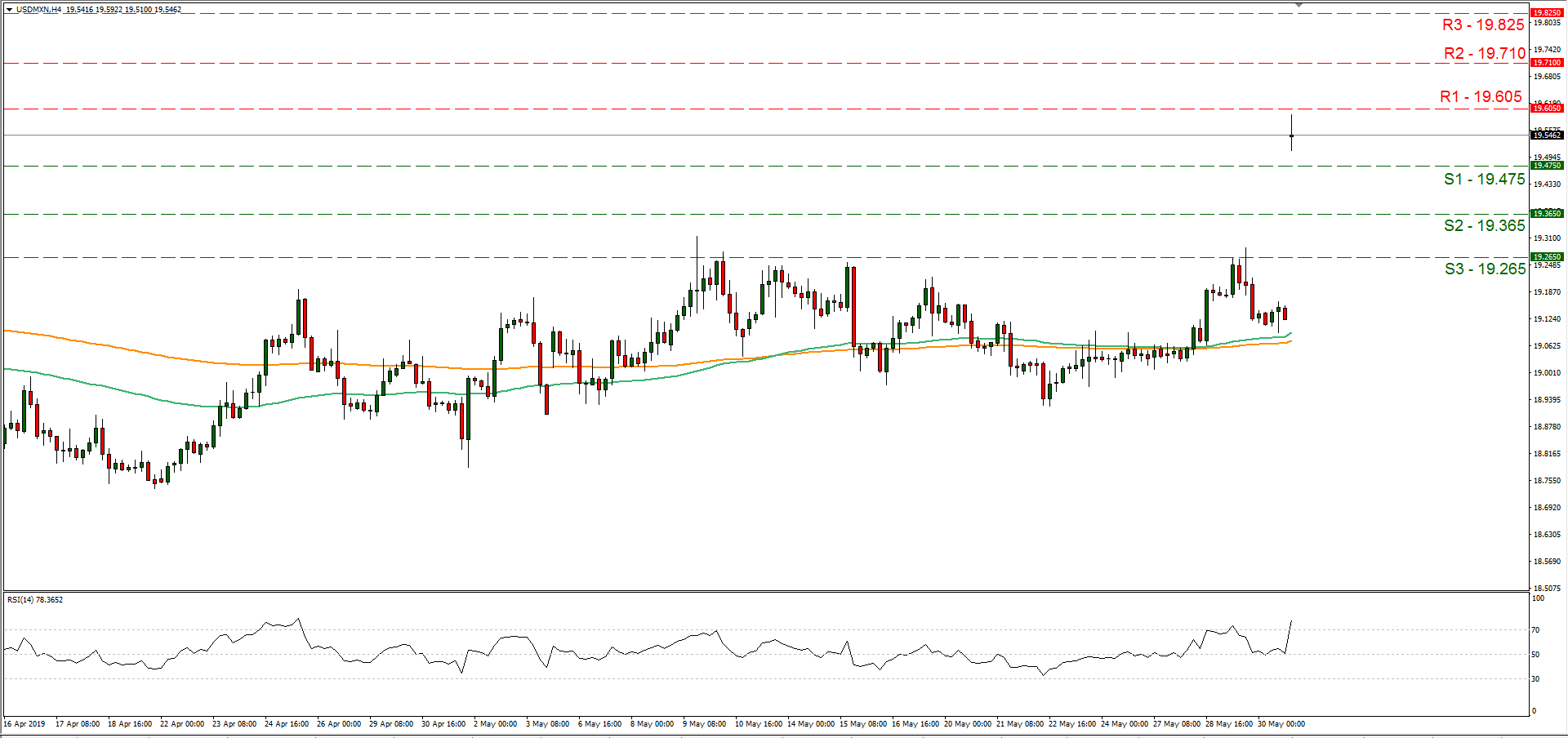

MXN weakened against the USD yesterday as the Trump administration announced tariffs of 5% on all imports from Mexico, until that country prevents immigrants from entering the US illegally. The newly imposed tariff is to take effect on June 10th and as per the president’s tweeter account, “until such time as illegal migrants coming through Mexico, and into our country, STOP”. The tariff is to gradually rise until the issue is dealt with and could hit also American automakers and companies having production south of the US border. Mexican officials stated that it plans to immediately retaliate until the issue has been discussed with the US first. NAFTA implications are also expected as the move is considered a clear violation of the agreement as well as WTO commitments. The new situation is expected to add further concerns about the global trading conditions and the threat of an economic slowdown, with safe havens as the Yen strengthening. Should the situation escalate further, we could see the MXN weakening even further, while safe havens could climb higher. USD/MXN had a positive gap during today’s Asian session as the MXN weakened substantially, landing above the 19.475 (S1) resistance line (now turned to support). We could see the pair maintain the bullish outlook should the Peso weaken further due to a possible escalation of the tensions in the US-Mexican relationships. Should the bulls continue to dictate the pair’s direction, we could see it breaking the 19.605 (R1) resistance line and aim for the 19.710 (R2) resistance hurdle. Should the bears take over, we could see the pair breaking the 19.475 (S1) support line and aim for the 19.365 (S2) support barrier.

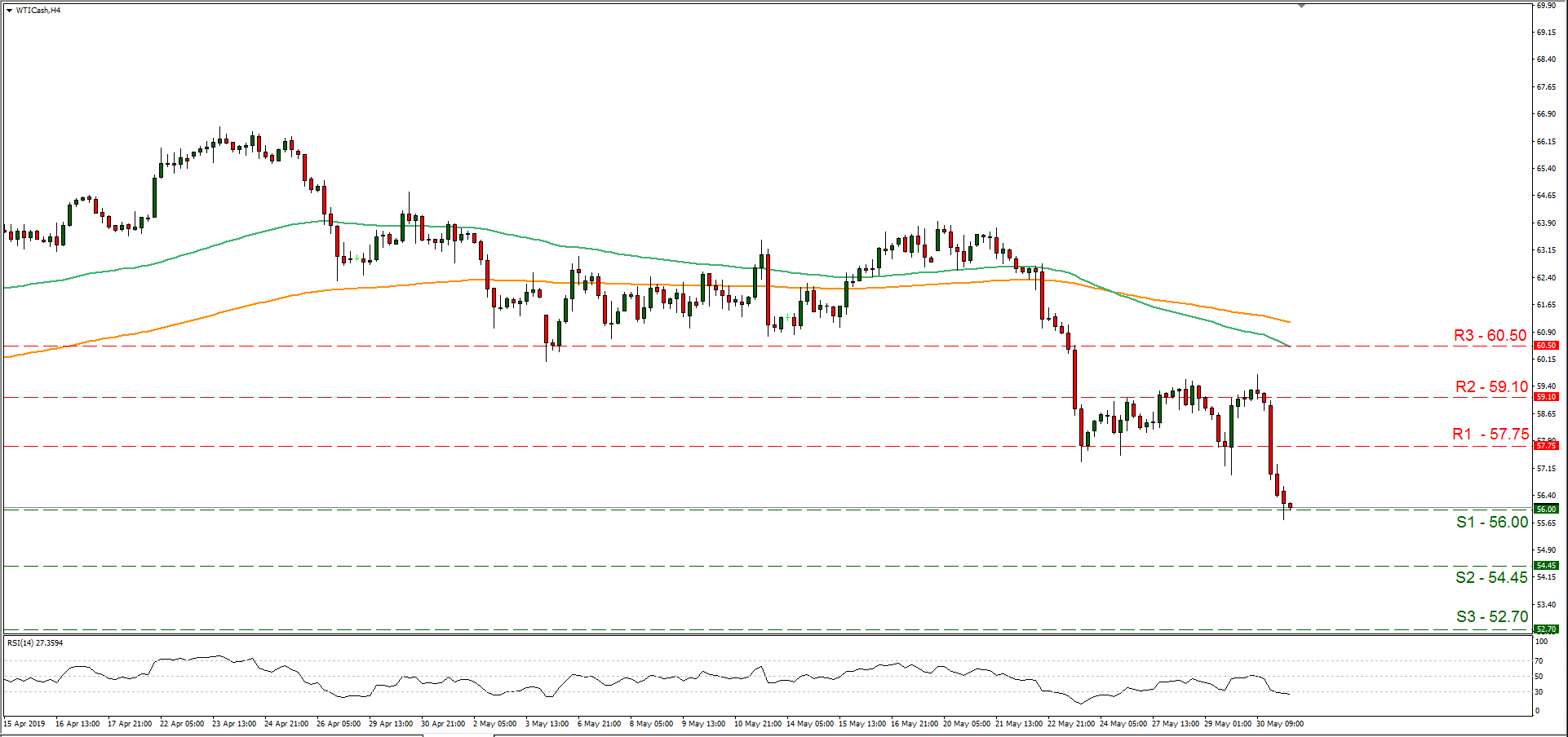

Oil prices tumble, as global trade and slowdown worries grow

Oil prices dropped yesterday, despite US oil inventories decreasing a bit as shown by the EIA. Trade tensions and worries about a possible slowdown if not a recession, had a detrimental effect on oil prices, as demand for black gold could drop. Also, according to a Reuter’s survey, Saudi production levels raised in May, yet may still prove short to compensate for the loss of Iran’s exports. On the other hand the US production seems to have returned to record high levels of 12.3 million bpd (barrels per day). Should the prementioned worries intensify and production continue to be raised, we could see oil prices dropping further. WTI prices dropped yesterday, breaking consecutively the 59.10 (R2) and the 57.75 (R1) support lines, (now turned to resistance). Should worries about a possible economic slowdown be intensified, we could see oil prices dropping further and breaking the 56.00 (S1) support line aiming for the 54.45 (S2) support level. On the flip side should WTI come under the buying interest of the markets, we could see it breaking the 57.75 (R1) resistance line and aim for the 59.10 (R2) resistance level.

Other economic highlights, today and early tomorrow

Today during the European session we get Germany’s retail sales for April and later the preliminary HICP rate for May. In the American session, we get from the US the consumption rate and core PCE price index for April and a bit later the University of Michigan final Consumer Sentiment reading for May and the Baker Hughes oil rig count figure. Also during today’s Asian session, we get Canada’s GDP growth rate for Q1. In Monday’s Asian session, we get China’s Caixin Manufacturing PMI for May. Please note that Atlanta Fed President Bostic is scheduled to speak and New York Fed President William’s speech will be released.

USD/MXN H4

•Support: 19.475 (S1), 19.365 (S2), 19.265 (S3)

•Resistance: 19.605 (R1), 19.710 (R2), 19.825 (R3)

WTI H4

•Support: 56.00 (S1), 54.45 (S2), 52.70 (S3)

•Resistance: 57.75 (R1), 59.10 (R2), 60.50 (R3)