Mwana Africa (MWA.L) has today announced a 31% (or 618koz) increase in gold resources at its 80%-owned Zani-Kodo project in the Democratic Republic of the Congo, from 2.0Moz to 2.6Moz. Of particular note was the 22.0% increase in ‘indicated’ ounces at Kodo Main and a maiden resource contribution from Lelumodi of 443koz, achieved at the same cut-off grades as the previous resource statement (0.50g/t).

Valuation: 2.5x the current share price

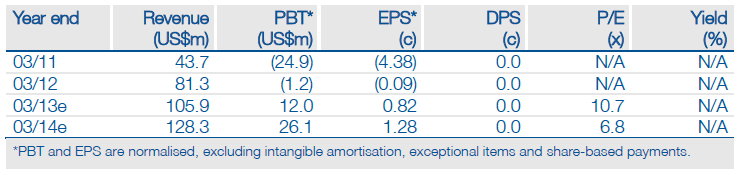

Before 14 February, Edison’s absolute valuation of Mwana was 24.2-23.7c (15.5-15.1p) per share, assuming execution of the Freda-Rebecca and BNC mine plans and with Zani-Kodo valued at 2.80cps (see Outlook note published on 25 April 2012). The recent leachate spillage at FRGM (which Edison assumes will depress production until end-June 2013) then reduced this to 23.8-23.3c (15.6-15.3p). In addition, the average value of London-listed ‘inferred’ ounces (originally 77.6%, now 79.1%, of the resource base) has fallen by c 90% since our original valuation of Zani-Kodo, although, in this case, the reduction in value is offset by the increase in the resource size and the upgrading of ‘inferred’ resources to ‘indicated’ status. Applying the updated average values for London-listed ‘inferred’ and ‘indicated’ ounces (as derived in our report entitled Gold, New benchmarks for old published in November 2012), Edison calculates an updated value for the Zani-Kodo resource of $17.0m, or 1.22cps for Mwana’s 80% attributable interest in the project. While some 46% lower than our previous valuation of April 2012, it is nevertheless still 16% higher than it would have been in the absence of the upgrade. As such, Edison’s updated value for Mwana is now 22.3-21.7c (14.7-14.3p) per share, compared to which its shares remain trading at a 59-60% discount. Additional upside exists in the form of the potential to expand and extend the Bindura restart in the future and exploration generally, neither of which has been considered in the current calculation.

Zani-Kodo value uplift potential 5.2 times

In January 2010, Edison (in partnership with BDO) calculated global average costs of discovery of US$10.50 for an ‘indicated’ ounce and US$7.16 for an ‘inferred’ ounce. At $17.0m therefore, our overall valuation of the Zani-Kodo project is within 4.0% of the average cost of discovery of a comparable resource globally of US$16.5m. As such, it may be considered as approximating book value. At the current point in time, overall value added to the project as a result of exploration and drilling activity has necessarily been restrained by the need to delineate additional ounces, rather than upgrading existing ones. In this particular case (using the same benchmarks as our overall valuation), we calculate that, if the entire resource was upgraded to ‘indicated’ status, the Zani-Kodo project would be worth c $105.4m in its entirety, or 9.41 cents per Mwana share on an attributable basis.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Mwana Africa Zani-Kodo Resource Upgrade

Published 02/27/2013, 07:31 AM

Updated 07/09/2023, 06:31 AM

Mwana Africa Zani-Kodo Resource Upgrade

As promised…

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.