Forecasts tweaked, still cheap

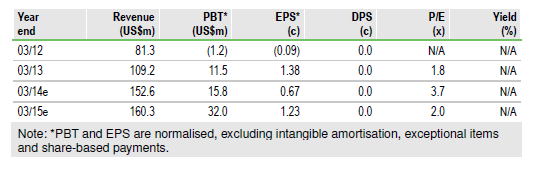

Third-quarter production was something of a curate’s egg at Mwana Africa, (MWA), with higher sales at Trojan offset by higher costs and temporarily lower outputat Freda-Rebecca. We have adjusted our full-year basic EPS forecasts downwards. Nevertheless, Mwana remains noticeably cheap on a current year P/E of under 4x, notwithstanding its exposure to Zimbabwean risk.

Operations: Freda Rebecca (FRGM) and Trojan

Production of gold at FRGM declined 25.5% in Q3 compared to Q2, while quoted C1 cash costs rose 27.4% q-o-q to US$1,066/oz. When adjusted for a concurrent decline in grade however, this implies a 0.9% decline in unit working costs per tonne milled to US$54.0/t. Nickel sales at Trojan increased 76.1% q-o-q in Q3, although this result was also attended by a 15.4% increase in C1 cash costs to US$11,181 per tonne of nickel produced (including offtake costs). This was because of the lifting of the proscription on certain expenses and the start of work on the shaft re-deepening coinciding with a period of electricity supply disruption and concentrator thickener outages.

Valuation: >100% upside potential at spot prices

We have reduced our earnings expectations for Mwana in H2 in the wake of the quarterly update. However, our longer-term (ie 2015 and beyond) EPS and cashflow forecasts remain intact at around 2.5p/share at our long-term metals prices (or 0.54p/share at current spot prices of US$1,255/oz Au and US$14,080/t Ni), such that our valuation of Mwana, based on the successful execution of the FRGM and BNC mine plans (at a 10% discount rate), is 11.5c (6.9p) per share, offering an IRR of 56.1% over the life of operations. In addition, Mwana has assets in the form of Zani-Kodo, SEMHKAT and residual resources once the FRGM and BNC mine plans have been completed, which we previously valued at 2.8-3.2c/share (principally based on historic investment at SEMHKAT), to give an overall valuation of 14.3-14.7c/share (8.6-8.9p/share). At current spot prices, our estimate of the discounted dividend flow valuation of the company reduces to 2.7c/share (1.6p/share), and our estimate of the overall valuation of the company to 5.5- 5.9c/share (3.3-3.6p/share) – nevertheless, still leaving potential upside to the current share price of >100%. Alternatively, its market capitalisation of c US$32.0m buys a forecast US$14.7m in cash plus US$11.6m-worth of publicly quoted shares in Bindura Nickel Corporation, meaning that investors are effectively buying Freda-Rebecca (a mine now forecast to generate a gross profit of US$22.9m in FY14) and Zani-Kodo (with a resource of 3.0Moz) for just US$5.7m.