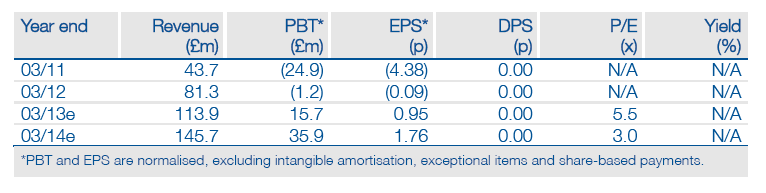

Mwana’s interim results for the six months to 30 September, released yesterday, have shown a 13-fold increase in profit before interest and tax and a five-fold increase in EPS to 0.75c (0.47p) per share, notwithstanding the increase in equity relating to the fund-raising that allowed the Bindura Nickel recapitalisation to proceed. Aside from the BNC restart, the major corporate event of the period was the SEMHKAT agreement with Hailiang, while Freda Rebecca has continued to achieve record gold output.

Old Warhorse Showing New Life

Having reached agreement with its creditors, BNC is now on course to ramp up production to a rate of 7,000tpa nickel in concentrate, with sale of the first concentrate to Glencore anticipated in CY Q213 (ie the April-June quarter). In the longer term, MWA’s intention remains to bring Hunters Road into production and to restart the Bindura Smelter & Refinery (BSR).

Freda Rebecca On The Road To Manderley Again

Simultaneously, FRGM (which accounted for 98.3% of group revenues and 99.1% of costs of sales) achieved its best quarter of gold production since its restart in the September quarter and the highest level of gold production in a single month in August, when 7,242oz was produced. At its current annualised rate of production of 72,000oz (ie 6,000oz per month), it is once again the largest producing mine in Zimbabwe, at a C1 cash cost of c $800/oz.

Valuation: 23.91-24.45cps (14.9-15.2pps)

Four assets comprise Edison’s valuation of Mwana Africa: the dividend stream to investors originating from its interests in Freda Rebecca and BNC discounted to present value (17.99cps), the Zani-Kodo resource (2.80cps), the value of FRGM’s and BNC’s residual resources after the completion of their official mine plans (1.21cps) and SEMHKAT (2.45-1.91cps). We have adjusted our FY13 and FY14 forecasts to account for the interim results, as well as a slightly lower prevailing nickel price, a high marginal rate of taxation and the continuation of care and maintenance costs for slightly longer than previously expected. At 5.2p, Mwana’s shares are still trading at a c 65% discount to Edison’s valuation – as wide as in late-June (when its shares traded as low as 3.5p) and despite a much-reduced risk relating to BNC after its successful recapitalisation and agreement with creditors. Additional upside exists in the form of exploration (especially at Zani-Kodo) and the potential to expand the Bindura restart in the future, which have yet to be considered in the current valuation.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Mwana Africa: Interim Results

Published 12/11/2012, 08:23 AM

Updated 07/09/2023, 06:31 AM

Mwana Africa: Interim Results

13-Fold Increase In Interim Profits

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.